US investors are getting nervous

Trading day ends with a sell-off

December 20, 2023, 11:21 p.m

Listen to article

This audio version was artificially generated. More info | Send feedback

After the recent record hunt on Wall Street, nervousness is spreading. At the end of the trading day, investors take profits – and cause the most important US indices to slip significantly into the red. Google parent Alphabet is resisting the downward trend.

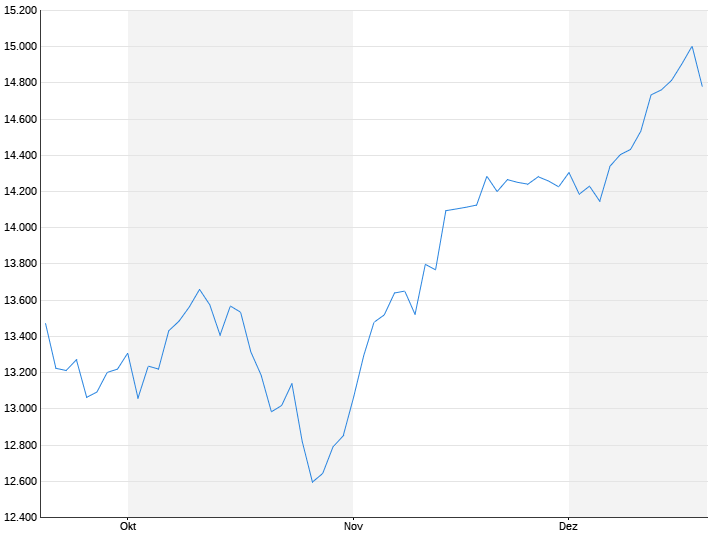

The US stock markets closed in the red on Wednesday after a mostly positive trend. Market participants pointed to an abrupt sell-off in late trading. Previously, the interest rate rally on the US stock exchanges had largely fizzled out. The Dow Jones Index the standard values fell 1.3 percent lower to 37,082 points from trading. The technology-heavy one Nasdaq fell 1.5 percent to 14,777 points. The broad one S&P 500 lost 1.5 percent to 4698 points.

Wall Street rose sharply last week after the US Federal Reserve announced the prospect of easing monetary policy next year. According to experts, this was already largely priced in during the most recent rally, which is why the rise was rather short-lived. “The interest rate hopes started in October, and things really took off in December,” said Daniela Hathorn, analyst at the trading platform Capital.com. “Now investors are starting to question the sustainability of another rally.”

Some experts also suggested that market expectations for rate cuts may be overblown. Almost 80 percent of market participants are currently expecting a first interest rate cut at the Fed meeting in March. Falling interest rates from May are almost certain. This results in five to six interest rate cuts by the end of the year. “I don’t think the economy is weakening so much that you need five interest rate cuts in the coming year,” Pavlik commented. “I assume there will be two rate cuts in 2024. After that, the Fed will pause again.”

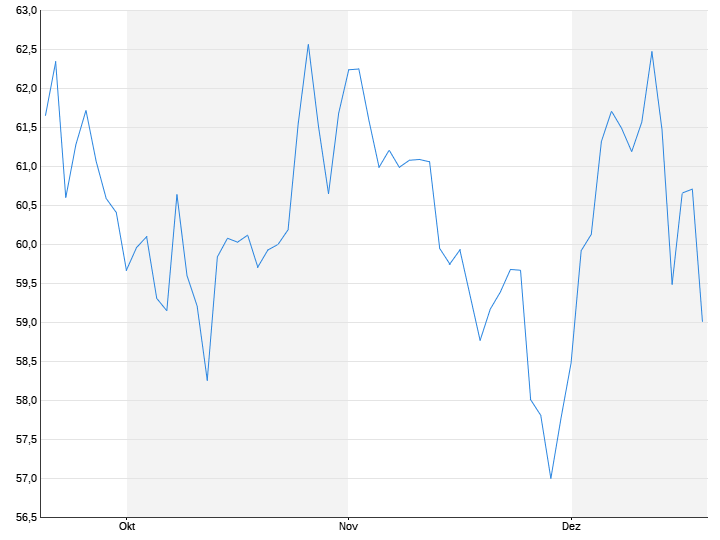

The uncertainty surrounding the exact timetable for interest rate cuts supported the US currency. The Dollar index was slightly up at 102,354 points. The Euro In return, it lost 0.3 percent to $ 1.0952.

When it came to the individual values FedEx under strong pressure. The shares of Deutsche Post’s rival slipped by a good twelve percent after a lowered forecast. The share also had a pessimistic outlook General Mills to. The shares of the provider of Cheerios breakfast cereal fell by 3.6 percent. The company expects an organic sales decline of up to one percent or stagnation in 2024. It had previously been assumed that growth would be between three and four percent. Analysts on average had expected an increase of 2.4 percent. The background is a decline in demand following cost-related price increases.

On the other hand, the titles from were in demand alphabet, which increased by 1.2 percent. A media report about Google’s parent company’s restructuring plans for its advertising business put investors in a good mood. The group wants to consolidate a large part of the department, which has 30,000 employees, reported the news portal “The Information”. This could mean that some of the staff will be laid off and some will be assigned to other departments.