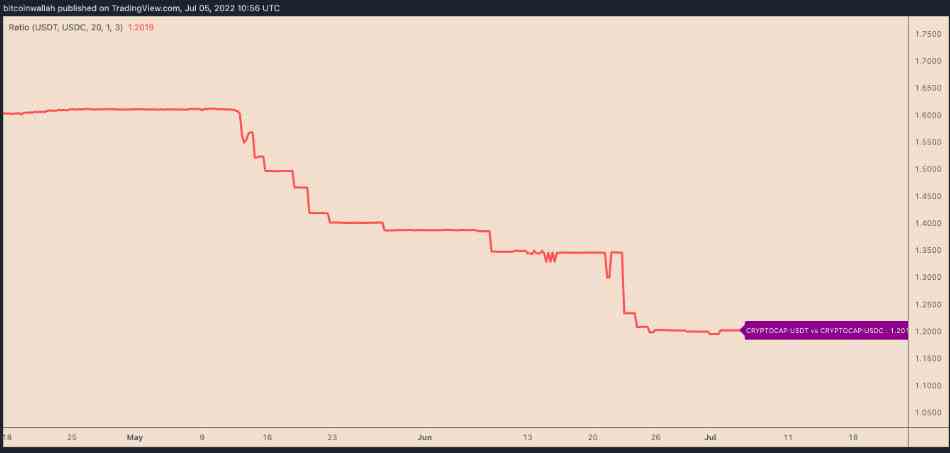

Circle’s Stablecoin USD Coin (USDC) Growth Over the Last Two Months Against Tether (USDT), the USDT to USDC market cap ratio is falling to its lowest ever level in July 2022.

USDT, USDC Market Ratio Hits Record Lows

USDC market cap has grown 8.27% since May It hit a high of $55.9 billion on July 2. In contrast, the USDT market cap is down more than 19%, which is currently around $66.14 billion.

USDC is now the closest to challenging USDT supremacy in the stablecoin sector, considering the narrowing gap between market caps.

The details, meanwhile, show that the USDT to USDC market cap ratio was above the “9” figure in August 2020, however, in July it dropped to 1.20, the lowest ever recorded. as shown in the picture below

At current rates — and with the current $10 billion difference between the two stablecoins — USDC could overtake USDT with a larger market cap in a matter of months.

Interestingly, USDC has flippedOvertakes USDT in terms of “real volume” on the Ethereum blockchain.

USDT is faced with doubt.

Crypto investors have become more cautious ever since.Fall of Terra”stablecoin algorithm project” in May. Fears the same could happen to USDT, mainly due to speculations that Tether’s USDT tokens are not backed by cash. and other traditional assets 100% as claimed

There were speculations that Tether would not be able to exchange all USDT for dollars in a “bank run” situation, resulting in people starting to sell stablecoin at a discount.

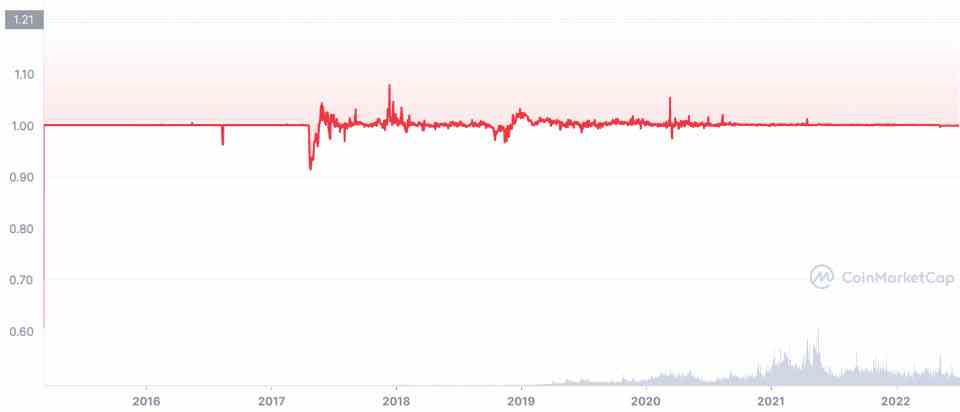

USDT has a history of being below or above $1 during periods of extreme market volatility. For example, in October 2018, the token’s value dropped to $0.85 (on Kraken) amid rumors that one of its affiliates (a crypto-currency firm) was slated to drop to $0.85 (on Kraken). Ripto Bitfinex) is bankrupt.

And the same thing happened again after Terra’s collapse in May, with USDT’s declining momentarily.Down to $0.97, however, Stablecoin has recovered to the dollar every time.

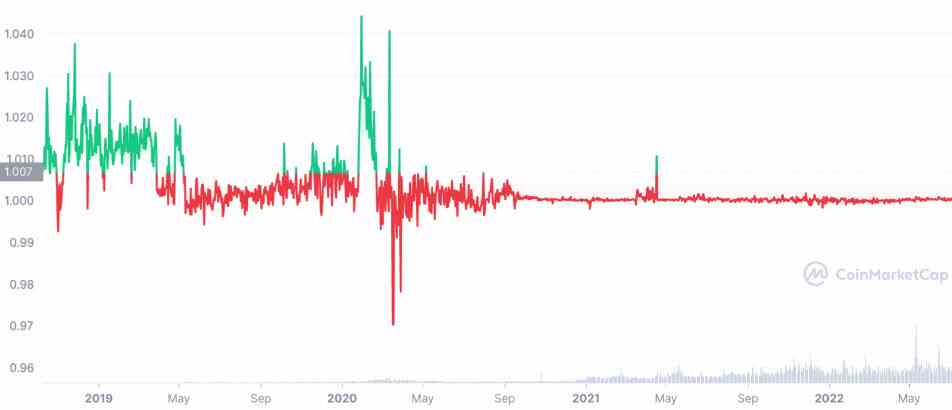

In contrast, USDC has fallen just two times below $0.99-1 since its launch in 2018, andreduced to $0.97 during the “COVID-19 Crisis” in March 2020

Crypto investors have increased their trust in USDC as Circle is registered with FinCEN and 46 US state regulators.

Circle is also audited by Grant Thornton, a leading global accounting firm.

Paolo Ardoino, Tether’s Chief Technical Officer, gavepledge in junethat they are providing a full review of the reserves by one of the top 12 accounting firms, for now, the MHA accounting firm.giveQuarterly Tether Certification