The AI boom is turning the chip company Nvidia into a sales and profit giant. Business is going well, but delivery restrictions for China are casting a shadow on the balance sheet.

Nvidia’s special chips for artificial intelligence (AI) are currently selling wildly. In the last quarter, the company’s sales were a good $18 billion, three times as high as the year before. Profits shot up to $9.2 billion from $680 million a year ago. The Nvidia technologies, originally developed for graphics cards, have long been proven for computing work when training applications with artificial intelligence.

A gigantic growth market

Nvidia is thus playing a leading role in an absolute growth market: “Artificial intelligence will spread into almost all areas of our daily life. This unique technology has the potential to become the greatest increase in productivity for the global economy since electricity,” says Dom Rizzo, portfolio manager , Global Technology Equity Strategy, T. Rowe Price.

“The total addressable market for AI chips could quickly grow from $30 billion this year to $150 billion in 2027, a compound annual growth rate of about 50 percent,” said Rizzo. Digital semiconductors are the key technologies that will drive this revolution in artificial intelligence.

“AI change is just beginning”

In view of these forecasts, it is not surprising that Nvidia expects that business will continue to run at full speed: for the fourth quarter, which began at the end of October, the group forecast sales of around $20 billion.

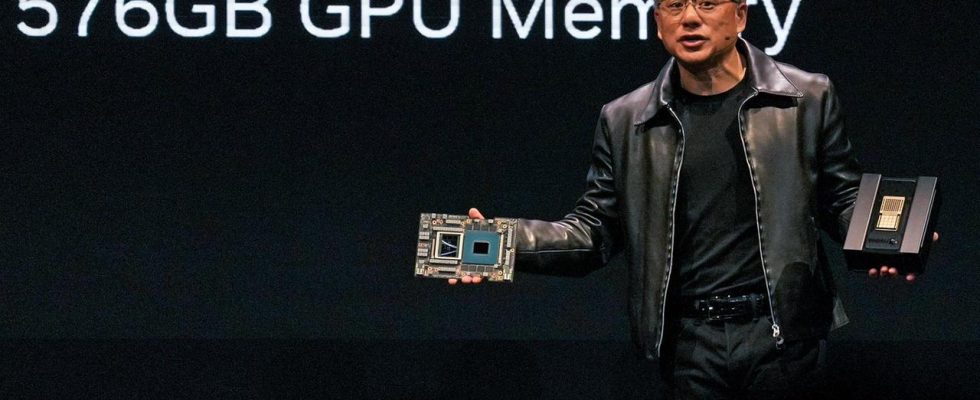

Nvidia boss Jensen Huang emphasized in a conference call with analysts that he sees the change brought about by artificial intelligence as just beginning. Above all, there will be the introduction of so-called generative AI across the board, such as chatbots modeled on ChatGPT, he predicted.

Consequences of the trade dispute with China

However, disappointing statements about business in China overshadowed the balance sheet. Nvidia management admitted that business in China would decline “significantly” under the pressure of extended supply restrictions. Chinese companies were among the major buyers of Nvidia’s AI chips, and the business there recently brought in 20 to 25 percent of data center sales.

The background is the US government’s restrictions on exports to China on the Nvidia technology previously sold there, which were expanded a few weeks ago. Nvidia emphasized that business in other countries would more than compensate for the decline in China. Nvidia is working on configurations and solutions that could also be sold to China according to current rules, said CFO Colette Kress. But that will take a few months and will no longer be noticeable in the current quarter.

“Fly in the ointment”

This would tie up development capacity for products whose sale could also be banned in the next round of sanctions, criticized analyst Jacob Bourne from the industry service Insider Intelligence. The statements about China were also a stressful factor for investors: market analyst Jochen Stanzl from the trading company CMC Marktes noted that this was “the famous fly in the ointment that separated the business figures from perfection.”

When evaluating the current price losses, the development of the share over the past few months should be taken into account. Since the beginning of the year alone, the stock has gained around 240 percent. That’s why it’s not unusual for some investors to take advantage of the opportunity to take profits now.