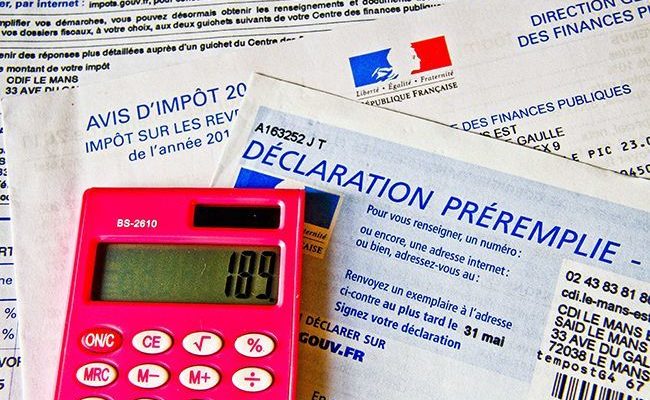

The income tax declaration period will soon open in France. Ahead of the campaign which is announced from April 11, the general directorate of public finances (DGFiP) will very soon contact some taxpayers, reports Actu.fr.

In fact, no less than 10.8 million French people liable for income tax should receive, from this Wednesday, an e-mail from the DGFiP. These are taxpayers whose tax situation has not changed since the 2023 declaration and who will be able to benefit from automatic declaration.

A simplified approach

This declaration is a simplified process reserved for individuals and households who have not experienced any change in income or situation since their last declaration. This allows them to be exempt from filing a declaration “only if the pre-filled information known to the tax services is accurate and exhaustive”, specifies the Ministry of the Economy.

This system, which has existed since 2020, requires taxpayers to self-declare any change in situation to the tax authorities, such as a new address, a change in family situation or even the acquisition of real estate. In 2024, self-employed workers, liberal professions, traders and owners benefiting from rental income are excluded from automatic declaration.

In the event of an oversight or error in the information transmitted to the DGFiP, a fine may be imposed on taxpayers if this oversight led to “reducing tax or increasing a tax advantage” in favor of the person. This fine takes the form of a 10% increase in tax.