Status: 07/08/2021 4:49 p.m.

With cryptocurrencies you can not only pay ransom demands, but recently also diamonds at Sotheby’s. But more and more experts are warning of the bursting of the crypto bubble.

From Angela Göpfert,

tagesschau.de

“Bitcoins are only good for two things: speculating and paying ransom.” With this statement, the world’s top central banker, BIS General Manager Agustín Carstens, recently provoked the crypto fan base. This week there is yet another application option: paying for diamonds at Sotheby’s.

New payment option at Sotheby’s

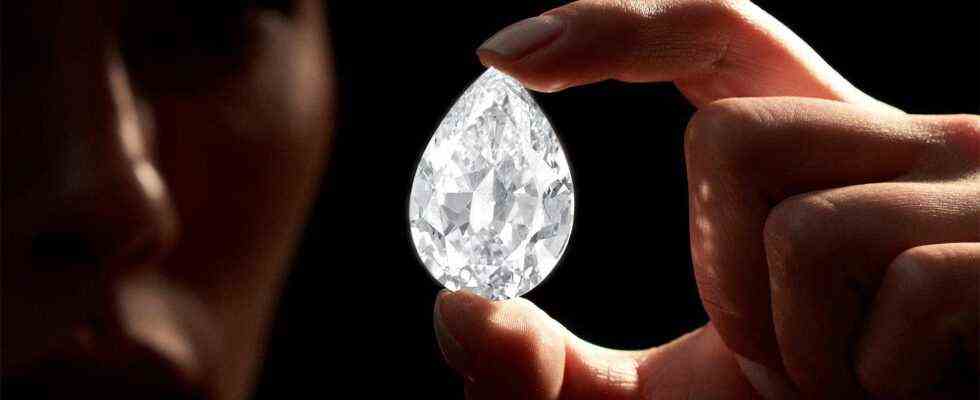

When Sotheby’s auctioned “The Key 10138” in Hong Kong on Friday, the pear-shaped diamond with more than 100 carats could fetch up to $ 15 million. For the first time at an auction of this type, according to the auction house, payments can also be made in crypto currencies.

Sotheby’s first allowed cryptocurrencies to pay for an auctioned work of art in mid-May. British street artist Bansky raised $ 12.9 million for the “Love is in the Air” protest painting. How the buyer finally paid his bill, whether in crypto or traditional currencies, is not known.

Estimated at $ 3-5 million prior to auction, the Bansky painting eventually sold for $ 12.9 million.

Image: picture alliance / Photoshot

Bitcoin in the downtrend

From the auction house’s perspective, this additional payment option, which could also be used with “The Key 10138”, is in any case a great vote of confidence in cryptocurrencies. After all, Sotheby’s does not know how much the Bitcoin or Ether paid are still worth a few hours or days later.

Known for its high volatility, a clear downward trend had recently established itself in Bitcoin. While a Bitcoin was still worth over $ 50,000 at times in the spring, a unit of the oldest and most important cyber currency currently costs around $ 27,000 – around the same as at the beginning of the year.

Musk and China as price risks

For months, a tweet from Tesla boss Elon Musk was enough to get the courses dancing. Most recently, however, it was primarily reports from China that caused turbulence in the crypto markets. The Chinese regulatory authorities are increasingly brutal against crypto currencies.

The People’s Bank of China is increasingly limiting the opportunities for banks and companies to trade in cryptocurrencies. In Sichuan Province, several Bitcoin farms had to close following a crypto mining ban.

Biden is targeting cryptocurrencies

But not only in China, but also in the western markets, tougher rules threaten. For example, the Biden administration is working on an action plan against ransomware attacks. According to Biden’s national security advisor Jake Sullivan, cryptocurrencies are “at the core of such ransom transactions.”

All in all, the risks for investors in the crypto market have not diminished in the past weeks and months. Cryptocurrencies have “turned out to be an extremely risky speculative object in the past,” says Nikolas Kreuz, Managing Director of Invios GmbH.

The major Swiss bank UBS goes one step further and warns its customers against investing in the crypto market. She advises investors to stay away from cryptocurrencies and build their portfolio from less risky assets.

Classic “boom-and-bust” cycle

With a view to Bitcoin & Co., experts speak of a classic “boom-and-bust” cycle: a speculative bubble in which asset prices rise enormously over a longer period of time, only to collapse suddenly.

In recent years, Bitcoin has already experienced three such spectacular boom-bust cycles: The first ran from 2013 to 2014, the second from 2017 to 2018, and the third started in 2020. The longer this third cycle lasts, the louder the warning voices of experts become.

Bitcoin threatens “mother of all crashes”

Star investor Michael Burry recently said that Bitcoin was “the mother of all crashes” still to come. His argument: The crypto universe has problems with leverage positions, i.e. with investments that use leverage. This enables investors to open positions that are larger than their own capital. “If you don’t know how much leverage there is in cryptocurrencies, you don’t know anything about cryptocurrencies. It doesn’t matter how much else you think you know,” warned Burry.

Burry is a legend on Wall Street. The 50-year-old with Asperger’s Syndrome is considered a kind of nostradamus in the financial world, as he predicted the financial crisis and dated it exactly to the year 2007. Actor Christian Bale set him a cinematic monument in the Oscar-winning film “The Big Short”.

Let some air out of the bladder

The big question with regard to the medium-term prospects of cryptocurrencies remains: At what point in the cycle are we currently, is Bitcoin still in the boom or already in the bust phase? According to the latest Bank of America survey, three-quarters of fund managers still see Bitcoin in a bubble.

But it is also a fact: If it was the fear of missing out on something for a long time (FOMO – Fear of missing out), which drove the prices for Bitcoin, Ether & Co. higher and higher, the recent price decline and the growing regulatory Risks caused disenchantment and at least deflated some air from the bladder. Since the spring high, Bitcoin has lost almost half of its value.

Even if that was probably little more than a small cooling off in an overheated market: The story of cryptocurrencies as a golden ticket to wealth and prosperity, which is popular in Bitcoin forums, may not be so easy to tell in the future.