In the past year, Luna, the Terra Coin, has yielded more than 16,674% and attracted a lot of interest. The price of Luna reached a high in April 2022, but after UST, Terra’s stablecoin, Luna backed through an algorithmic mechanism that the coin developer required to tie (Peg) to the US dollar, Luna reached its highest peak in April 2022. It cannot be maintained at the rate of $1 UST to $1 USD. thus causing a loss of trust from coin holders and traders. Consequently, UST has been sold continuously, affecting the value of Luna.

Therefore, it is the origin of the study of behavior and account characteristics of Luna traders in Thailand how they behave. Looking at the overall trading value of digital asset exchanges in Thailand in 2022, using Bitcoin or BTC trading value as an indicator of the direction of the digital asset market at different times, it was found that After April The trend of the digital asset market is bearish. However, in May, Luna’s trading volume rose sharply, in contrast to Luna’s steadily declining price after hitting its highest point in the month. April

for this reason The researchers divided the data periods used in the study (January 1, 2022 – May 22, 2022) using the range of milestones affecting the price of Luna as a divider.

which can be divided into 3 periods as follows (Figure 1)

Pre-stage (before May 9) is the time before the price of UST (stable coin).

It’s about to come off the bound at a rate of 1 UST to $1, or less than $1.

Fall – stage (between May 9th and 13th): This is the time when the price of UST tokens dropped from

Rates tied or priced less than $1

Bottom out – stage (after May 13): This is the period when the price of Luna has dropped.

to the lowest point at that time And the digital asset trading center in Thailand announced the suspension of trading.

Temporary Luna for 1 day

Figure 1. Study time period by Lunar milestones.

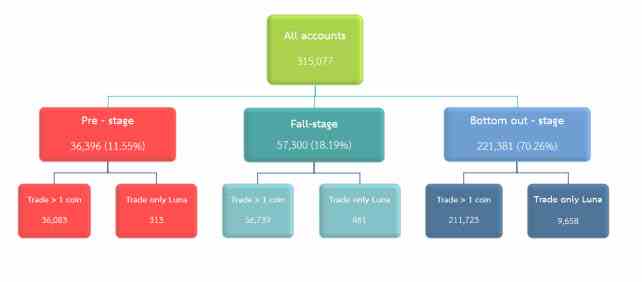

When looking at the overview of accounts that come into trading in 2022, there are a total of 315,077 accounts, with a proportion of

It accounts for about 99% of domestic investors and 1% of other types of investors.

Come to trade with a portfolio size in the range of 5000 – 1,000,000 baht and divide the number of accounts according to the time period.

The study was performed as follows (Figure 2).

- Pre-stage : 36,396 accounts or 11.55%

- Fall-stage: 57,300 accounts, 18.19%

- Bottom out – stage : 221,381 accounts or 70.26%

Figure 2. Number of accounts trading Luna during each study period.

Of the total number of accounts trading in Luna, there are 211,723 accounts, approximately 67% of whom have experience in trading other cryptocurrencies. But have never bought Luna and have just started trading in the bottom out. There are 9,658 accounts that come in only to speculate on Luna, accounting for about 3%. This can be due to many reasons. factors together as follows

- The first factor is the price of Luna, after it had bottomed out (as of May 13), as well as resumed trading after a temporary suspension of trading. The price of Luna has soared to around 400 times (as of May 14) from its lowest point. The price adjustment has increased dramatically, resulting in a large number of people flocking to buy. It is thought that they can profit from periods of high price volatility. This type of behavior may be explained by the behavioral biases of traders who often find themselves over-confident. (Overconfidence), that is, forecasting the opportunity to earn higher than it is. while underestimating the risk of loss

- The second factor is Confidence in Luna’s project that historically has been among the top 10 coins with the most market capitalization in the world. As well as the founder’s announcement of a recovery plan to salvage the Lunar coin situation, it has brought in a large number of new traders who have never bought Luna.

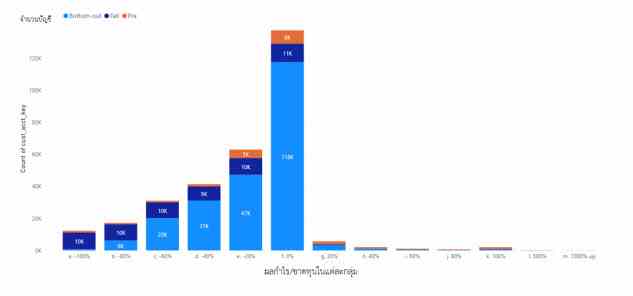

However, when looking at traders in Luna, it showed a return on losses of 96%, with the majority of the accounts losing money being those that had just started trading in the bottom-out period (Figure 3. )

Figure 3. The proportion of accounts in each group divided by study period

Summarizing the profit/loss of the accounts of each group of traders studied in the Thailand Digital Asset Trading Center. It was found that the net loss was about 980 million baht, which was found that most of the accounts were domestic individuals. The accounts entered during the Fall are the ones with the largest losses (Figure 4).

Figure 4. Profit and Loss Proportion in each group divided by study period

From this study, it can be seen that traders in the digital asset market aim for short-term speculation. including investments according to the current and mainly pay attention to the numbers of high returns Ready to accept losses in exchange for the opportunity to earn very high profits in a short period of time. which at times may lack investment diversification and assess the risks that will be received The results of this study will help reflect the trader’s profit and loss over time. To realize careful consideration before deciding to trade in the digital asset market. The actual profit potential may not be as many as expected, in addition to the high volatility nature of digital assets. Therefore, the money invested should not come from borrowing or spending money on a daily basis. And if this money is lost, it must not be a burden to yourself and your family.

refer : LINK