Bitcoin price drops more than 9%, confirming bear theories about The “sell-the-news” that followed the approval of the Spot BTC ETF came after the price rose more than 75% in 90 days.

Traders are questioning whether the “bears” will make a comeback after repeatedly failing to break through the $47,000 level last week. On the one hand, there are some reasons behind this fear: market makers and whales are buying. Leading up to the launch, ETFs may be forced to sell at a loss. Moreover, Bitcoin miners may feel pressured to sell some of their holdings as the halving is less than 100 days away.

Regardless of mining Bitcoin How much profit will be made? But reducing block subsidies by 50% will definitely have a significant impact on profit margins. According to Bitcoin News, miner outflows hit the highest level in six years, with $1 billion worth of BTC sent to exchanges.

Let’s take a look at the factors that affect the price of Bitcoin today.

Major investors are still considering the launch of Spot Bitcoin ETFs as institutions typically wait two – three days before deploying their funds.

Large accounts with large amounts of capital are usually processed with caution and precision. They tend to avoid the frenzy of launching new financial products. and chose to wait for the market to stabilize before investing large amounts of capital.

So, while some may feel that why is the Bitcoin price not responding to the launch? But the current correction could be a period of adjustment that will be followed by bigger moves as larger capital flows begin to flow.

According to Yahoo Finance, the second day of trading for the Spot Bitcoin ETF saw trading volume surpass $1 billion. And this brings the cumulative volume of Spot Bitcoin ETFs to $5 billion.

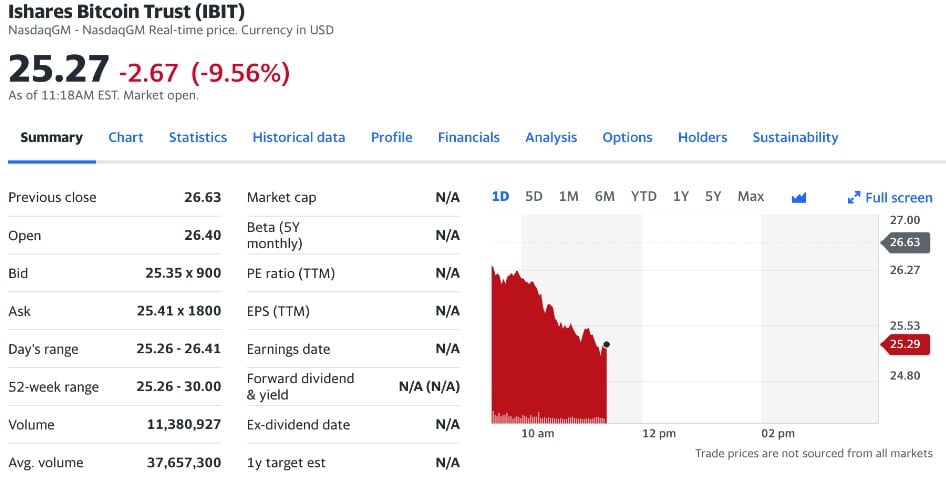

BlackRock’s iShares Bitcoin Trust (IBIT) opened the second day’s session at $25.27, losing 9.5% over the previous 24 hours. IBIT volume stands at $11.3 million at the time of writing.

Grayscale Bitcoin Trust (GBTC) traded down 5.5% and Valkyrie Bitcoin Trust (BRRR) traded down 10% over the same period. with volumes of $27.8 million and $112,980, respectively.

Bitcoin long liquidation

The rapid movement in the Bitcoin futures market appears to be the reason for the current sharp price drop. The duration of the liquidation on the long side coincided with a sharp drop in the price of the cryptocurrency.

Long-side settlements rose sharply to $12.52 million in the span of one hour on January 12.

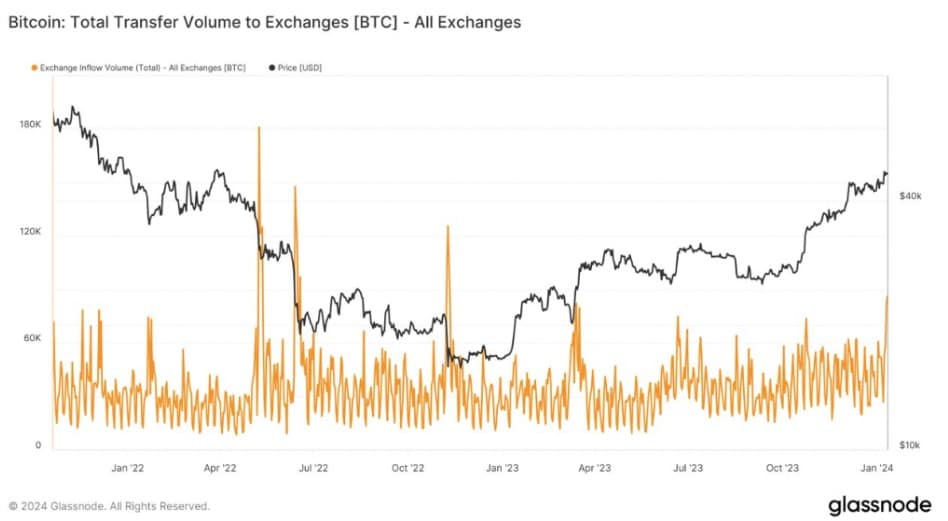

According to data from Glassnode, the amount of Bitcoin transferred to exchanges soared on January 10, indicating increased selling pressure in the market.

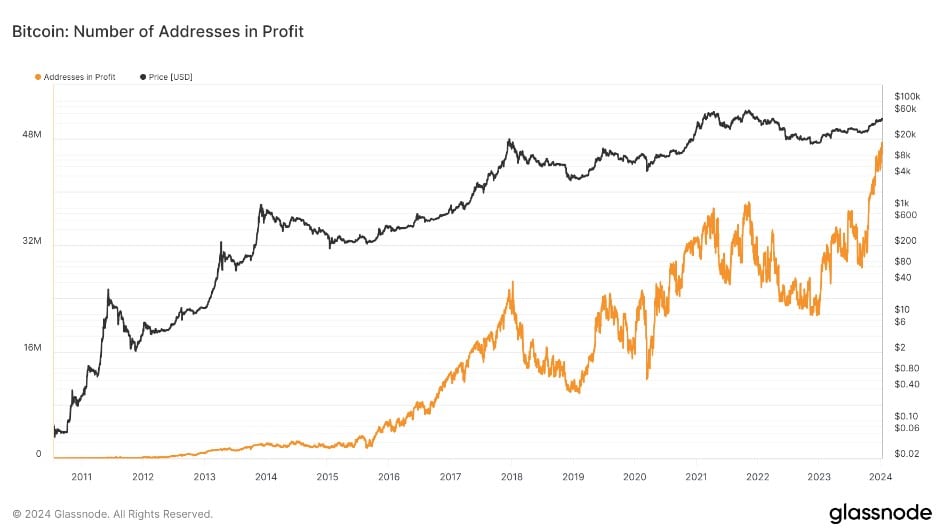

Additional information from Glassnode also points out that Number of Bitcoin Wallets Currently Profitable It reached a record high of $46.8 million.

With the number of bags with profits at an all-time high. This allows investors to lock in profits at the current price. This might explain the current low prices.

Bitcoin continues to face strong resistance at $50,000.

BTC’s sudden rise to $49,000 on January 11 was short-lived, and the price quickly corrected to $46,000. This could be due to strong resistance around the $50,000 zone.

The first time the BTC price fell below this level was in May 2021, losing more than 41% of its value. The second time came after a failed attempt to regain this level in March 2022, when selling pressure hit. causing the price to collapse by more than 77%

As a result, Bitcoin has had to push back above $45,000 and attempt to turn the $50,000 resistance into support to maintain its uptrend.

Key levels to watch for on the downside are the support level at $41,200 and the demand zone around $40,000.

refer : cointelegraph.com