various exchange platforms looking for new ways in building confidence

even though it seemsFTX event collapsehas rocked the centralized exchanges (CEXs), but that’s not entirely true.

The data shows that even fear uncertainty and people’s Fear, Uncertainty and Doubt (FUD) of CEXs and their transparency, but trading volumes on the 13 major exchanges do not reflect a clear decline in sentiment (see The third row on the far right contains “Dec 22”, “Jan 23” and “Feb 23”. [เดือน “ธ.ค. 22” “ม.ค. 23” และ “ก.พ. 23” ตามลำดับ]) Please note that data for February 2023 (“Feb 23”: “Feb 23”) was recorded on February 10, 2023. The volumes shown do not reflect data for the full month.

If there is no Black Swan event or any other emergency Frightening the market again in February 2023, we assume that the volume for the month will increase 3 times from the figure calculated on the chart. to a level similar to that of June, July and August 2022, which is after Terra crackedand before FTX collapse

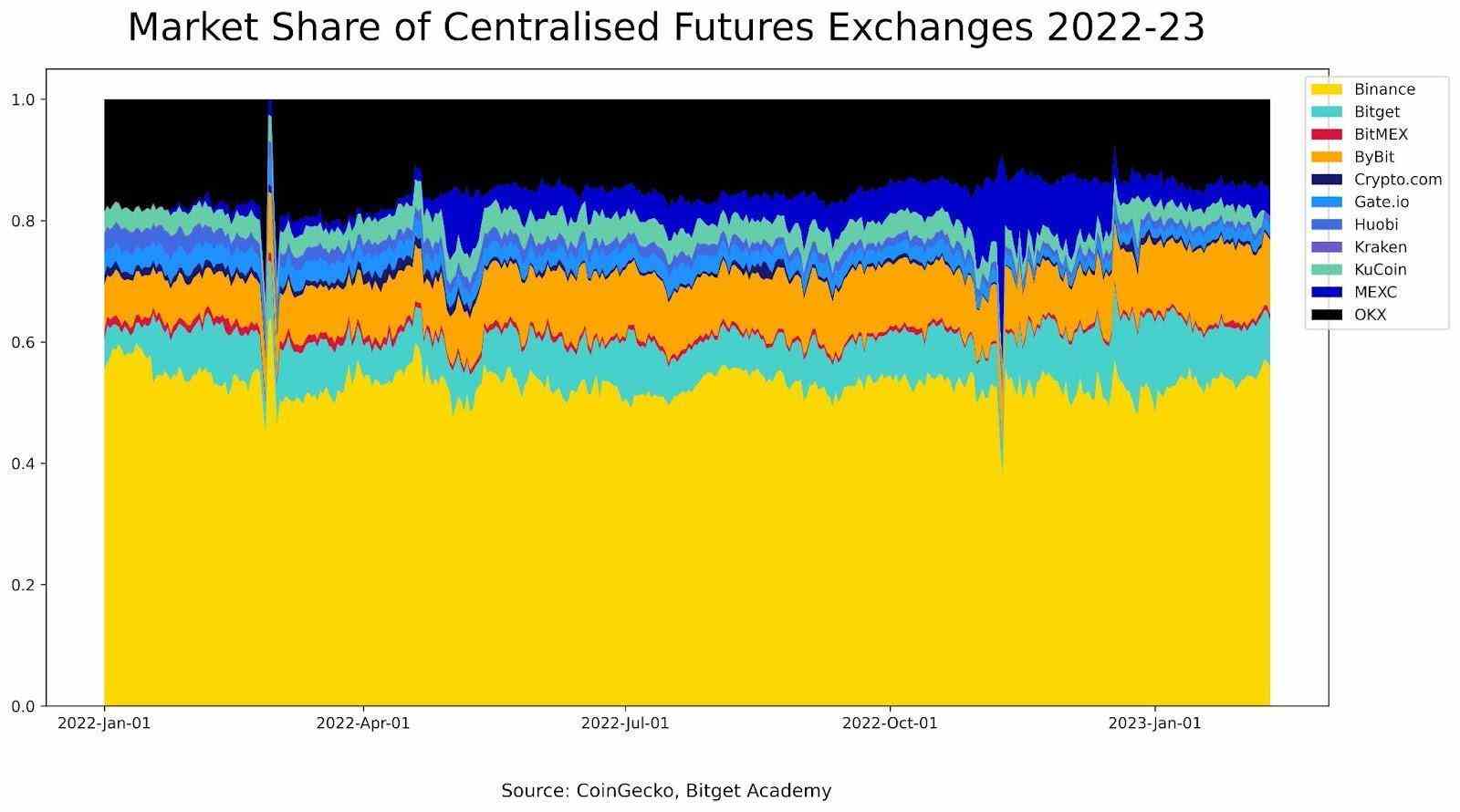

Futures volume equals only a small percentage of spot volume, meaning that market speculation is more intense. (Due to the spike in spot trading volume) after the Terra crash, it weakened towards the end of the year.

Binance has always been a giant among CEXs in the spot and futures markets. During this period, Binance’s spot volume gradually grew, but the Binance futures market did not. What is noteworthy is that after the FTX incident, there were other exchange platforms. Stepping up to play both Bybit and Bitget in Spot and Bitget and KuCoin in Futures.

Based on the average daily volume data, only Binance and Bitget can have active spot trading activity in the first 40 days of 2023. faced with the shrinking of their spot market size, implying a decrease in revenue As for futures trading, there are three platforms that still stand out: Bybit, Bitget and Binance.

Below is a summary of the exchange and token performance of each platform. The exception is Coinbase, which has already listed on NASDAQ. Offshore exchanges each issue their own tokens. This is usually issued after a successful acceptance period. in the beginning Exchange platform token holders are often used to deduct fees and to use with cryptocurrencies. Initial Exchange Offerings (IEOs) Mainly, but later expanded the scope of use of tokens on exchange platforms. which makes various tokens These are of higher value.

After the stock of Coinbase (NASDAQ: COIN) hit an All Time High in November 2021, the price of COIN has lost 85.90% of its value as of the end of 2022. Crypto Exchange Token Performance .com (CRO), the native token of Crypto.com’s own blockchain, is the worst of the nine exchanges, but Bitget Token (BGB) is an exception. It increases in value in proportion to the growth of the exchange platform. And understandably, the falling prices of these tokens, such as FTX and FTT, the FTX token, caused people to avoid holding on to exchanges.

Data up to Feb. 10, 2023 shows that the market recovery appears to have revitalized most token exchanges except Huobi Token (HT), with Huobi reportedly laying off a large number of employees. Including reducing employee incentives as well thus causing the price to fall The top 3 exchange stocks/tokens based on performance to date are Coinbase’s COIN, Bitget’s BGB and OKX’s OKB.

The 7-day average daily returns of exchange-based tokens can help identify the main price trends of these tokens by equalizing the daily volatility generated by the COIN crypto market’s normal volatility. Coinbase, Huobi’s HT and Bitmex’s BMEX have both higher highs and lower lows, while the less volatile and trend-following token, Bitget’s BGB, was the only token that posted a positive. February 10, 2023

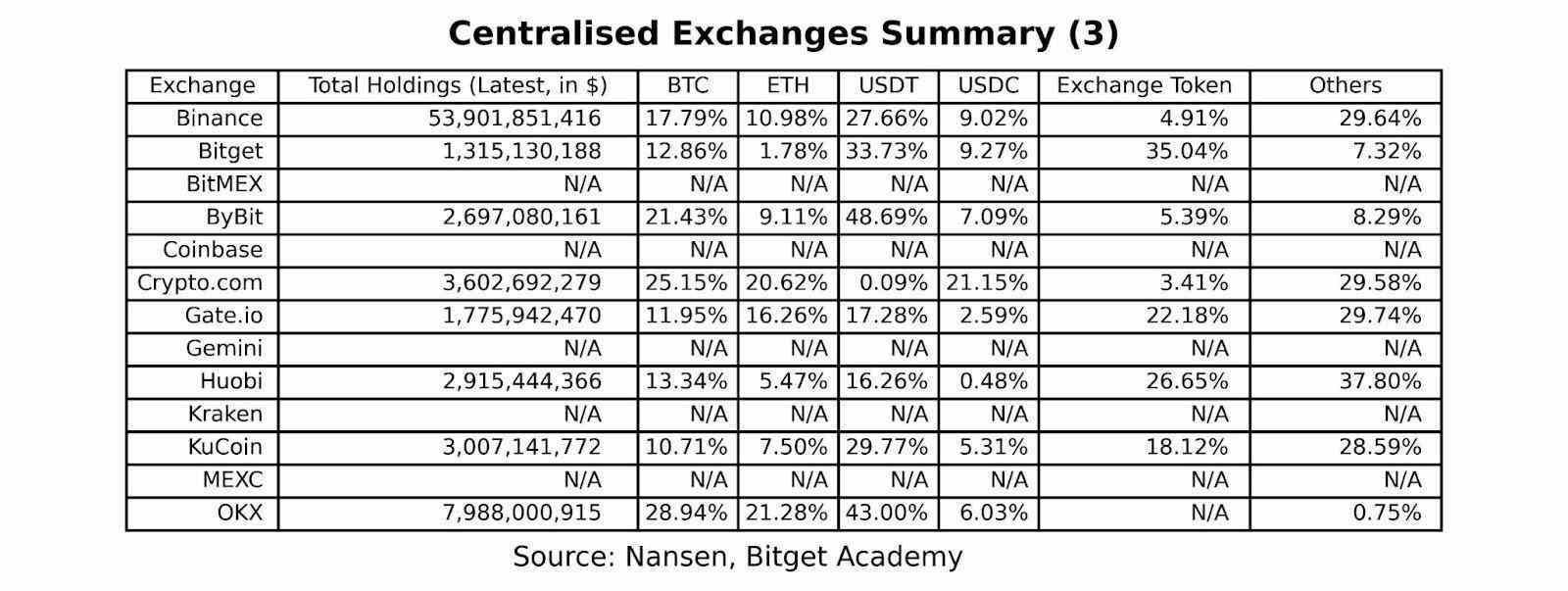

Troubled exchange FTX faced tight liquidity after Binance sold its tokens (FTT) holdings, causing investor confidence in the centralized exchange’s reserves. So many exchange platforms are rushing out. Proof-of-Reserves (PoR) to demonstrate greater transparency and regain user trust. The latest data from Nansen shows that exchanges Most of its reserves are Stablecoins (Tether is more popular than USD Coin), Bitcoin and Ethereum. The Bitget platform has one-third of its reserves held by Bitget Token, while about 30% of its reserves are held by Binance, Crypto.com, Gate.io, Huobi and KuCoin. It is considered a small cap token or a riskier asset such as the Shiba Inu (SHIB).

The institutional group still exists.

Crypto industry financing has been in recession since May 2022 as the case of Terra has resulted in Three Arrows Capital (3AC) goes bankrupt. It is one of the main sources of funding for the crypto industry. However, the institutional group is still not giving up. Especially when Ethereum Merge is successful. number of deals It started to increase towards the end of 2022. Again, the data was recorded on February 10, 2023, so February’s figures may not reflect the sentiment of the institutional group. (Institutional Sentiment) really big players. Highly likely to participate in the Seed and Pre-Series A rounds.

The most popular category in the financing deal was the blockchain services category at 35.6%, higher than the DeFi and GameFi categories combined. Axie Infinity’s Ronin Bridge hack incident cost $650 million. As a result, interest in GameFi projects dwindled in the second half of 2022. Surprisingly, CeFi companies, on average, received more funding than NFT and Metaverse projects, although they did not split. very different though

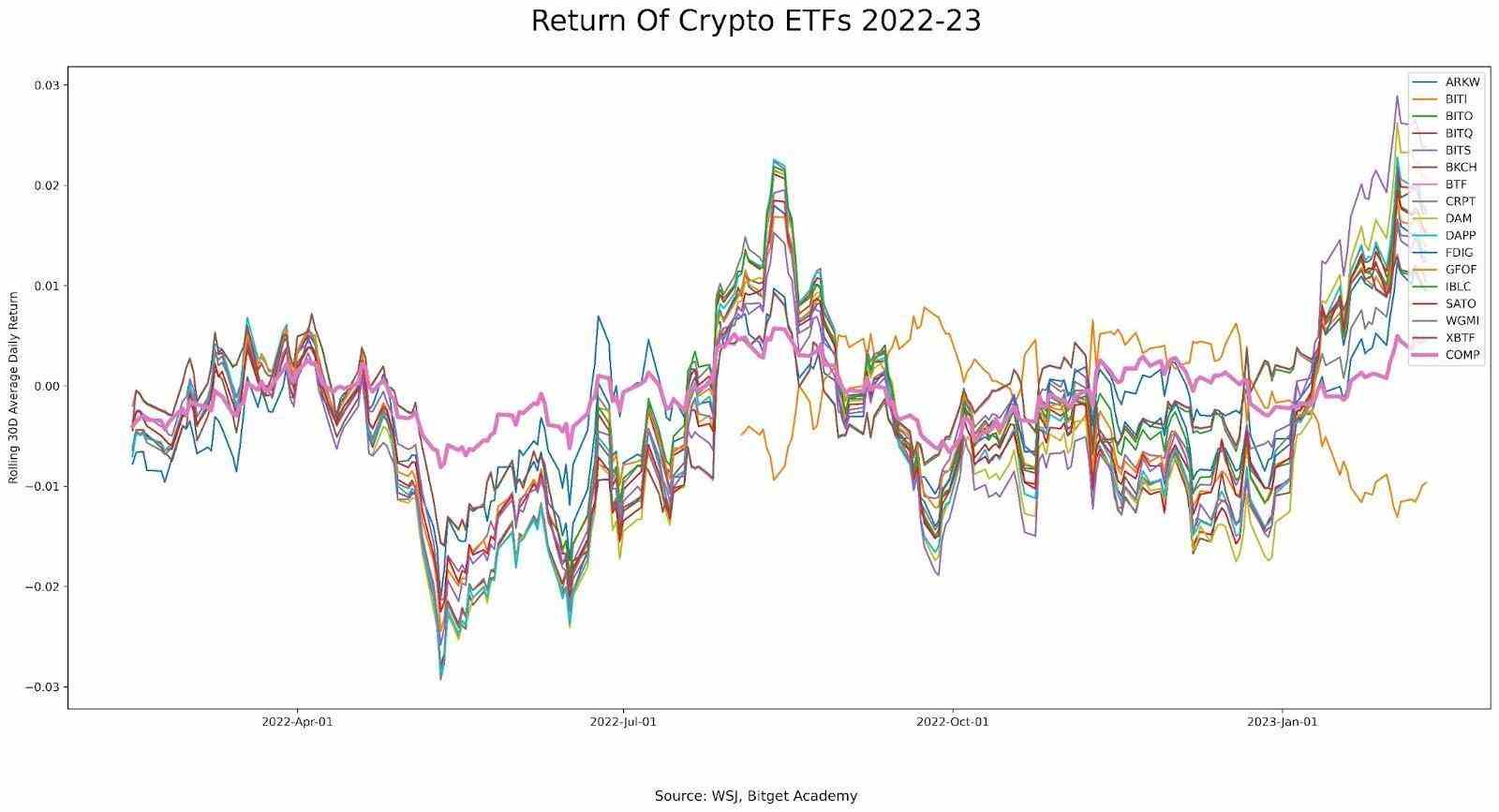

Crypto ETF trading represents another avenue for the convergence of traditional finance (TradFi) with crypto. Bloomberg The crypto ETF has performed strongly in early 2023, climbing into the top 14 based on Year-To-Date returns as of Jan. 13, 2023.

Looking at the NASDAQ Composite Index (the dark pink line) as a benchmark, we can see that crypto ETFs have surged after the new year, but one ETF has lost, the ProShares Short Bitcoin Strategy ETF, which makes sense. Because the price of Bitcoin is rising. Considering the fact that the NASDAQ index often outperforms other indexes such as the S&P 500 or the Dow Jones, investing in crypto ETFs should appeal to more risk-tolerant investors from TradFi. Come and explore this emerging industry.

justcreate an account And start exploring the amazing Bitget-Verse today!

Disclaimer

We have tried our best to ensure that the information herein comes from reliable sources. But we will present the information “AS-IS BASIS” WITHOUT WARRANTY OF ACCURACY, ACCURACY, USEFULNESS. being present We will not be responsible for any errors or omissions, loss and/or damage arising from the display and use of the information.

The information, views and opinions contained herein belong to Bitget at the time of publication and are subject to change at any time. due to economic or financial situations and may not be updated or updated to reflect changes made after the release date.

Information, views and opinions in this report are for informational and educational purposes only. It is not intended or offered as legal, tax, investment, financial or other advice. In no event shall Bitget, its employees, agents, partners and/or other joint ventures is not responsible for decisions, actions or results arising out of or based on the use of the information contained herein. You should not use any investment or trading ideas, strategies or actions. Regardless of individual personal circumstances and financial situation. and/or consult with a financial expert

Thanks for the information: https://www.bitget.com/en/academy/article-details/Bitget-Annual-Briefing-2022-23-Part-3Translator: Bitget Thailand Team