The Signature Bank (SBNY) assessment by the US Federal Deposit Insurance Corporation (FDIC) revealed that Poor management and inadequate risk management practices are the cause of the collapse.

Federal regulators ordered the closure of Signature Bank on March 12. To protect the US economy and strengthen public confidence in the banking system.

On April 29, reportThe FDIC highlights that the collapse of major US banks such as Silvergate Bank and Silicon Valley Bank has led to a lack of liquidity due to the outflow of deposits.

“however The reason for SBNY’s failure was mismanagement. SBNY management does not prioritize good corporate governance practices. and consistently ignores the concerns of FDIC inspectors. including failing to respond or in a timely manner in addressing FDIC regulatory advice (SRs).”

The FDIC slammed Signature’s board of directors and executives for allowing it to “grow relentlessly” by using unsecured deposits without a liquidity risk management strategy.

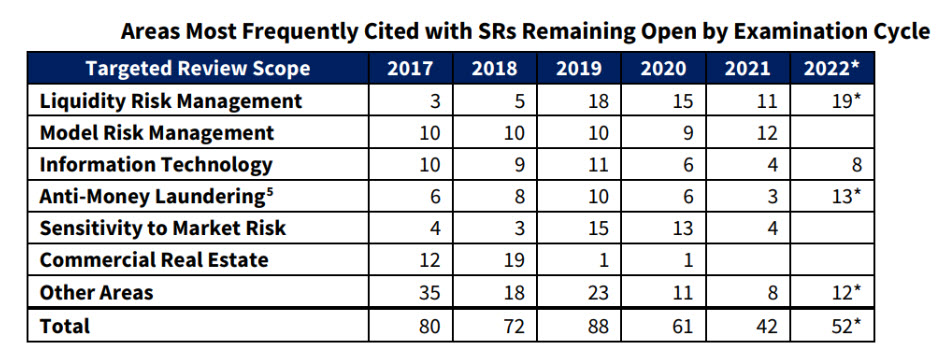

The report also revealed that Signature frequently declined to address FDIC concerns or act on the regulator’s oversight recommendations. Since 2017, the FDIC has sent numerous regulatory letters to SBNY citing criticism. regulatory, auditing, or risk management as shown below

The post FDIC points out! Signature Bank’s downfall was caused by bad governance. And the lack of liquidity appeared first on Bitcoin Addict.