Data, data, data – they are the raw material of the 21st century. Only: This raw material also has to be processed. Without the combustion engine, oil could do two things: stink and make unsightly stains. Likewise, data would just be useless mountains of ones and zeros and artificial intelligence would be a distant dream if it weren’t for high-tech computer chips.

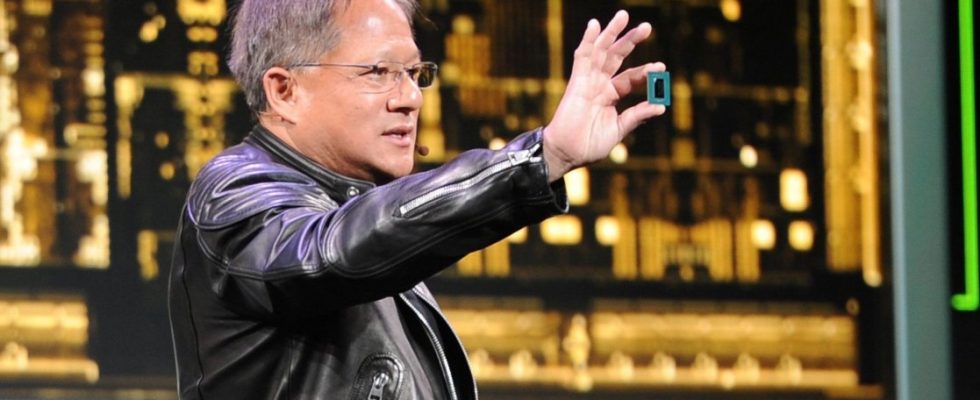

And no one currently has better chips for AI than Nvidia. According to the market analysis firm Omdia, the Californian company controls around 70 percent of the market for the best AI processors. They are mostly manufactured in Taiwan, but the Californian company is behind the complex design. On Wednesday evening it presented its quarterly results – and surprised again: sales rose to 22.1 billion dollars – three times as much as in the same period last year. Growth came primarily from the data center business, which contributed $18.4 billion to revenue, five times as much as in the same quarter last year. And the quarterly profit also shot up from 1.4 to almost 12.3 billion dollars. Nvidia’s market dominance remains unbroken. Founder and managing director Jensen Huang, usually in a black leather jacket, can be satisfied.

Jensen Huang, head of the chip specialist Nvidia, at an appearance at the CES technology trade fair with the prototype of a chip.

(Photo: Andrej Sokolow/dpa)

At the headquarters of Microsoft, Google and Amazon, this success is viewed with envy. Although the tech giants have huge amounts of data, they need all of Nvidia’s chips to train artificial intelligence. Many of them also earn money with so-called cloud computing: They rent the computing capacity of their data centers to companies so that they don’t have to build expensive infrastructure themselves. In order for these data centers to be suitable for AI training, they also need the best chips – and they come from Nvidia. By expanding their own chip production, the tech companies are walking a fine line: they are Nvidia’s customers and competitors at the same time.

It won’t be an easy road, Nvidia’s lead is big. Huang founded the company in 1993 with chip designers Chris Malachowsky and Curtis Priem. They soon manufactured a specific form of chip: graphics processors that were actually intended for computer games. Traditional processors (CPU) are perfect at computing one complex task after another. Graphics cards (GPU) excel at processing many simple tasks in parallel. The US journalist Stephen Witt recently explained with this beautiful image: A CPU is a delivery truck that delivers one large package after another. A GPU is a fleet of motorcycles that swarms through the city with lots of small packages.

A supercomputer made of graphics processors

If you have several such graphics cards, the real trick follows: you can then connect them together and build a supercomputer for certain types of calculations. These high-performance computers can process a large number of computationally intensive tasks in parallel. Perfect for the vast amounts of calculations that underpin today’s most powerful AI models.

Nvidia was the first to discover the hidden potential of graphics cards: They are the shovels and pickaxes for the AI gold rush – that is, what really makes the money. Nvidia sells so many of them that they can barely keep up with production. The chips, according to multi-billionaire Elon Musk, are “currently harder to get than drugs.” Nvidia is the number one dealer in this scenario. “If I want to develop AI models at the highest level, then I need Nvidia,” says Jan-Peter Kleinhans. He is project manager for technology and geopolitics at the “New Responsibility Foundation”, a non-partisan organization thinktank in Berlin. “It could look different in five years, but as of now Nvidia remains dominant.”

Investors also recognize this: Nvidia is now even worth more than Amazon and Google’s parent company Alphabet. Even OpenAI boss Sam Altman would like what Nvidia has. Privately, he is said to have asked investors for a staggering seven trillion dollars to set up his own chip production, the reported Wall Street Journal recently. Shortly afterwards he tweeted quite casually: “Screw it, make it count.” Even for someone like Altman, it seems unrealistic whether he can collect twice the gross domestic product of Germany in investments. But it illustrates the scale at which insiders think about the industry – and what they would spend to challenge Huang’s company’s position.

The competition only offers the second best choice

Altman isn’t the only one nipping at Nvidia’s heels. There are two chip design companies that are roughly in the same league: AMD and Intel. They both offer chips that perform roughly as much or a little more than Nvidia’s second-best product – and therefore always only remain the second and third choices. They are Pepsi, Nvidia remains Coca Cola, with no change in the short term.

The pursuers who are even further behind are either very big or very small. There are start-ups like Graphcore and Cerebras. Graphcore wants to improve the efficiency of existing designs so that virtually the same chips can deliver more computing capacity. Cerebras excels at better connecting the different parts of the chips, which makes them extremely powerful and, unfortunately, extremely expensive.

However, the companies that can afford this are often Nvidia pursuers themselves. The tech giants are making plans for their own chips so that they are no longer dependent on them in the future. Amazon recently introduced the new generations of its own Graviton and Trainium chips, which are supposed to be alternatives to Nvidia. At the same event, Amazon also announced an “expansion of the partnership” with Nvidia and CEO Huang was personally present on stage. Everyone wants to be independent, but no one can afford to alienate Nvidia. According to market analyst Omdia, Amazon purchased 50,000 of the best chips in 2023.

According to the same analysis, Microsoft and Meta each purchased three times as much last year. At the same time, Meta is planning to use its own chips from the “Artemis” series in its data centers for the first time this year – the name of the Greek goddess of the hunt is certainly a good fit if you want to catch up with Nvidia’s lead. Microsoft’s Maia chips will also be able to operate the company’s own cloud infrastructure this year, and Intel will help with this. Google has had its own chips since 2017 and uses them for its cloud offering and the chatbot Gemini, which until recently was called Bard. Nevertheless, according to Omdia, they bought a similar number of Nvidia chips as Amazon last year.

The software also decides

The problem is: Nvidia’s advantage lies not only in the complexity of the chips and their resulting superior computing capacity. They are also deeply integrated into AI development: “Nvidia has developed a software ecosystem called Cuda,” explains chip expert Kleinhans. “With the help of Cuda, customers can adapt their AI models perfectly to the chip and thus use the hardware particularly efficiently.” And there’s even more to Cuda. Nvidia uses the profits from its own dominance to invest in other AI companies. With the knowledge from the respective industries, Nvidia can then create industry-specific code libraries that relieve AI developers of a lot of programming work. Meta and OpenAI have now presented their own Cuda alternatives, which are even publicly available. AMD also has an in-house variant. But they all fall far short of Nvidia’s all-inclusive package.

Anyone who uses Nvidia hardware also uses Nvidia software – and has adapted their AI model accordingly. Anyone who wants to do without the former will also lose the latter. And since Nvidia has been in the business longer than others and delivers the best hardware, they and Cuda are almost everywhere. Replacing them is a bit like having to subsequently replace the foundation of a house that has already been built: the new one may be better, but the change is time-consuming and expensive. “This lock-in effect makes it particularly difficult for small start-ups to compete,” explains Kleinhans. “Not only do they have to deliver better chips, but they also have to convince developers that they should engage with their software.”

So for now, Nvidia has further expanded its supremacy. It is unlikely that a competitor could get in Jensen Huang’s way in the short term.