Bitcoin price fell 5.42% over the past 24 hours. to a new multi-week low of $57,151 on May 1, with on-chain data showing that slowing Bitcoin demand growth and increased short positions may be causing the rally. Latest loss And it is possible that BTC will have to find new lows.

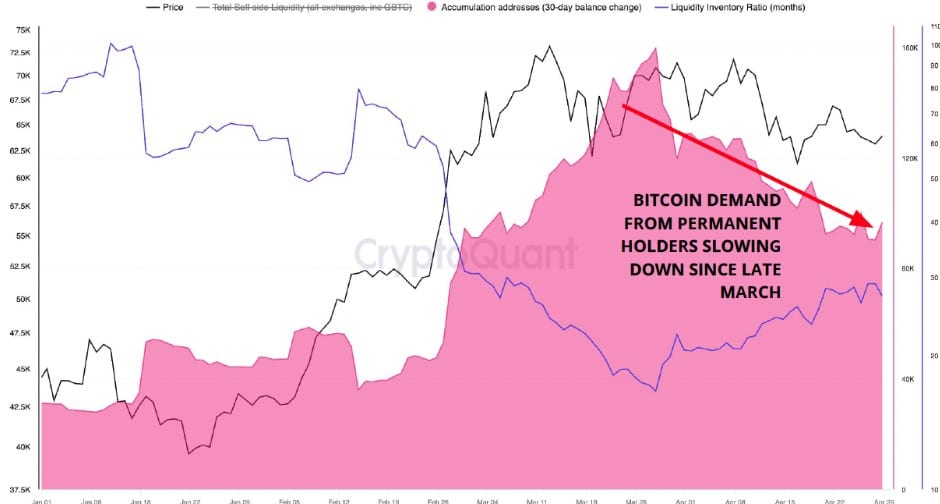

CryptoQuant reports that BTC’s recent decline is due to a slowdown in purchasing demand. This is characterized by a decrease in Bitcoin balances among permanent holders, a decrease in demand for Bitcoin ETFs, and an increase in short positions in the futures market.

Data from CryptoQuant shows that Demand from permanent holders Bitcoin (investors who only buy Bitcoin and never sell) dropped 50% in April, from more than 200,000 BTC at the end of March to about 90,000 BTC.

Demand from permanent holders It dropped to levels similar to early March when Bitcoin experienced a significant correction, dropping 7% immediately after breaking its all-time high.

Demand from whales has also dropped since the end of March. And according to CryptoQuant analysts, BTC corrections are often driven by slower growth in demand from large investors.

“Bitcoin demand growth (purple area) peaked at 12% in late March. And now it has slowed down to 6%.”

Analysts also say that the slowdown in demand for Bitcoin is due to This was due to lower purchases from Spot ETFs in the United States. which increases pressure on the sales side as well

“Currently, daily Bitcoin purchases from ETFs have dropped to zero. after peaking in mid-March at more than $1 billion,” the report said, adding that “a new wave of Bitcoin purchases from ETFs is needed to revive demand growth.”

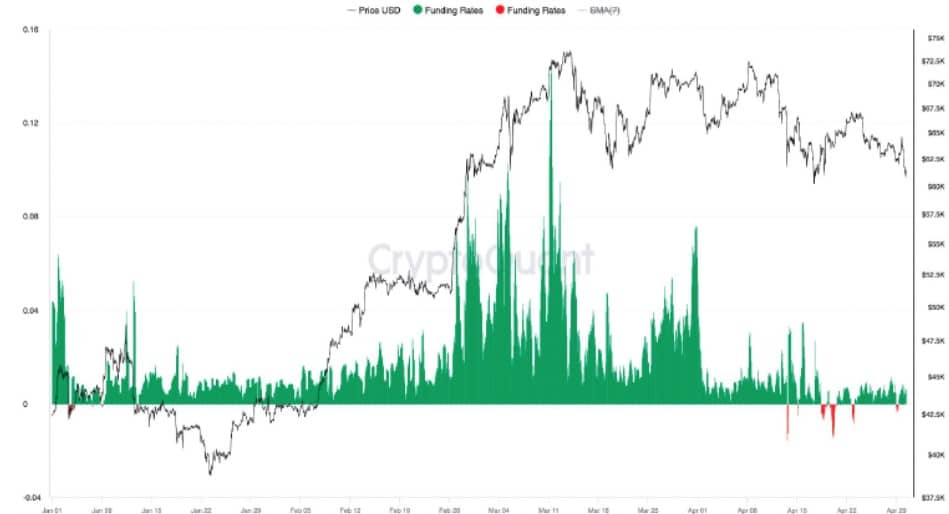

Another indicator used by analyst firms to explain the slowdown in Bitcoin demand is “the reluctance of traders to pay more to go long” as sell orders outpace buy orders.

Bitcoin’s funding rate drops to lowest level in a year This indicates that traders are unwilling to “Pay as much before going long”

“Recently falling prices This is due to traders opening short positions expecting the price to fall further,” the report said.

Possible direction of Bitcoin price

CryptoQuant analysts are targeting buying demand in the $55,000 to $57,000 zone, which is “10% below traders’ current costs of $63,000.”

Popular analyst Scott Melker sees $52,000 as the lowest the BTC price can go in the short-term. Melker saidThe correction remains mild for the bulls as the daily RSI is not yet oversold.

“This is still a 23% correction, which is very shallow for the bulls. And it is consistent with other corrections during this period, where we have not seen a correction of 30-40% during the bull market like in the past.”

refer : cointelegraph.com

picture kitco.com