price Ether It surged more than 3% in the past 24 hours to above $2,800 and rose 16% over the past seven days. This is due to a lower supply of Ether on exchanges due to staking, the accumulation of ETH whales. , and increasing optimism from retail and institutional investors.

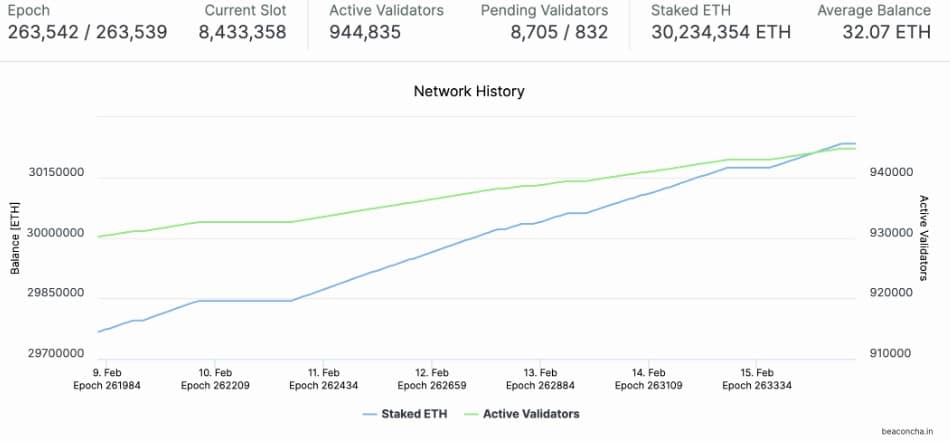

Ethereum staking moves higher

Data from Dune reveals that the supply of ETH staked on Beacon Chain has reached 30,708,316 ETH, accounting for 25.56% of the current total ETH supply. This is worth more than $86.68 billion at the time of writing, and 31.65% of this ETH is staked through Lido.

The image below also shows that investors deposited more than 600,000 ETH between February 1 and February 15 in Stake Ethereum 2.0 contracts.

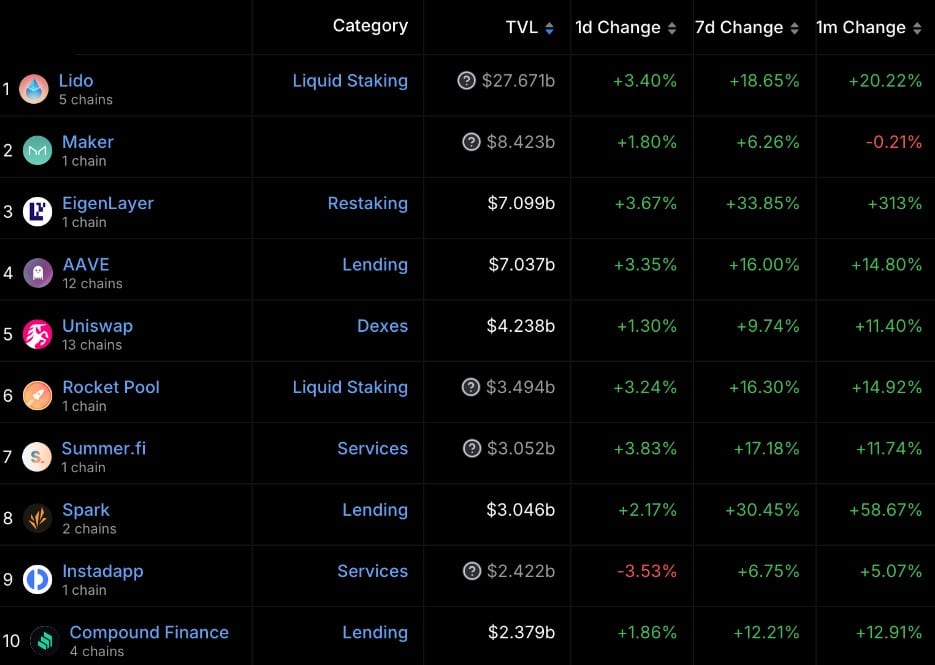

Ethereum restaking protocols have seen an increase in the number of tokens locked on Layer 2 blockchains, with the total value locked (TVL) on Ethereum restaking protocol EigenLayer increasing 33% over the past seven days to 7.09K. million on February 15, overtaking cryptocurrency lending protocols JustLend and Aave in third position, according to DefiLlama.

The increase in staking Ether ensures the efficiency and security of the network. It also reduces the supply of tokens available to buy and sell on exchanges. As a result, demand increases as supply decreases. And this could be a good sign for Ether.

Professional Ethereum traders increase their bets on the bull market.

Ether’s price action has mirrored that of Bitcoin in the past. This has raised traders’ expectations that once BTC breaks the $50,000 level on February 12, ETH could follow suit and break through a similar $3,000 level in the coming weeks. The next day

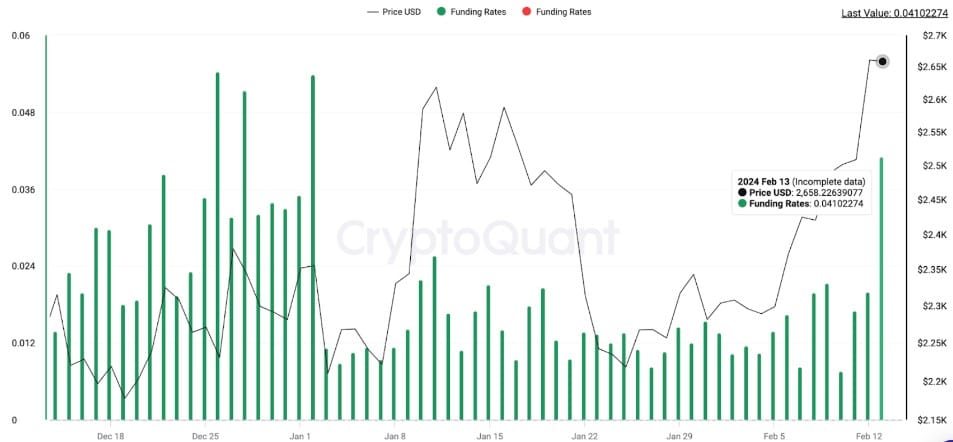

Derivatives indicators also show a significant increase in speculators placing long-side bets.

Data from CryptoQuant shows that the ETH funding rate increased to 0.4% on February 13, the highest since January 8, and indicates that professional traders are placing more leveraged bets on ETH prices. Possible

Whale Ethereum Increases Holding

Ether’s price rally is further supported by optimism that an Ethereum ETF will be approved in the first half of 2024.

To prepare for this Institutional investors are increasingly buying ETH, with data from blockchain analytics platform Lookonchain finding that the 24% increase in ETH prices since the beginning of February may be due to whales purchasing approximately 69,500 ETH worth $179 million in cryptocurrencies. current rate from leading exchanges such as Binance, Bybit, Bitfinex and OKX during the same period

refer : cointelegraph.com

picture dailyhodl.com