Ethereum (ETH) surged to a new high of $3,822 on March 5, rising 15% over the past seven days and 132% over the past six months.

Information from TradingView It shows that the price of Ether is approximately 3,496 dollar, approximately 28.3% from the all-time high of $4,891 on November 26, 2021.

The rise of ETH resulted in a 68% increase in daily trading volume, which currently stands at $33.29 billion. And with a market capitalization of $453 billion, Ether holds its position as the second most valuable cryptocurrency, according to CoinMarketCap.

And here are 3 reasons why Ethereum (ETH) price will reach $4,000 in the near future.

Reducing supply from web exchanges

One factor supporting Ether is a reduction in supply from exchanges. Data from Glassnode shows that ETH balances on exchanges hit a 20-month low of 13.14 million ETH after falling 7.7% over the past 90 days.

Reducing the ETH balance on an exchange means Investors withdraw their tokens to their own wallets. This indicates that there is no intention to sell in anticipation of future price increases.

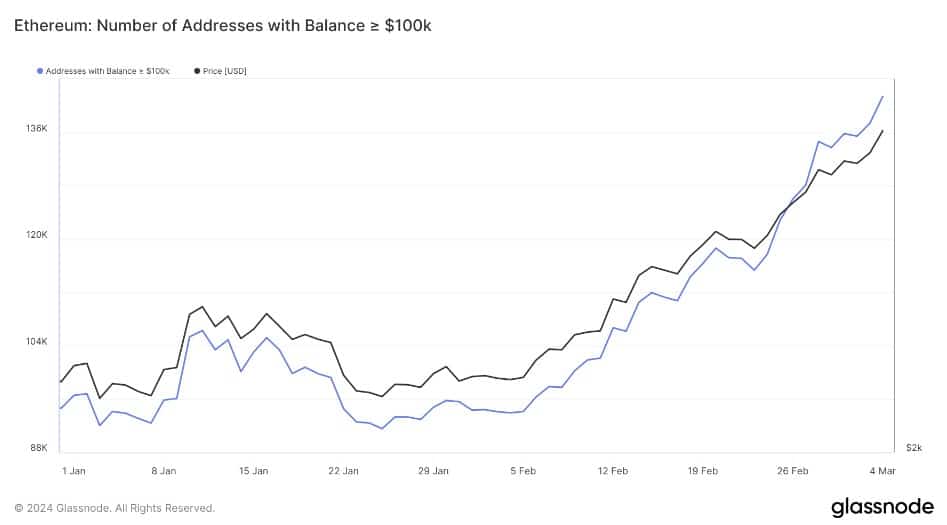

This is explained by the sharp increase in the accumulation of bags from major holders over the past two – three weeks. Additional data from Glassnode shows that wallets holding more than $100,000 worth of ETH have increased since the beginning of February.

Wallets holding $100,000 or more increased from 94,620 on January 1 to 141,406 on March 4. This means that whales did not sell off the latest price surge in ETH, but continued to accumulate.

Ethereum Staking Numbers Increase

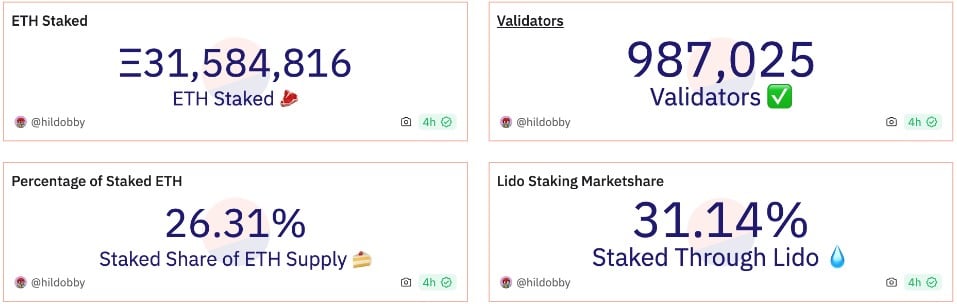

Data from Dune Analytics shows that more than $31.58 million of ETH, worth $119.8 billion at current rates, is being staked on Ethereum’s Proof-of-Stake Layer protocol.

This means that 26.3% of the ETH supply was staking and disappeared from the market, with over 987,000 validators involved.

Staking on Ethereum is further facilitated by liquid staking solutions such as Lido, Rocket Pool and EtherFi, which allow staking amounts of less than 32 ETH and staking assets as collateral in DeFi.

According to BlockBeats, the total value locked on EtherFi has surpassed the $2 billion mark. It indicates the growing popularity and adoption of Ethereum’s liquidity protocol.

Ethereum’s Open Interest Nears 2021 Highs

The increased demand for leverage has led to an increase in ETH Futures Open Interest (OI), which is estimated at $11.98 billion. This moved closer to its peak of $13 billion on November 9, 2021.

Data from Coinglass shows that Ether Futures OI surpassed the $8 billion mark on February 12 and stayed below this level for more than two years. Since then, OI has surged nearly 50% in less than two weeks. This indicates increased demand.

refer : cointelegraph.com

picture cryptopotato.com