Bitcoin Halving has been a part of the protocol since its inception in 2009, reflecting a deliberate design choice from Satoshi Nakamoto. With a capped supply of 21 million Bitcoins, it will be mined and reward participants for validating transactions. Halving occurs approximately every four years or every 210,000 blocks, reducing the reward in half per new block (currently 6.25 Bitcoins).

It will gradually reduce the speed of new Bitcoin creation to a limit around 2140. Three past halving events have occurred on January 28, 2012, July 09, 2016, and May 11, 2020, with the fourth scheduled to be April 19, 2024

Although these events will spark interest in the market in the short term, But the lasting impact depends on factors such as market demand. and the broader economic situation

This report delves into the impact of Bitcoin halving on the crypto market and explores its connection to the global financial landscape. By evaluating Bitcoin’s potential and risks, we aim to shed light on its evolving role as a new asset class.

Bitcoin Halving Impacts the Cryptocurrency Market

Investors

From past halving events, an important lesson for investors is the importance of patience and avoiding greed. While Bitcoin has continued to reach new highs after halvings, the time it takes to reach these highs will likely be more difficult than expected. more This is coupled with lower multiples. For example, after the first halving, it took 371 days for Bitcoin to reach all-time highs at a multiple of 100x. Subsequent halvings took 525 days at a multiple of 29x and 546 days at a multiple of 100x. It has a multiple of 7x as shown in the graph below.

| Number of days to ATH | double | |

| Halving first time | 371 | 100x |

| Halving second time | 525 | 29x |

| Third time | 546 | 7x |

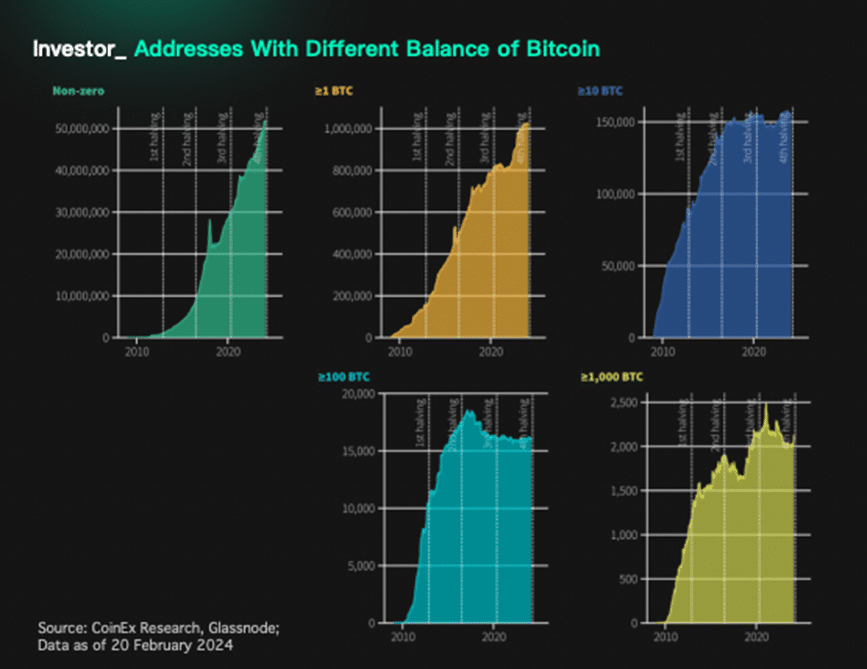

The growth of wallet addresses has been remarkable since the launch of Bitcoin, with over 50 million non-zero wallets and over 1 million wallets holding more than 1 Bitcoin. However, the number of whale wallets (with The balance of more than 100 or 1,000 Bitcoins) has decreased after the latest halving.

Traders

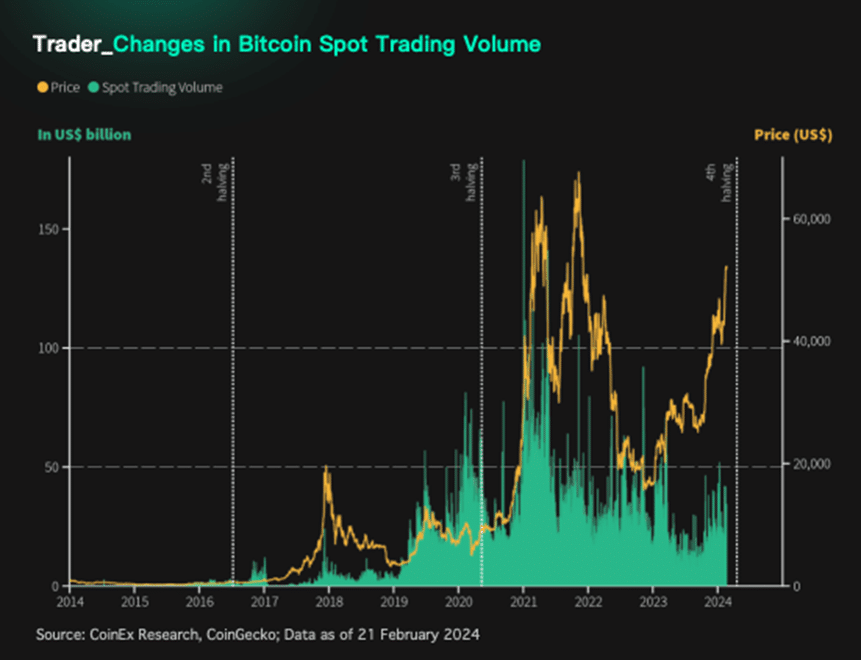

As the Fourth Halving approaches Trading activity is gaining momentum. Average daily spot trading volume currently hovers around US$25 billion. Indicates an active market But it is still lower than the level of the previous bull run. While spot trading volumes have gradually increased from the latest bear market, Bitcoin’s price has remained close to previous all-time highs. Expectations regarding the upcoming halving and increased adoption of cryptocurrencies are growing. It is expected to stimulate more trading activity.

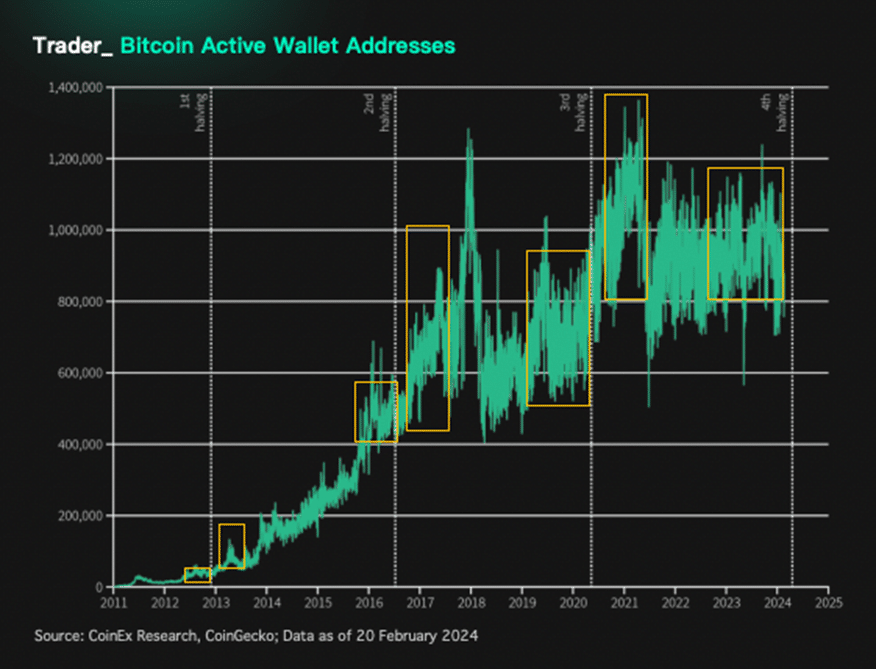

Bitcoin Halving presents a new story to the ecosystem This creates new activity for users. Historically, the number of Bitcoin addresses in use was stable before the halving and experienced a sharp increase afterward. This time around, the focus is on Layer 2 (L2) of BTC, with many related projects expected to launch. which has contributed to the new wave of user growth.

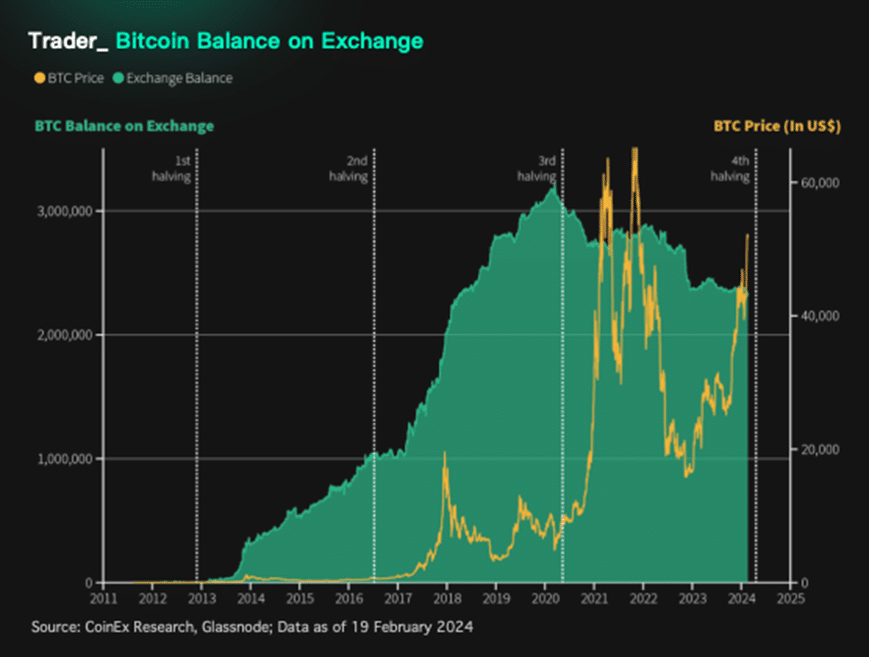

In anticipation of the halving, exchange balances have hit a new low since the last halving event, currently standing at 2.31 million Bitcoins (11.02% of total supply), indicating reduced selling pressure.

Miners

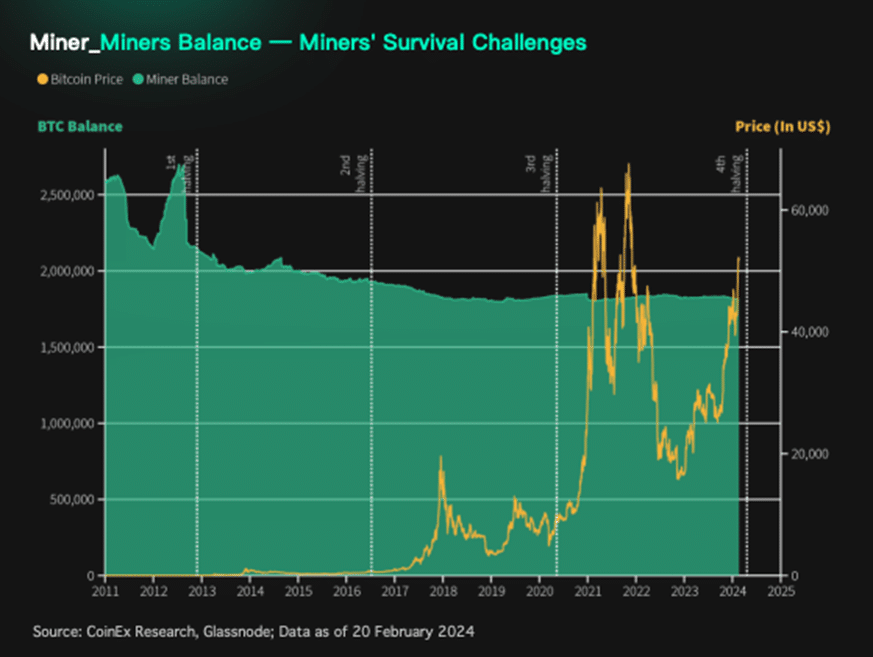

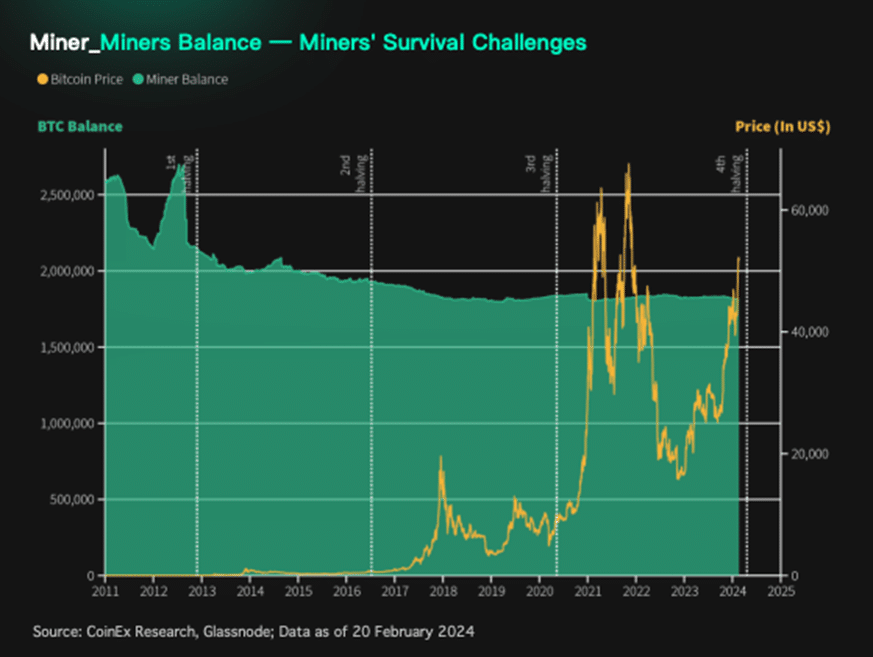

Miners face survival challenges. This is evident from their Bitcoin balances in their wallets dropping rapidly before each halving. The upcoming halving, which is expected to occur in April 2024, follows the trend that started in last quarter. 4 Year 2023, with miners continuing to sell Bitcoins As a result, current balances have reached levels not seen since June 2021.

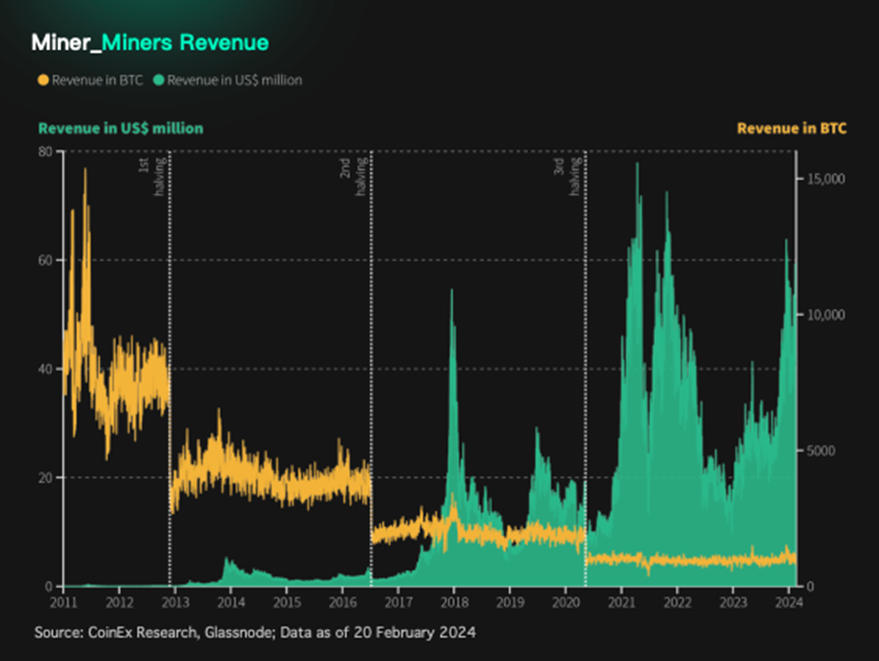

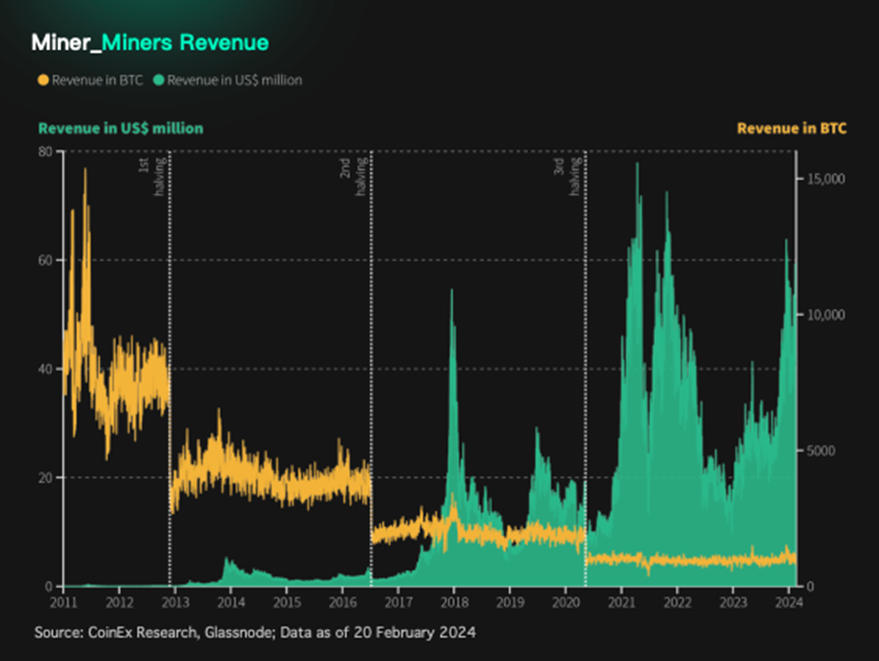

Although the block reward will be reduced. But miner income is still heavily dependent on Bitcoin’s price performance. Fortunately, total income has rebounded significantly from the last bear market due to higher Bitcoin prices.

Bitcoin Halving’s Insights into Global Financial Transformation

Bitcoin outperforms major asset classes.

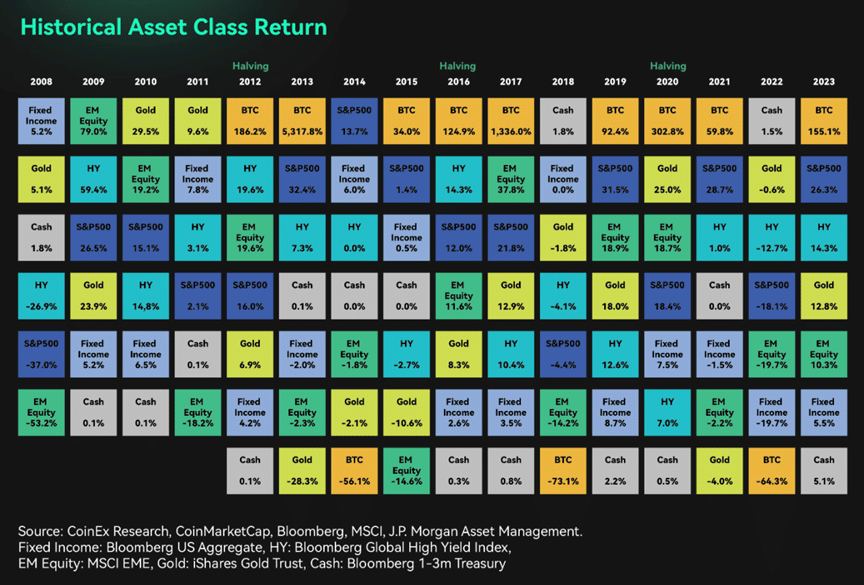

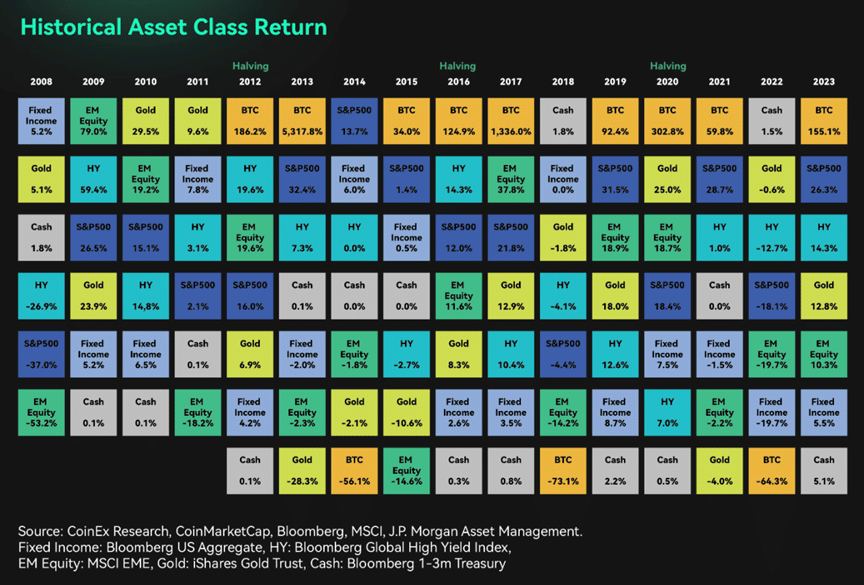

Historical returns by asset class from 2012 to 2023 are shown in the graph below. Highlighting how Bitcoin has consistently performed best in 9 of the last 12 years. Even though it has better performance than this But an interesting pattern emerges as Bitcoin shifts to the worst-performing asset class in the second year following a halving event (i.e. 2014, 2018, and 2022). This underscores the complex dynamics surrounding Bitcoin’s performance. in the broader financial landscape

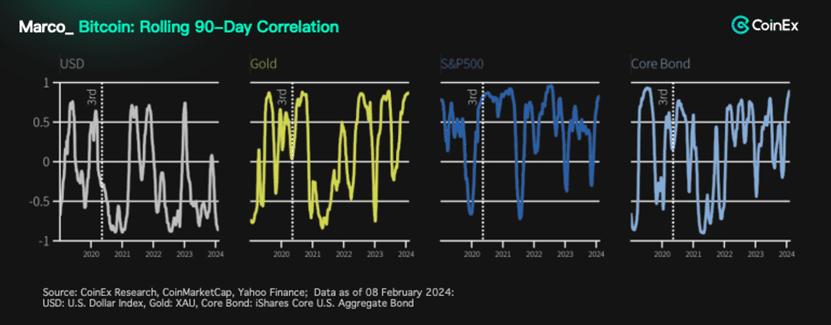

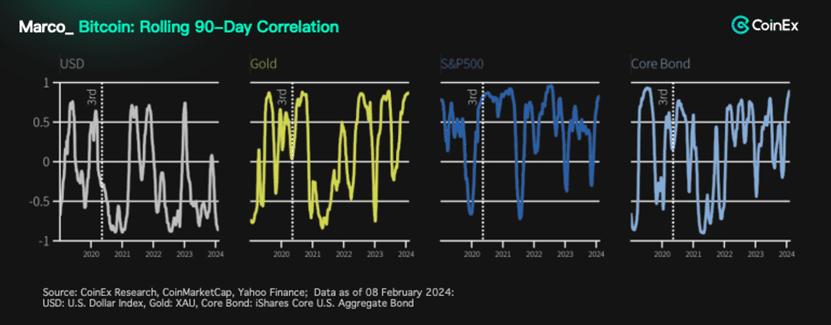

Bitcoin’s relationship with S&P

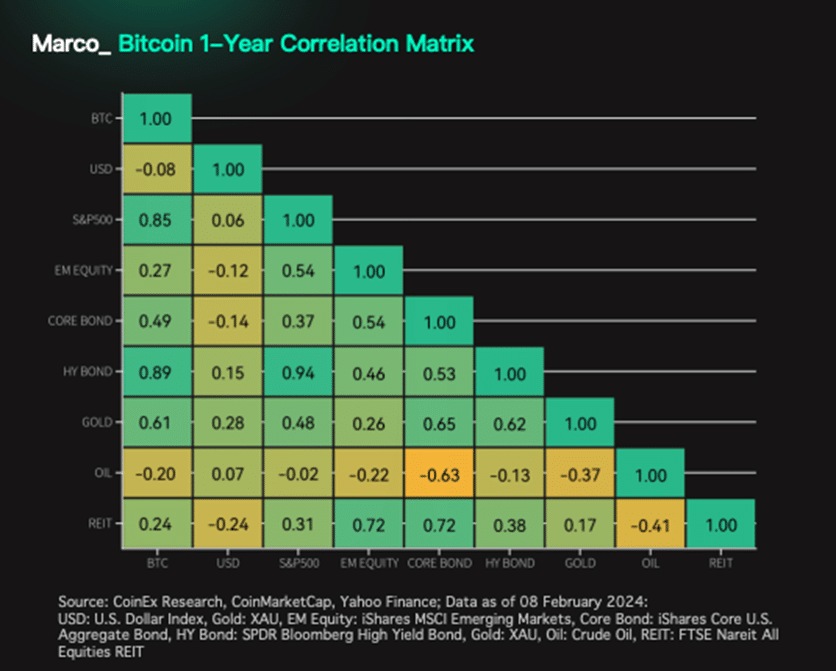

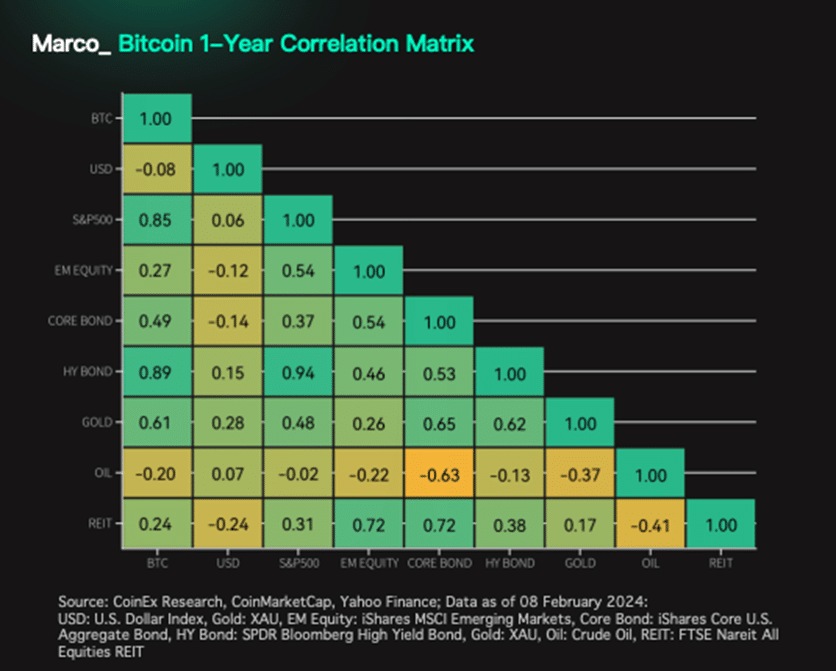

Over a 1-year period, Bitcoin has a high correlation (0.85) with the S&P 500 while maintaining a slightly negative correlation with the US dollar and crude oil prices. as shown below Especially towards the end of 2023 and the beginning of 2024, the 90-day correlation between Bitcoin and major assets such as gold, S&P 500 and Core Bond all increased to nearly 1.0, indicating an even stronger correlation.

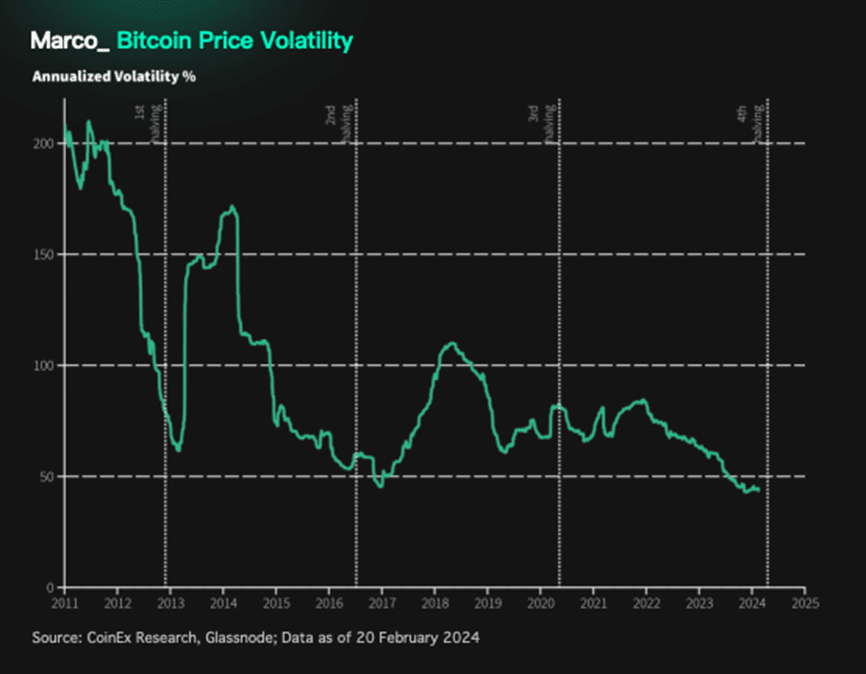

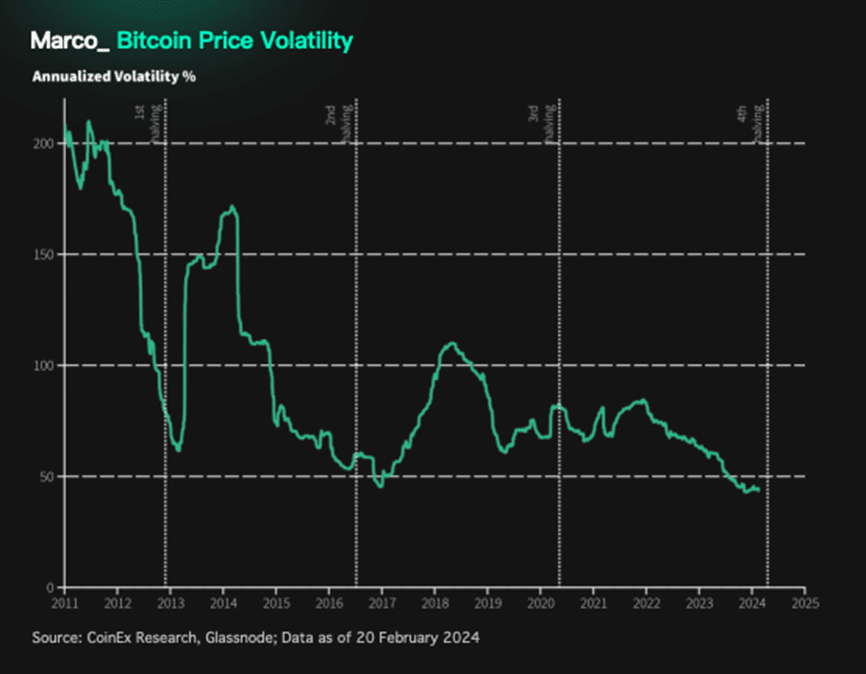

Reduced volatility in Bitcoin prices

Although Bitcoin has been known for its volatility in the past, But Bitcoin’s annual volatility is clearly trending downward. As shown in the chart This trend is due to the increasing adoption of Bitcoin by institutional investors. This increases market efficiency and subsequently reduces volatility. Bitcoin’s continued volatility changes make it a more mature and stable asset class. Compared to traditional equity and debt securities

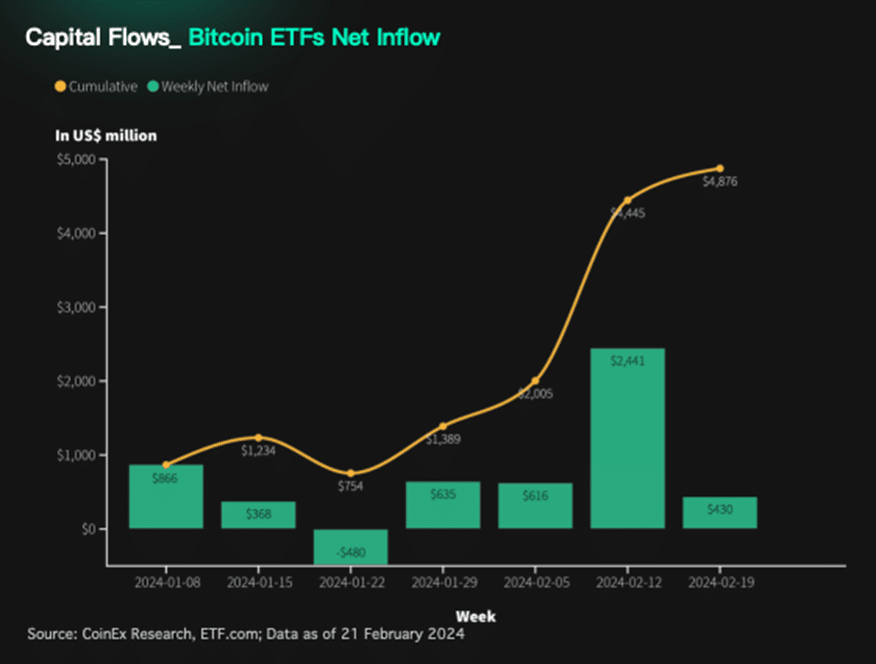

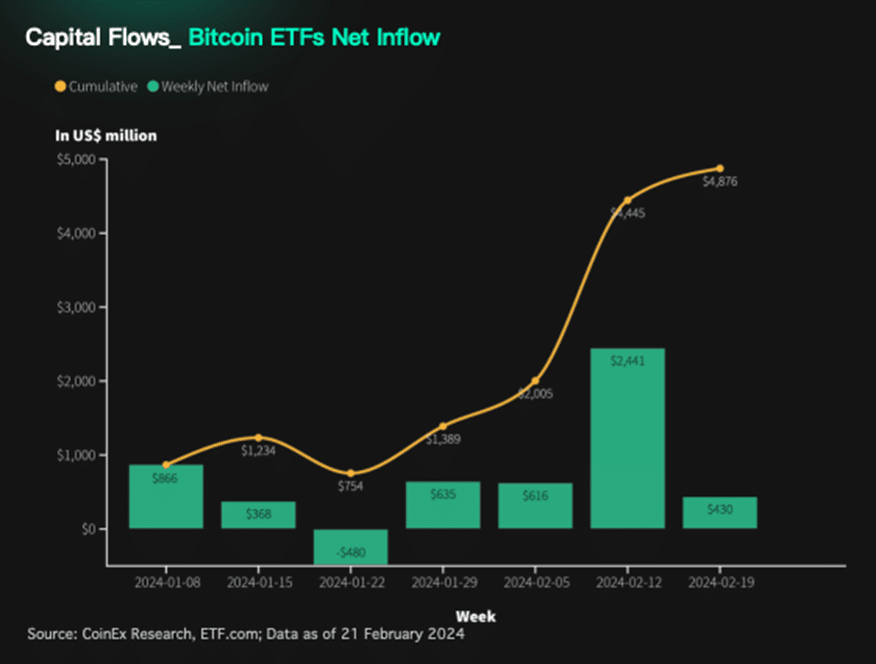

Bitcoin ETFs Witness Strong Net Inflows

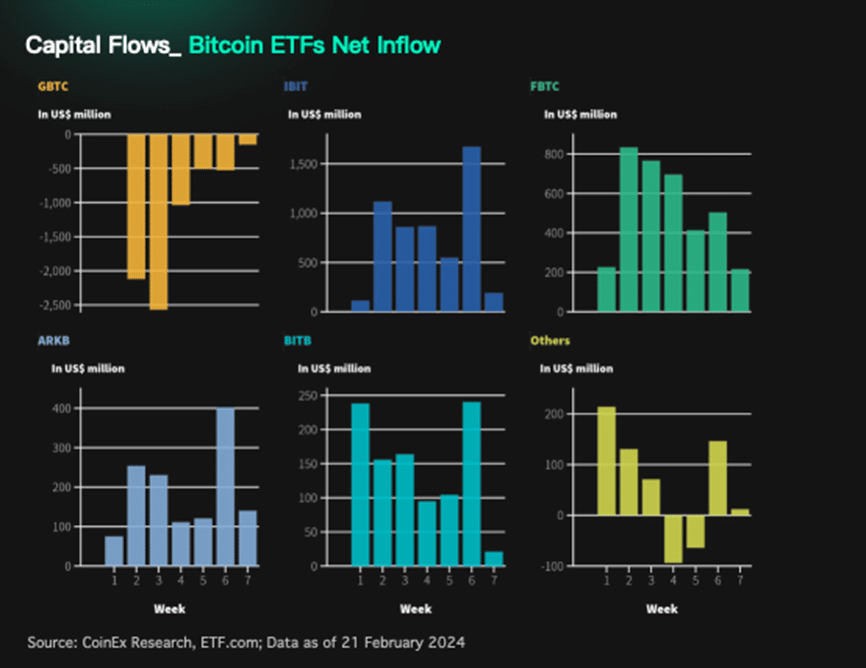

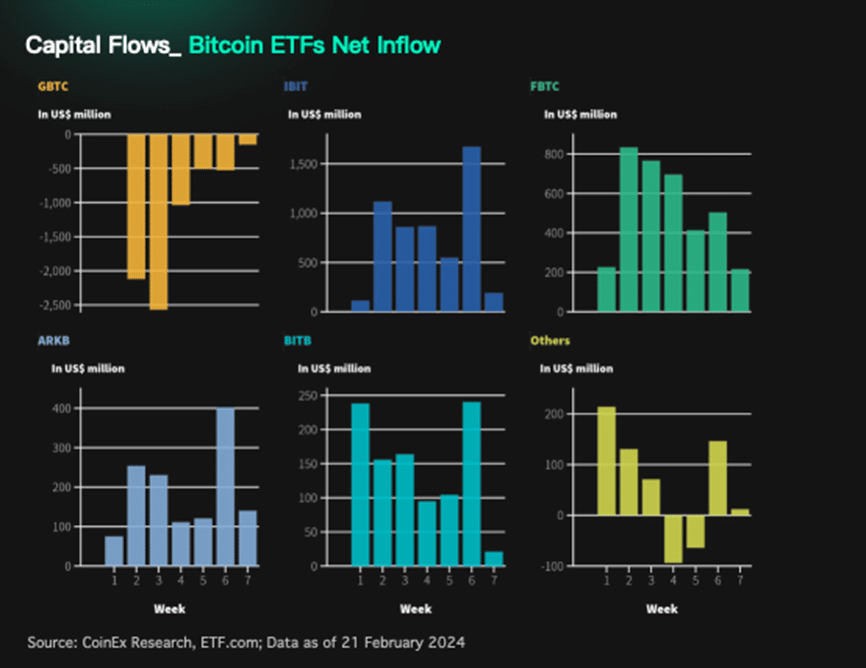

Since the launch of the Bitcoin Spot ETF on US exchanges on January 11, all 10 Bitcoin ETFs launched have received net inflows of more than $4.87 billion in just one month. except It faced the problem of continuous outflow.

As shown in the chart below, which does not include Grayscale, other Bitcoin ETFs are showing continued inflows. The most prominent ones are iShares Bitcoin Trust (IBIT) by BlackRock and Fidelity Wise Origin Bitcoin Fund (FBTC) by Fidelity.

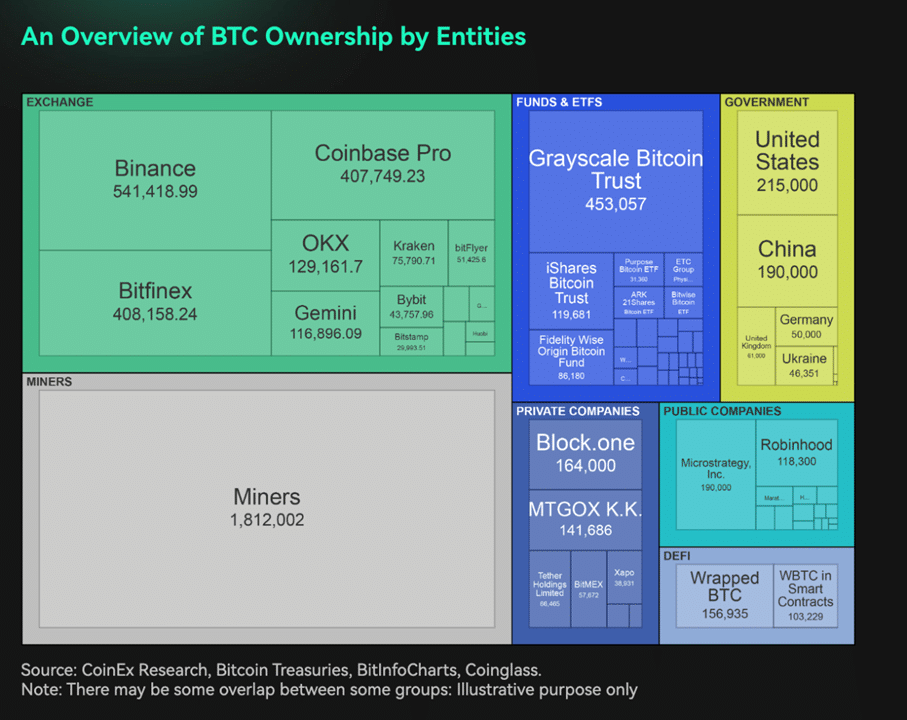

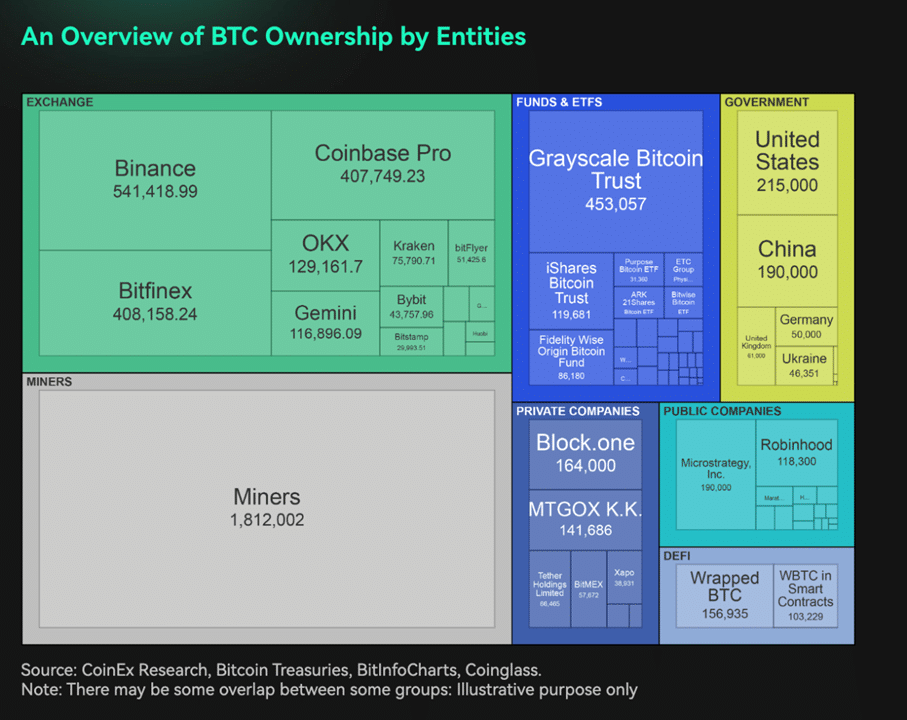

Gradually Decentralized BTC Ownership

Overall, approximately 30% of the total Bitcoin supply has been identified. Among exchanges, Binance, Bitfinex, and Coinbase collectively hold more than 1.8 million BTC, accounting for more than 8.8% of the total Bitcoin supply. Public companies hold approximately 385,000 BTC in total, with MicroStrategy holding 190,000 BTC, accounting for 0.9% of the supply. Bitcoin institutional funds have also accumulated large amounts of BTC, holding more than 850,000, with Grayscale Bitcoin Trust being the largest holder with more than 450,000 BTC.

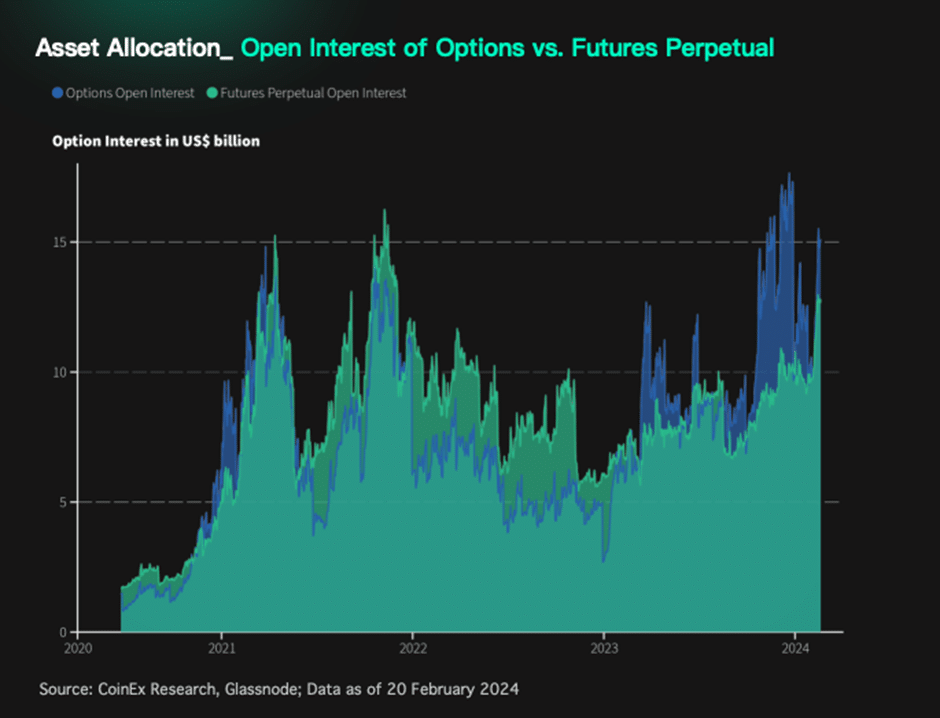

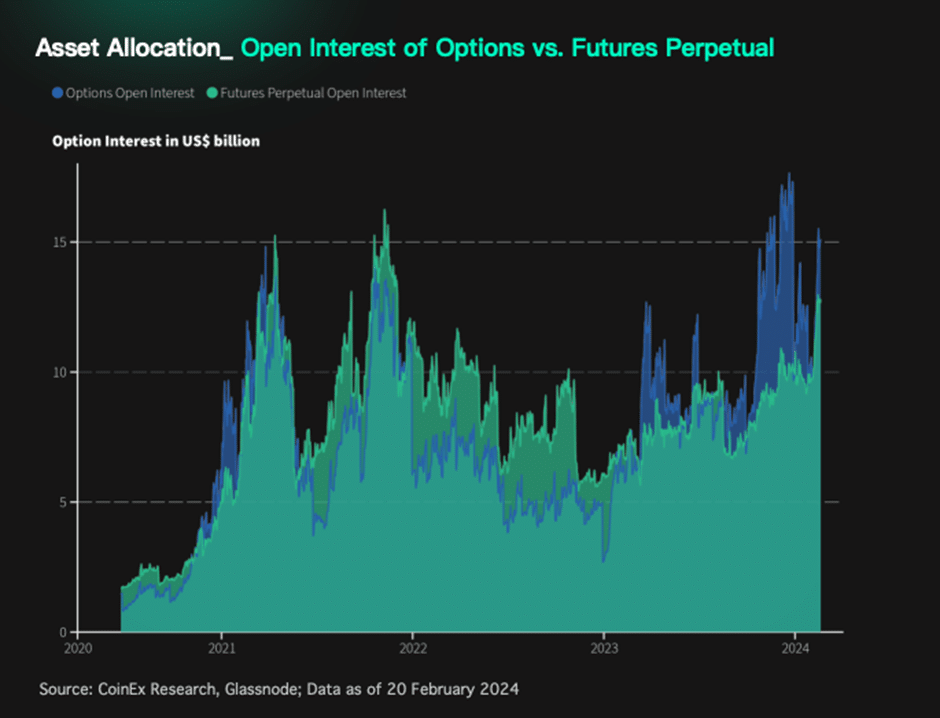

Growing Crypto Adoption by Institutional Funds

In the scope of disclosure and hedging of cryptocurrencies Derivatives serve as an important tool for both investors and speculators, although futures perpetual have dominated the market in recent years. But there are clear changes taking place. Alternatives have gained significant momentum since Q2 2023. As shown in the graph below, the surge in open interest has outpaced that of futures perpetuals, signaling a changing landscape. The expected positive trend in derivatives market activity is due to the upcoming halving event and the growing adoption of cryptocurrencies. This extends the scope from retail investors to institutional funds.

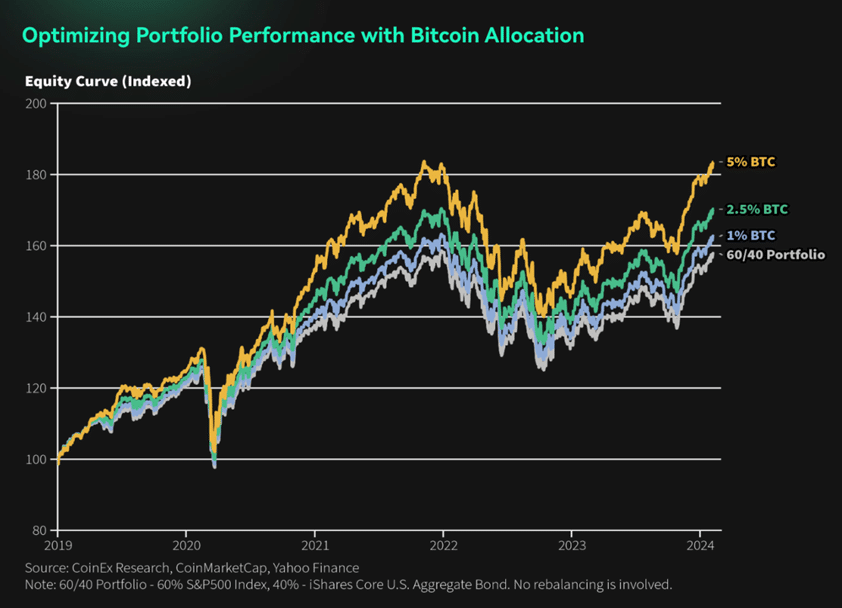

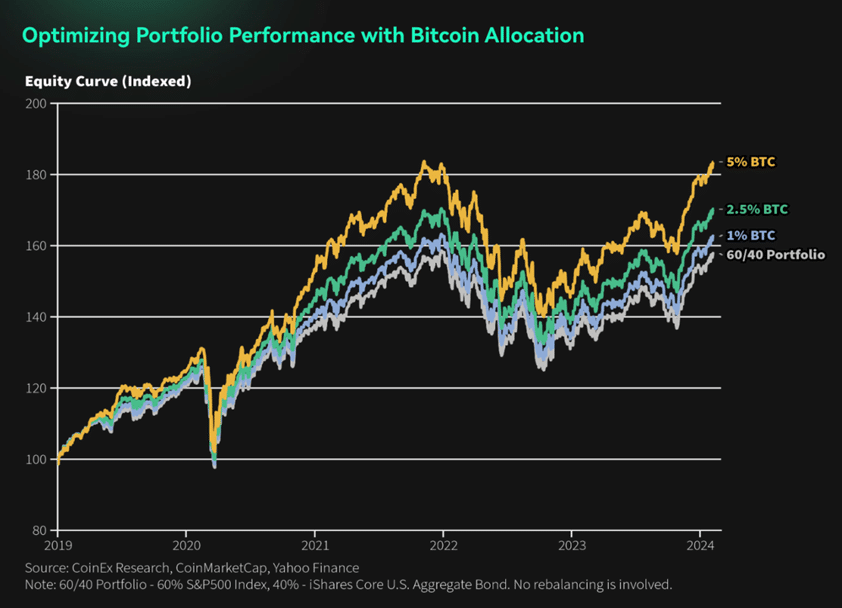

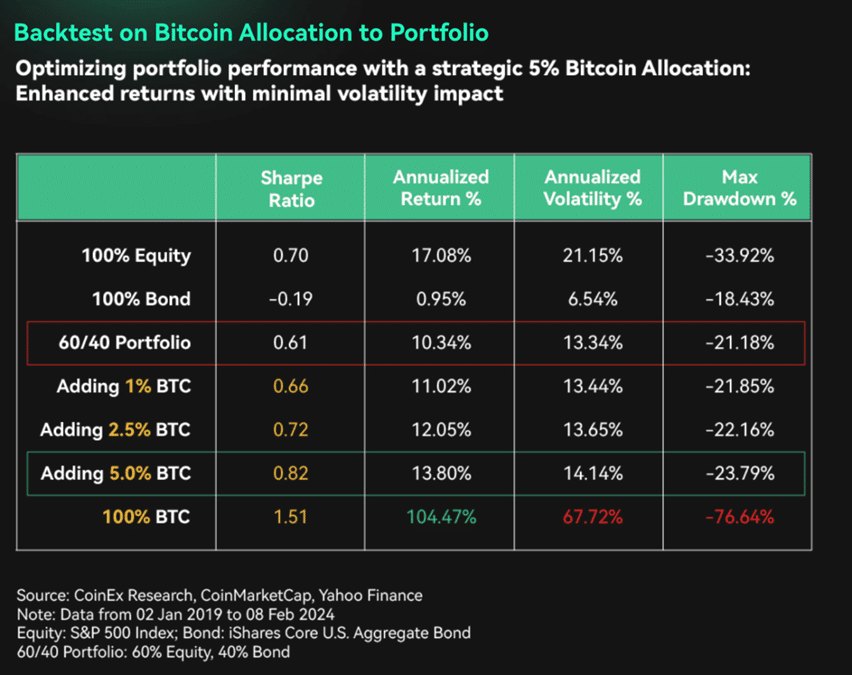

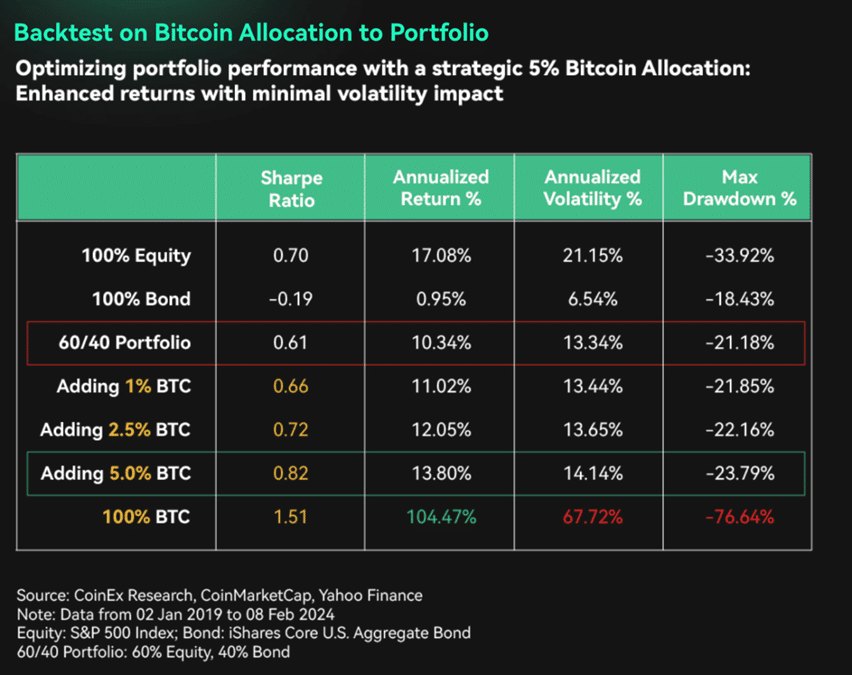

Portfolio Optimization with Bitcoin Allocation

CoinEx’s research team backtested the performance of a traditional 60/40 portfolio against several Bitcoin allocation scenarios. The results clearly show that Bitcoin is increasing even with single-digit allocations. (single-digit) will help increase not only the equity curve of shareholders But more importantly is the portfolio’s risk-adjusted return. Detailed analysis is shown in the table below.

Diversification is key to portfolio management. In fact Backtesting results reveal that even a 1% Bitcoin allocation can increase a portfolio’s risk-adjusted return or Sharpe ratio. A 5% Bitcoin allocation results in a further increase in the Sharpe ratio, but the impact to portfolio fluctuations or the maximum loss is limited.

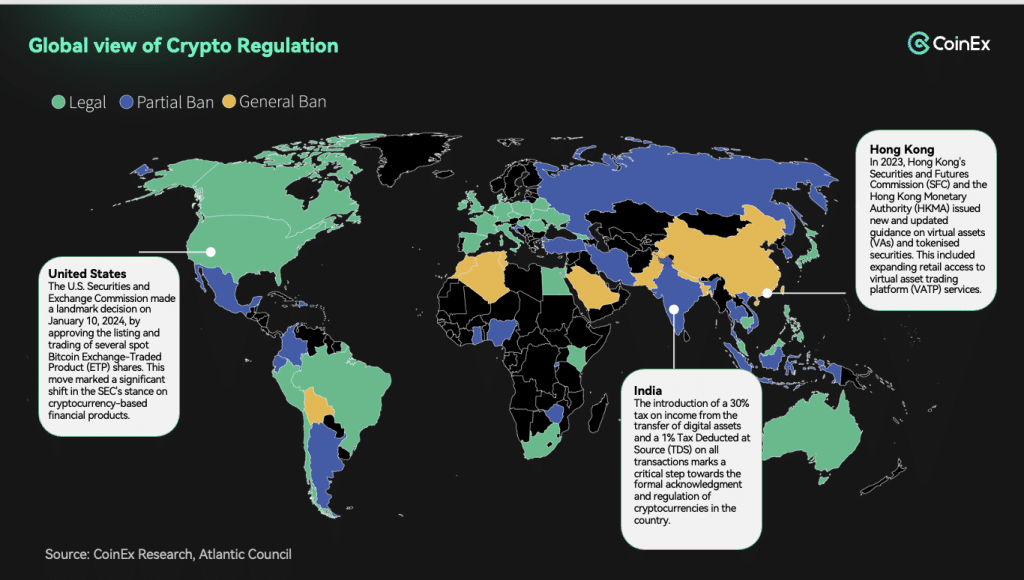

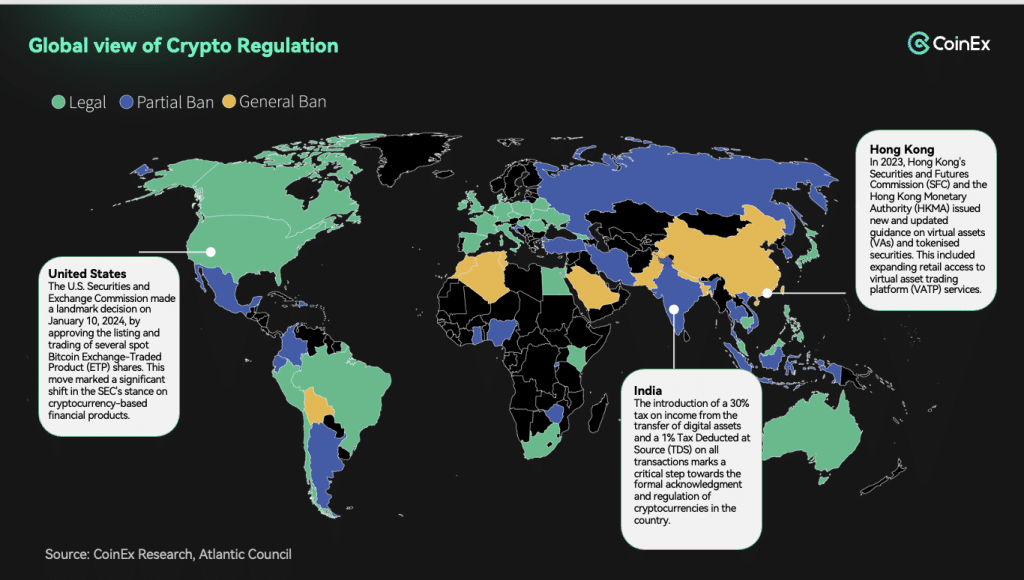

Official Crypto Regulations

Countries around the world have different attitudes towards cryptocurrencies, including Bitcoin. Some, such as the United States, Canada, and Brazil, consider them legal tender. and provide a strong regulatory framework. More transparency and protection for cryptocurrency investors Meanwhile Countries like Iran and Russia have placed some restrictions on cryptocurrencies. In Asia, for example Hong Kong has introduced cryptocurrency-friendly policies and regulations in recent years. This indicates that the level of government acceptance in this field is gradually increasing.

Conclusion

Bitcoin’s impact on crypto and financial markets around the world is profound and complex. Historical analysis reveals that halving events continue to attract increasing market interest. This pushed Bitcoin to new price levels. However, there was a noticeable slowdown in the timing and growth multiplier of this increase. It underscores the evolving nature of the cryptocurrency landscape. An increase in wallets with non-zero balances and a decrease in the number of whales. This indicates wider adoption of cryptocurrencies.

Halving events also act as a catalyst for new stories, increasing user engagement. and the launch of related projects This has contributed to sustainable growth within the Bitcoin ecosystem. This dynamic environment reflects the growth and expansion of the cryptocurrency space.

In the scope of the world financial market Bitcoin’s performance is closely tied to its global liquidity. This shows significant correlation with other asset classes and has seen increased adoption by institutional investors. Despite regulatory obstacles

But Bitcoin continues to gain acceptance and investment from institutional funds. This strengthens its position as a legitimate and influential player in the wider financial landscape. The wide-ranging dynamics of Bitcoin’s impact underscores Bitcoin’s role as a transformative force shaping both cryptocurrencies and the global financial world.