What is Futures Trading on Binance?

The crypto futures market is a market for trading. The “future contracts” that Binance generates are based on the price of a particular cryptocurrency. Users will be able to design more strategies than spot trading (normal buy and hold).

by the contract of trading Future There will be 2 types:

- Long contract / Buy

The long contract is similar to the spot we hold in that the higher the price of the coin we are contracting, the more the long contract is worth. on the contrary If the coin price that we have contracted goes down The value of our contract will decrease. which this type of contract is suitable for Profitability in an uptrend market

- Sell/Short contract

The short contract is the opposite of the long contract, in that the higher the coin price we are contracting, the lower the value of the short contract. on the contrary If the coin price that we have contracted goes down The value of our contract will increase. which this type of contract is suitable for Profitability in a down market or doing it for our hedge portfolios

In addition to making profits in both bearish and rising markets, futures trading can also allow us to increase our return on investment. But it will come with higher risks as well. by a method known as “Leverage”

Futures Leverage on Binance

Leverage is where we place some margin of our money. To be used to open contracts to trade that asset. For example, if we have only 100 baht, we can open a Bitcoin futures contract worth 1000 baht (10 times the money we used as collateral for the contract).

For example, we have 100 baht, but we want to open a short futures contract of BTC worth 1000 baht. This means that in this case we make a leverage of 10 times. Assuming BTC is 10% later, our long contract will have. The value added to 1100 baht means that we have made a profit of 100 baht (100% of the money we opened the contract). Conversely, if the BTC price drops by 10%, the value of our open contract will be 900 baht. It means that we lose. to 100 baht or 100% of the money we bring to open the contract In this case we will call it Our contracts are liquidated or forced to close at a loss. (All the money we used to open future contracts will be lost)

In Binance Futures, we can adjust the contract leverage from 1x to 125X, meaning that we can use $10 to trade up to $10 x 125 = $1,250 in futures contracts. Leverage is this high because if the coin price runs against the contract we are trading. There is a very high chance that our contracts will be liquidated more easily than the lower leverage. Usually most traders set this leverage around 4x – 20x (remember, the higher the reward, the higher the risk). )

How to open an account to use Binance Futures

After we apply and KYC verify your identity on Binance.com We can now start trading on Binance Future by

Go to the Derivative menu and select USD(S)-M Futures.

After pressing in On the window we will see a chart for trading futures contracts.

Depositing funds to your Binance Future account

Before we can trade futures, we need money to trade. We can do this by Tranfers the coins we want to trade, popularly USDT or BUSD from our Spot Wallets.

You can transfer money back and forth between your wallet in Binance and your Futures wallet (the wallet you use in Binance Futures). To transfer funds to your Futures wallet, click on Transfer in the bottom right corner. of the Binance Futures page, then set the amount you wish to transfer and click on Confirm transfer. You will see the increased balance in your Futures wallet.

Introducing the Binance Futures interface.

When we enter the Binance Future homepage window, we will see the following elements:

number 1

Name of the contract we will be trading The example in the figure is BTCUSDT Perpetual This means that we are currently trading the futures contract of the BTCUSDT pair. Perpetual means that the contract will never expire or that we can continue trading without worrying about the contract expiration itself.

number 2

Funding Rate is a number that we should pay attention to. If this number is positive, the person holding the Long Position will pay the person who opened the Short Position according to the numbers shown. which will be paid every 8 hours or 3 times a day

number 3

This is your chart. In the top right corner of this area you can switch between the Original and TradingView charts or see the depth of the order book in real time.

number 4

This is where we choose to open an Isolated or Cross position. For beginners, it is more advisable to open Isolated to prevent breakage. The number on the right shows how much we leverage.

number 5

Here you can enter the price of the contract we want to open and adjust our Position size.

number 6

Here you can enter your order. and switch between different order types. During the opening of a Short or Long position

After you have opened a position, your position will be displayed at the bottom of this page.

number 7

Below are your position positions: the price at which we bought the contract, the price of the contract in the current market, the margin ratio, and the PNL (profit or loss for each position).

number 8

The dial shows the risk of the positions we open.

Setting the Mark Price and Last Price trigger prices for various Stop orders.

To avoid unnecessary liquidation (forced close of the contract) during high volatility, Binance Futures offers us the option to set the Last Price and Mark Price.

Last Price is the last price at which the contract was traded. In other words, the last trade in trading history determines the final price. using PnL (Profit and Loss) calculations

Mark Price is designed to prevent the owner’s price manipulation in a particular market. Calculated using a combination of funding data and basket of price data from multiple crypto exchanges. The price at which you will be liquidation (forced contract closing) and unrealized PnL will be calculated based on this Mark Price.

(Please note that Mark Price and Last Price may differ. When you set a stop order as a trigger at any price, you can choose the price you want to use as a trigger between the Last Price or the Mark Price. Select Mark Price to be used to set Stop orders)

Types of Orders for setting up buy-sell contracts

Limit : A limit order is an order you place in an order book that has a limit price you specify. When you place a limit order, a trade is executed only when the market price reaches your limit price (or better). Limit orders may be used to buy at a lower price or sell at a price higher than the current market price.

Market : market order is an order to buy or sell at the best current price. The limit orders that were previously placed in the order book are executed. When you use a market order, you pay a fee as a market taker.

Stop-Limit : The easiest way to understand is Stop order Limit type. It is divided into stop price and limit price, where stop price is the price that caused the limit order, and limit price is the price of the called limit order, which means when the stop price is reached. your price and your limit order will be placed in the order book immediately.

* You can use the Stop order price trigger as Mark Price and Last Price.

Although stop and limit prices are the same. But in reality it is safer to set your stop price (trigger price) slightly above the limit price for sell orders or slightly below the limit price for buy orders. This increases the likelihood that your limit order will be filled after. to stop price

Stop-Market: Like stop-limit orders, stop-market orders use stop price as a trigger. However, when the stop price is reached, it immediately results in a market order.

* You can use the Stop order price trigger as Mark Price and Last Price.

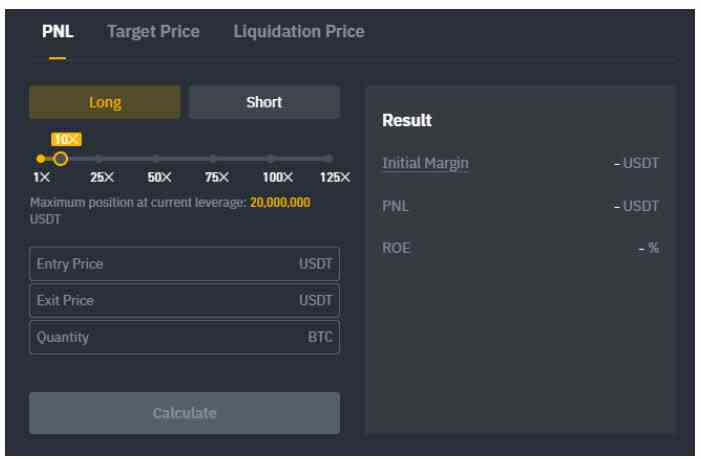

Binance Futures calculator

You can find calculator next to the Transfer button in the lower-right corner. It allows you to calculate values before long or short positions. You can adjust leverage in each tab to use as a basis for calculating your contract.

The Calculator has 3 tabs:

PNL – Used to calculate your Initial Margin , Profit and Loss (PnL), and Return on Equity (ROE) based on entry and exit price and position size.

Target Price – Used to calculate the price at which you will exit your position to obtain the desired percentage return.

Liquidation Price – Use this tab to calculate your estimated liquidation price based on your wallet balance, entry price and position size.

Summary of advantages and disadvantages

- It can be profitable whether the market is in an uptrend or a downtrend (coin price goes down, buy short contracts to make profit, coin price goes up, buy long contracts to make profit).

- Low capital use, big profit from leverage (the bigger X amount, the higher the risk)

- Use hedging the price risk of the coin held. For example, if we are confident that the coin price will definitely go down. Short futures contracts can be purchased to balance the value of the coin held.

- There is a chance of being liquidated (forcing a loss to close) when the coin price runs against the contract we bought. For example, when we buy a short contract, the coin price goes up sharply.

Warning

A leverage of no more than 10x is recommended as the crypto market is highly volatile. And always check the health of our open positions to avoid liquidate.