Price increase at Apple

Weak job data boosts US stock markets

May 3, 2024, 10:41 p.m

Listen to article

This audio version was artificially generated. More info | Send feedback

Unexpectedly poor labor market data is giving the US stock markets a boost and giving more room to hopes of a turnaround in interest rates. Apple in particular is causing people to buy in the tech segment with a price jump.

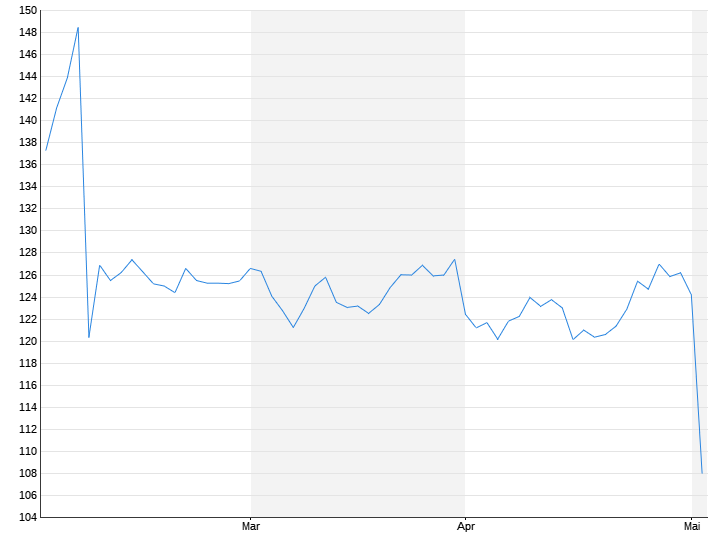

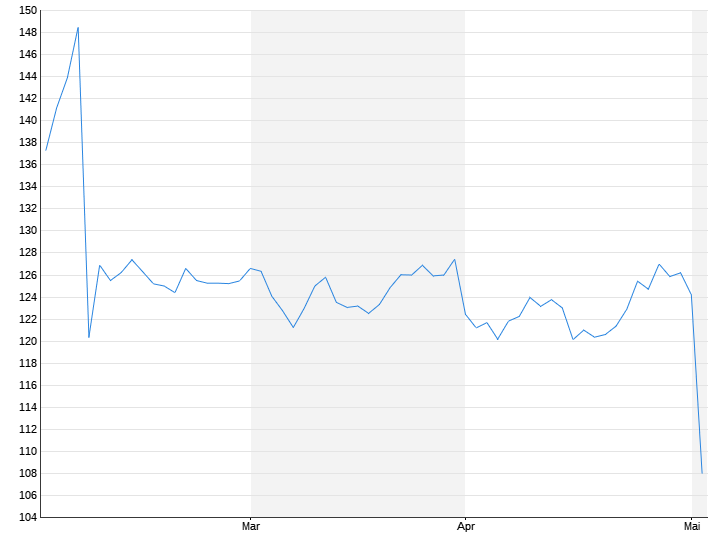

At the end of the week, US investors bought stocks after surprisingly weak US labor market data. The Dow Jones Index the standard values closed 1.2 percent higher at 38,675 points. The technology-heavy one Nasdaq moved up two percent to 16,156 points. The broad one S&P 500 increased 1.3 percent to 5,127 jobs. All three major Wall Street indices achieved weekly gains.

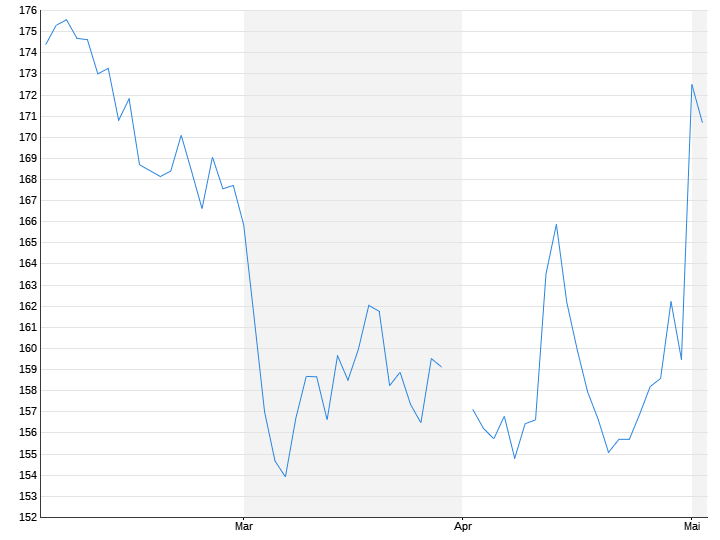

Significantly fewer non-agricultural jobs were created on the US labor market in April than expected, at 175,000, which revived hopes of falling interest rates on the stock markets. “From the Fed’s perspective, the data is weak across the board, and that’s what really matters,” said Glenmede investment strategist Jason Pride. The central bank wants to curb persistent inflation and also cool down the hot labor market.

Interest rate hopes are getting a boost

Since the beginning of the year, expectations of an interest rate cut by the US Federal Reserve have cooled noticeably on the stock markets. On the futures markets, the probability of the Fed cutting interest rates in September was now estimated at 78 percent on Friday. Before the data was published it was only 63 percent. The number of interest rate cuts expected this year also increased to two steps from one previously.

The dollar came under pressure as a result of interest rate speculation. The dollar index lost 0.2 percent to 105.05 points. The crypto currency Bitcoin, on the other hand, had the upper hand and gained almost five percent to $61,609. Investors also increasingly placed bonds in their portfolios. In return, the yield on ten-year US Treasuries fell by more than seven basis points to below 4,500 percent.

Good news from Apple

There was a jump in prices in the tech sector Apple of almost six percent for a good mood. A robust services business and the sales success of new laptop models in the first quarter prompted the US technology giant to buy back shares worth $110 billion. With a price increase of around twelve percent, the shares of Amgen out. The biotech group hinted at encouraging data from an interim study of its experimental weight-loss drug MariTide.

The shares of Expedia However, prices fell by more than 15 percent after the online booking company forecast slower sales growth. The company, known for its three brands Expedia, Hotels.com and the vacation rental platform Vrbo, now expects sales growth in the mid to high single-digit percentage range for the full year, after previously expecting a double-digit increase.