Markus Schell appears self-confident, but you probably have to if you want to go from a supplier to at least a small truck manufacturer. The head of the family business BPW Bergischeachsen has had a semi-transparent circus tent put in his parking lot. “We’re not in Munich here, we’re not in Stuttgart either,” admits Schell, referring to the big truck manufacturers MAN and Daimler Truck. No, really, you are in Wiehl, a small town with 25,000 inhabitants east of Cologne, with a stalactite cave and half-timbered houses. But now the curtain is falling, resounding music, a battery-powered truck drives into the tent over a catwalk. You are showing “the first truck that really packs it,” says Schell.

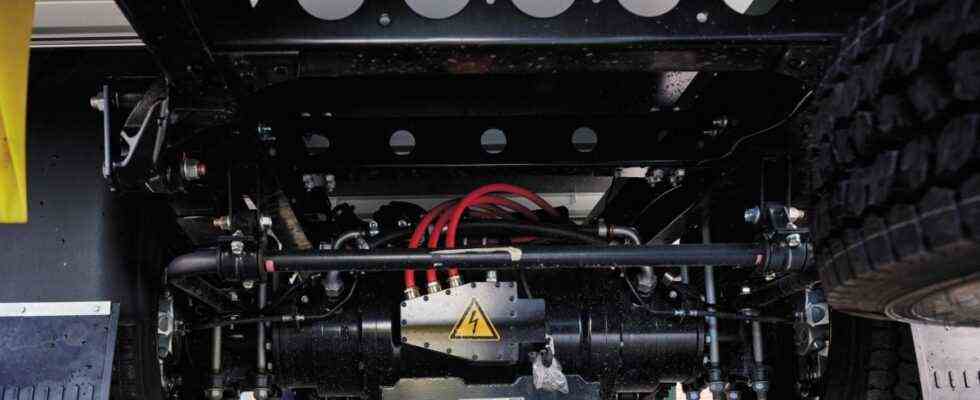

That seems elaborate for a largely unknown medium-sized company whose history began in 1898 with axles for carriages. BPW now primarily manufactures axles and brakes for truck trailers. And since 2018 the company has been working on a small scale to build electric motors directly on the rear axle of commercial vehicles. This saves the gearbox and the large central motor at the front. Together with the vehicle retrofitter Paul from Lower Bavaria, BPW installed the technology in a good 50 old Mercedes diesels of the “Vario” model. Since then, for example, the Berlin city cleaning service has been on the road with its first electric trucks. “Today we’re going one step further,” says Schell: With their new truck, the companies want to prove above all that the axle drive works.

The demand for trucks without noise and emissions will increase

Because, of course, the change in the market leaders in Munich and Stuttgart also began a long time ago. On the one hand, climate protection regulations are driving the industry: according to the EU, manufacturers must reduce the CO₂ emissions of their newly registered vehicle fleets by 15 percent by 2025 and by 30 percent by 2030 – compared to the period between mid-2019 and mid-2020. Otherwise, there is a risk of heavy penalties . On the other hand, the demand for trucks without noise and emissions is likely to increase in the next few years, even though an electric truck costs around three times as much as a diesel vehicle to buy. Because freight forwarders don’t look so much at one-off expenses – they calculate exactly how much a vehicle will cost them over the entire operating period.

BPW boss Schell calculates that the price of his new truck called Bax starts at 75,000 euros if you include the subsidies for climate-friendly commercial vehicles. The federal government is currently assuming up to 80 percent of the additional costs of an e-truck. If the demand is shifting more and more, the only question left for corporations is: How do you build emission-free, practical trucks in all segments as quickly as possible?

Smaller trucks are used to distribute goods to shops

Because not all trucks are the same. There are the smaller trucks that are used, for example, for deliveries from logistics centers to shops, often in cities. Electric trucks with a range of 200 to 400 kilometers are usually sufficient for this distribution traffic because the daily mileage is usually not greater. These trucks are then loaded roughly overnight when they are parked in depots.

It is precisely this segment that BPW and Paul want to serve with their new 7.5-tonne truck. With a so-called box body, the Stromer offers space for 15 standard pallets, which is more than a normal transporter, for example for removals or parcel delivery. The companies advertise, of course, that they can assemble all kinds of superstructures: from urban garbage trucks to flatbed trucks for gardening.

According to their own statements, the companies are currently working on a European type approval for their new model. “The first will be delivered in February,” announced BPW boss Schell. The scale is of course still very small: 200 pre-orders have been made for the coming year. Then you can go up to 1000 Bax annually.

Production is to take place in Vilshofen near Passau

The assembly is to take place at Paul in Vilshofen on the Danube. “At the moment we can do this with our available resources,” says authorized signatory Christian Huber. However, depending on demand, they are also prepared to expand capacities. Paul buys individual parts from major brand manufacturers anyway, batteries from BMW, for example, and technology such as air conditioning from other suppliers. The Bax, which is up to 7.80 meters long, comes across as rustic and shirt-sleeved.

Daimler Truck is already producing the eActros electric model.

(Photo: Uli Deck / dpa)

It is clear that at the same time most established manufacturers are also starting to convert their fleets. For example, Daimler Truck started production of the “eActros” in Wörth near Karlsruhe at the beginning of October. Volvo, Scania and Renault also have their first electric trucks. In addition, there are new manufacturers such as the Swedish company Volta Trucks, which, together with Steyr, wants to produce zero-emission trucks in Austria from 2022. Most recently, the Swabian-American joint venture Nikola-Iveco made people sit up and take notice when it opened a factory for electric and, in the future, fuel cell trucks in Ulm in September. Nikola-Iveco was the first manufacturer to present an electric tractor unit which, with a range of up to 560 kilometers, is quite suitable for long journeys. The first copies should be built this year. Incidentally, in Ulm, too, you experienced boundless self-confidence at the presentation of the new trucks, when Nikola boss Mark Russell directly issued the slogan: “The sky is the limit.”

If you then look back at the mundane problems, from an ecological point of view, the greatest hurdle lies in the long haul: the majority of CO₂ emissions are not caused by distribution or delivery traffic, but rather by the large, heavy trucks that travel hundreds of kilometers a day. Almost all manufacturers use hydrogen as an energy carrier for these models. But it should take at least another two or three years for the first models to hit the market.