Massive price increase

This is how the fuel price is made up

The sight that drivers fear: fuel prices at German gas stations

© Wolfram Steinberg / DPA

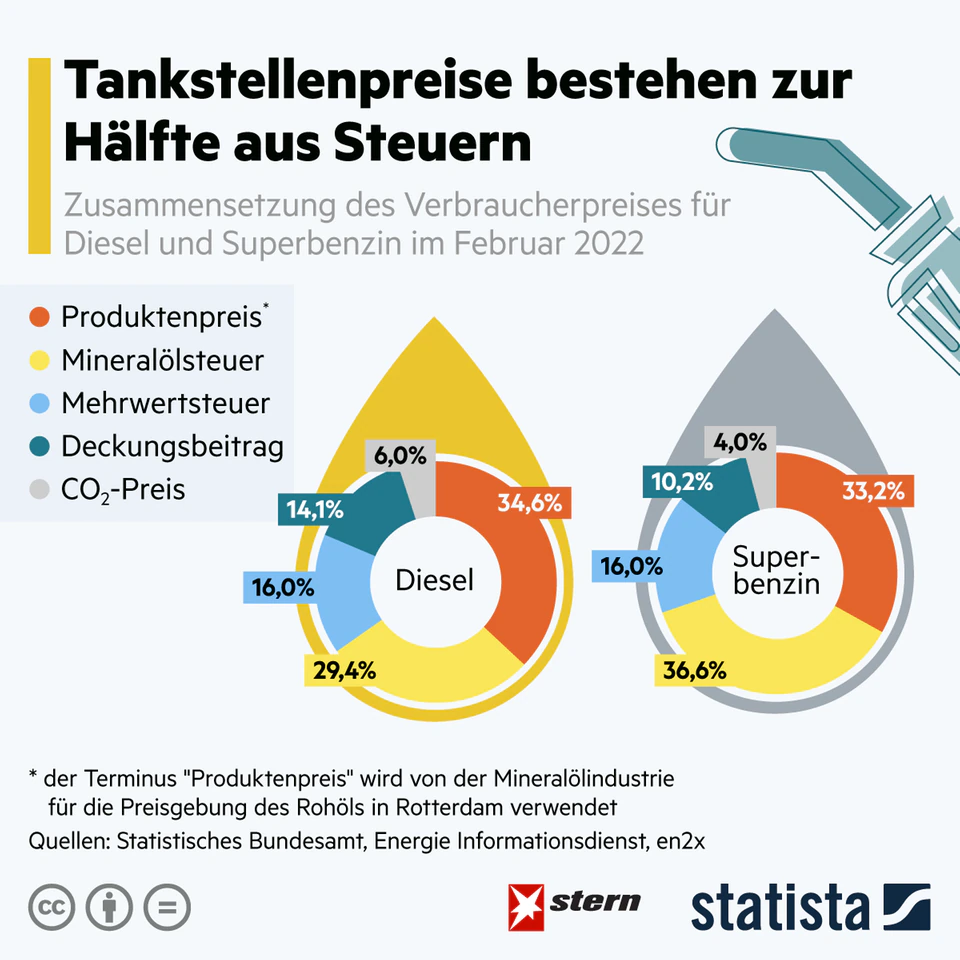

Refueling becomes more expensive. A large part of the car-driving population is pushing for tax cuts to lower the price. The Statista chart shows the composition of petrol and diesel prices in February.

The enormous increase in the price of petrol in Germany is heating up the minds of motorists. Many are calling for a reduction in taxes on diesel and super to bring the price back down to what it is used to. Finance Minister Christian Lindner plans to use a subsidy to push prices at petrol stations back below two euros per liter.

But the tax cut would also be a possible way, like that Statista graphic with data from the Federal Statistical Office, the Energy Information Service and en2x. Because around half of the price for diesel and premium petrol is made up of taxes. The actual fuel therefore makes up just under 33 to 37 percent of the price.

In addition, there is CO2 pricing, which is included in the consumer price in February at around four to five percent, with a certificate for one ton costing 30 euros since 2022. At around 28.3 percent, the mineral oil tax is the second largest component of the diesel price. At around 36.6 percent, it accounts for the largest proportion of premium petrol. However, this is set to be constant per liter of fuel, i.e. independent of the sales price.

Value added tax makes up a small proportion of the fuel price

Value added tax, which many Germans are calling for to be reduced, is 19 percent on petroleum goods, but since it is added to the net price, it affects the consumer price by around 16 percent. With a current diesel price of around 2.30 euros, this corresponds to around 37 cents.

The share of the contribution margin was around ten to 14 percent in February 2022. The contribution margin includes transport, warehousing, legal storage, administration, sales and since 2007 costs for biocomponents and the admixture and since 2021 the costs for the CO2 surcharge according to the Fuel Emissions Trading Act (BEHG).