Bitcoin price has begun to recover, recovering above $63,000, and BTC continues to lead the recovery across crypto markets.

Information from TradingView It shows that BTC prices rose sharply from an opening of $60,618, up 5.5%, to an intraday high of $64,240. Has it ended?

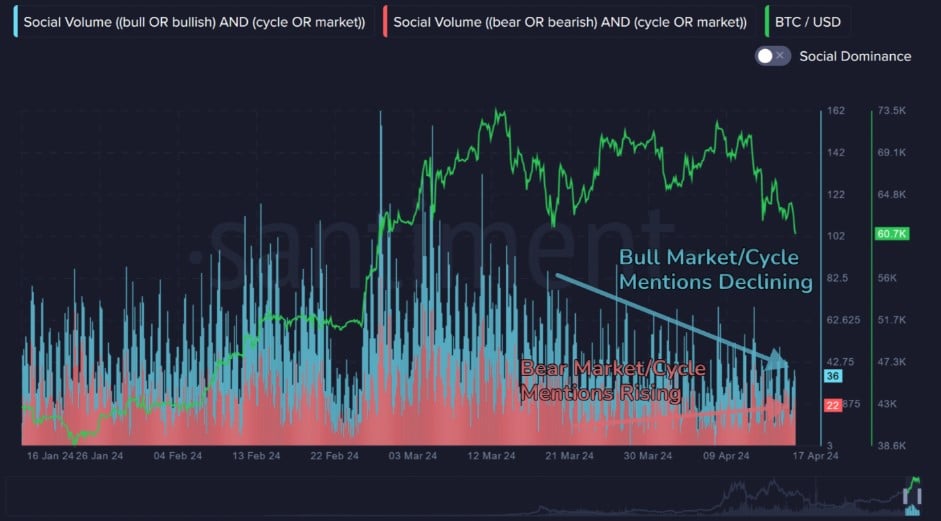

The confidence of the crowd is bearish. Signaling the bottom of the market

Santimet, a market intelligence company, said: The crowd’s confidence in cryptocurrencies has turned bearish. After the recent price drop of Bitcoin, in an April 18 post on X CompanysharedThe image shows that the crypto community has consistently expressed negative opinions about Bitcoin and other large tokens such as Ether.

The image above reveals that The number of mentions of a “bull market” or “bull cycle” on crypto social media has decreased since March 14, when Bitcoin hit a record high of $73,835.

Meanwhile The number of mentions of a “bear market” or “bear cycle” continues to increase.

Historically, the sentiment of the bearish crowd has often been at the bottom of the market. By Santiment Analyst writethat:

“Historically, prices have moved in opposition to the expectations of major traders. A sharp decline in #FOMO combined with a notable increase in #FUD is a promising combination. #cryptocurrency May recover before #halving or shortly after.”

Fading hopes of a Fed rate cut in 2024 and escalating war uncertainty have led to a decline in BTC prices, resulting in a 10% weekly decline in BTC prices at the time of publication.

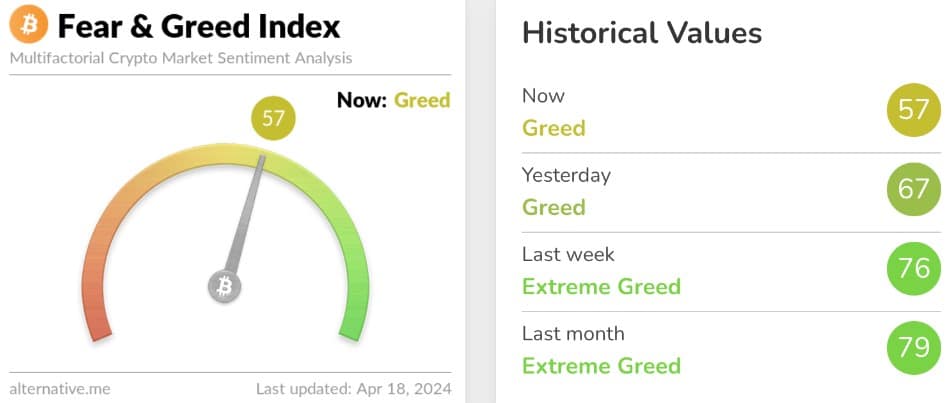

Information from Alternative.me which is a platform that follows The “mood and sentiment” surrounding Bitcoin reveals that although the Crypto Fear and Greed Index dropped sharply from last week’s figure of 76 and last month’s figure of 79, sentiment is at “extreme greed” levels. But it is still in the “greed” zone at 57.

This suggests that Bitcoin traders remain bullish even after more than a week of correction.

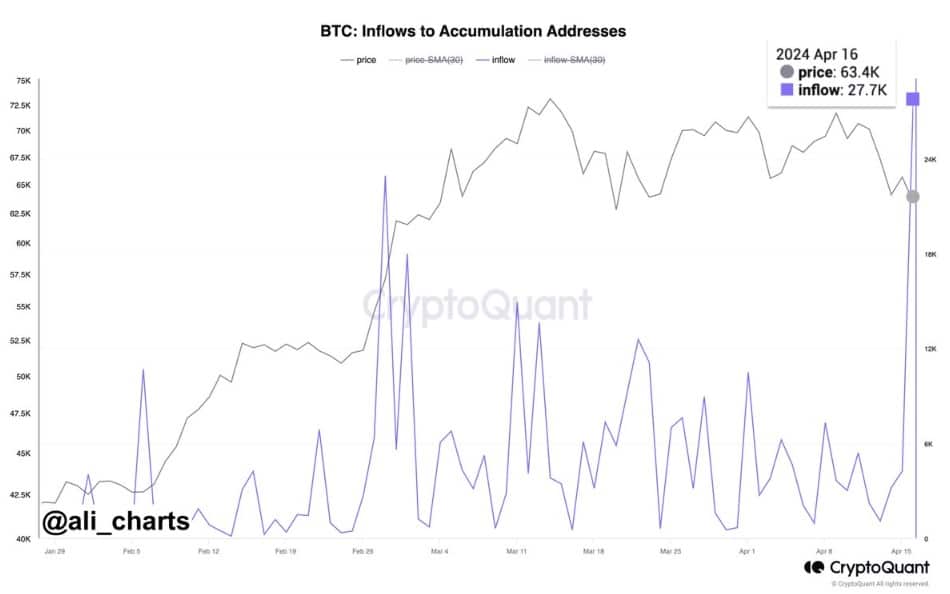

Accumulation activity remains high among Bitcoin holders.

The increase in accumulation among Bitcoin investors comes alongside BTC’s recent fall below $60,000, with data from CryptoQuant revealing a significant move in accumulation of more than 27,700 BTC, equivalent to approximately $1.72 billion, on the day. On April 15, according toshareby Ali

This information indicates that Investors are very interested in accumulating Bitcoin in anticipation of future price increases.

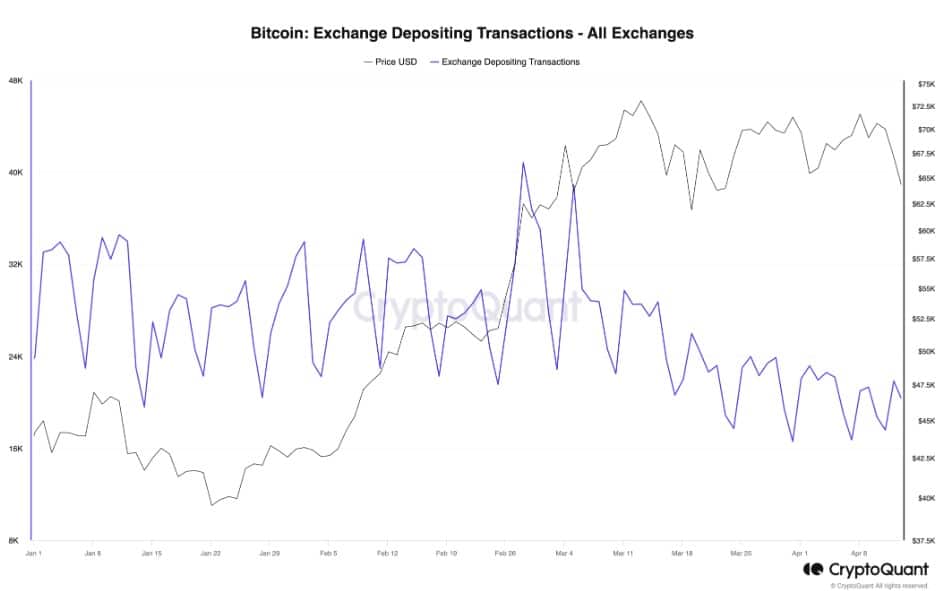

Additional data from CryptoQuant reveals that the number of deposit transactions to known exchange wallets began falling on March 5, when the price of BTC surpassed the previous all-time high of $69,000, and this decline is continuing. On April 12th, although the price dropped more than 8%.

Bitcoin short settlements increasing

The strong moves in the Bitcoin futures market appear to be the reason behind the current jump in price. The duration of the short liquidation coincided with the sudden price increase of the cryptocurrency.

Data from Coinglass shows that more than $32.52 million in BTC shorts were liquidated in the past 24 hours. Total settlements in the crypto market amounted to $174.9 million.