Ethereum price surges to new 2024 high of $4,065 due to whales ETH Accumulation is accelerating Along with an increased ETH burn rate and a near-full Dencun upgrade.

Ether whales are accumulating more as Ether on exchanges decreases.

Major Ethereum investors have been increasing their holdings in anticipation of future price increases. This is according to data from market intelligence firm Santiment, which shows that the percentage of wallets holding between 10 million and 100 million ETH increased from 27% on January 1 to 30.56% on March 11, as shown in the image above. lower The percentage of holdings between 1 million and 10 million ETH has also increased sharply over the past five days from 7% to 7.6%.

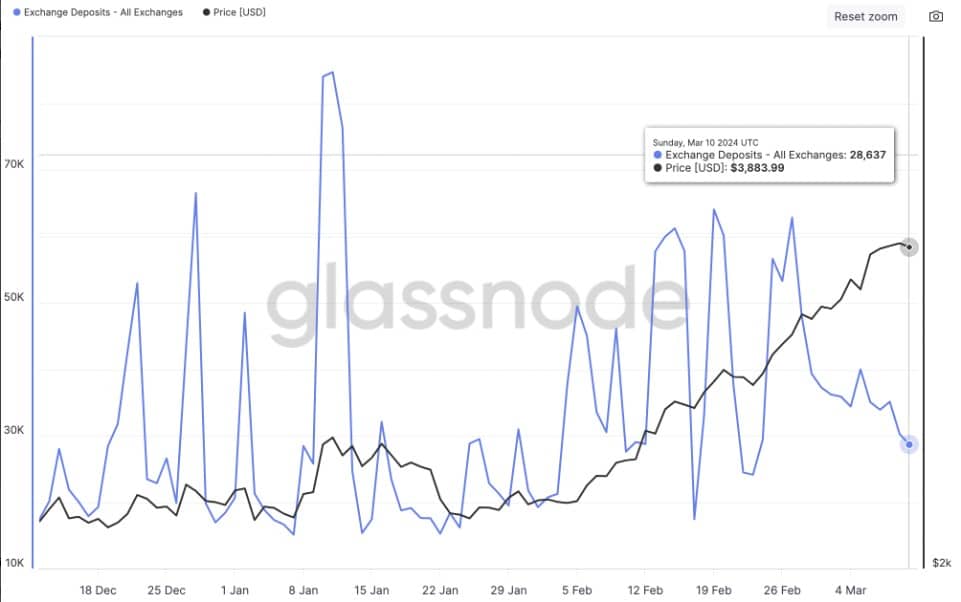

The accumulation of Ether whales coincided with a reduction in ETH deposits from exchanges, according to Glassnode, with the number of transactions deposited to known exchange wallets starting to decline on February 27, when the ETH price surged above 3,200. dollar, and this decline continued on March 5th when ETH rose above $3,500, falling from 39,953 transactions to 28,637 transactions on March 10th.

Ether Transfers to Exchanges Decreasing This indicates that the investor has no intention of selling. This is generally considered a good sign.

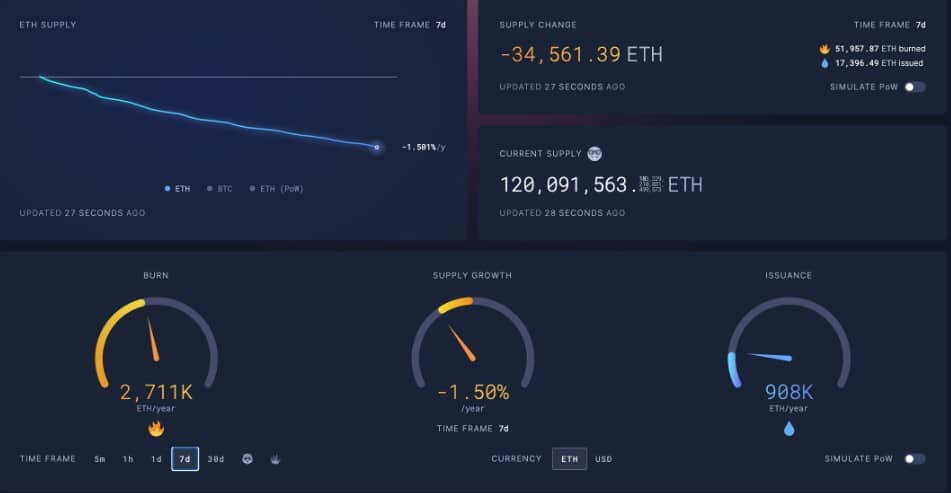

Increased ETH burning rate

Information from ultrasound.money It reveals that more than 51,957 ETH worth approximately $210 million has been burned over the past seven days.

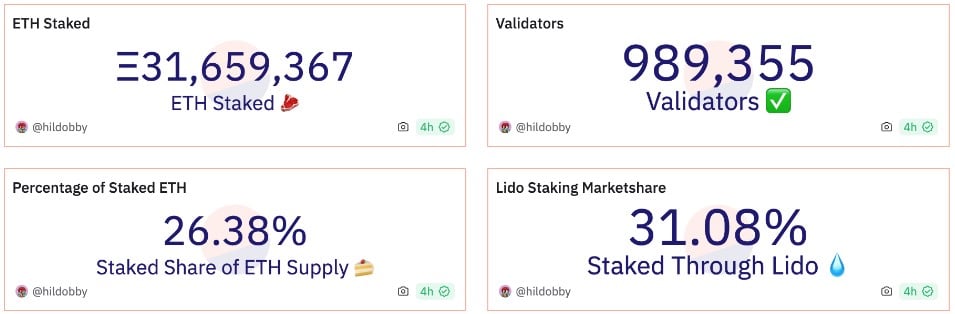

Additionally, the amount of ETH staked on Beacon Chain Dune is over 31.65 million ETH, worth $128 billion at current rates. It is currently being staked on Ethereum’s proof-of-stake layer protocol, meaning 26.38% of Ether’s circulating supply is currently being staked and disappearing from the market, with more than 989,000 validators.

Upgrade Dencun and Ethereum ETF Raise Investors’ Expectations

Investors and developers are keeping an eye on theUpcoming Dencun Upgrade It is expected to go live on March 13 and will be activated. “proto-danksharding” is a feature that aims to reduce costs for transactions on the Ethereum Layer 2 network (rollups) by providing dedicated storage, or “blobs.”

This new upgrade will reduce Ethereum mainnet’s data availability costs and make projects like Celestia, EigenDA, and Avail more attractive to users.

The price of Ether was also supported by rising expectations of Spot Ether ETFs after 11 Bitcoin ETFs received approval from the US Securities and Exchange Commission (SEC) on January 10. Investors They all think ETH ETF approval will be next.

The US SEC expects a decision by May 23, the legal deadline. By the beginning of March Regulators have postponed a decision on BlackRock and Fidelity’s Ether ETF applications in February. And regulators have also postponed a decision on Grayscale’s Ether ETF application.

James Sayffart, a Bloomberg ETF analyst, commented that although the SEC has postponed its decision, But the important date is May 23.

refer : cointelegraph.com

picture decrypt.co/205331