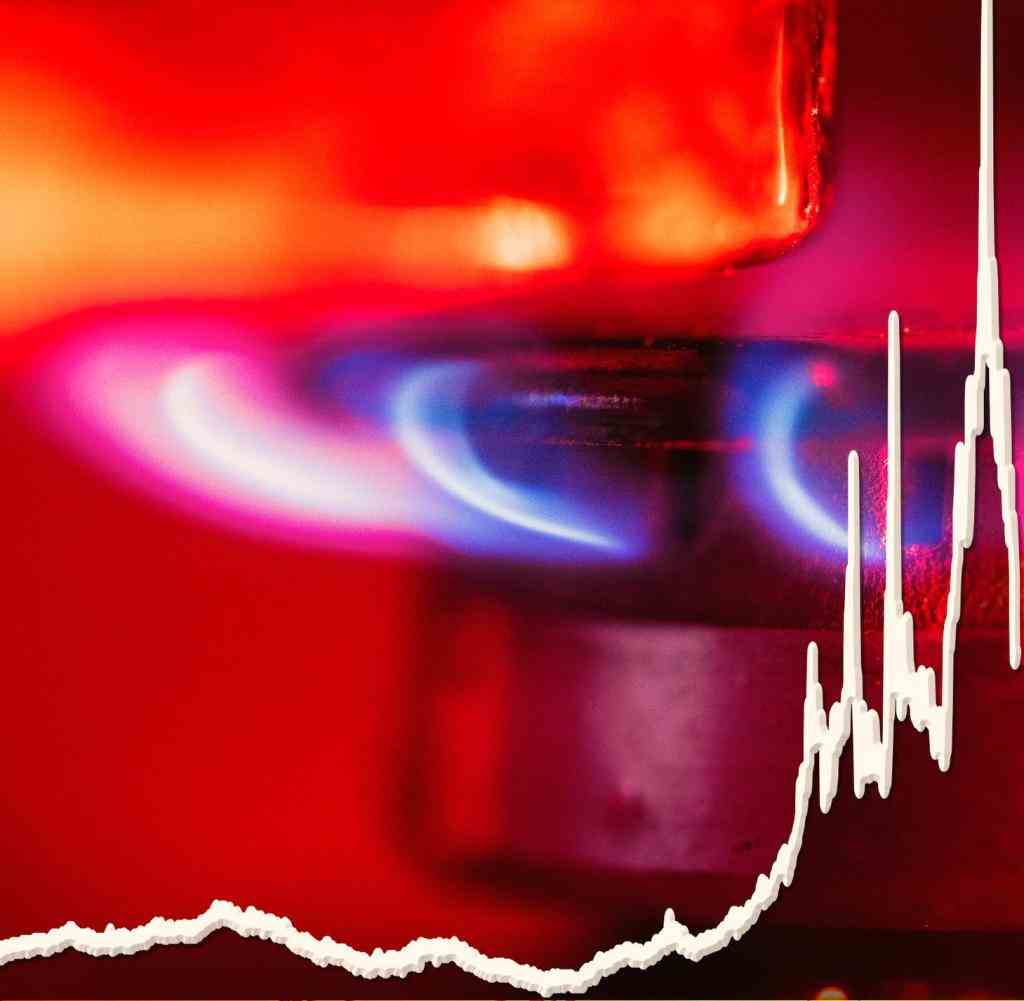

Dhe heads of state and government were largely in agreement on Thursday that the European gas price cap is coming. Only: Whether it will have any effect at all is still pending. Because the most important European gas trading center TTF in the Netherlands could be relocated by the operator to the USA or Great Britain at short notice. The price cap would have no effect there.

On Monday, the energy ministers of the Union are to negotiate details, such as the exact maximum price at which gas can still be traded in Europe. After that, the gas price cap should come into force immediately. A test phase is not planned.

However, the stock exchange operator Intercontinental Exchange (ICE) expects drastic reactions from market participants. Trading at the most important European hub for natural gas, the Title Transfer Facility (TTF) in the Netherlands, could then no longer make sense.

“The corrective mechanism is imposed on consumers and market infrastructure without allowing time for robust testing or risk management,” warns the exchange operator: “As a consequence, it is ICE’s responsibility as market operator to consider all options, including also whether an effective market in the Netherlands would still be viable at all.”

The exchange operator expects that numerous European gas traders will no longer be able to fulfill their obligation to deposit security deposits in exchange trading when the price cap comes. Companies such as the German Uniper are already suffering from significant liquidity bottlenecks, which recently could only be closed by way of nationalization.

Due to the gas price cap, however, such companies would have to deposit more money as security for every stock exchange transaction. However, many companies could no longer raise the sums, trade would dry up.

Alternatively, traders could increasingly resort to direct transactions outside of the stock exchange. However, such OTC trading (“over the counter”) is more volatile, less transparent and less well regulated. In addition, security deposits called “margins” are also mandatory here, so that OTC transactions could not compensate for the possibly collapsing European trading volume.

Security deposits could be too high

The recent negotiations in Brussels did not address the “worrying consequences for the gas market and the threat to financial stability at all,” criticizes exchange operator ICE: “In fact, the latest proposals have made the effects even worse.”

Because the price cap was extended from the front month to the upcoming quarter, the need for security services (“margins”) to be provided by the companies doubled to 47 billion euros. “Such an increase in margins could destabilize the market,” warns ICE.

The costs of the increased liquidity requirement would be passed on to customers, and financially overwhelmed traders would also stay away from the market altogether. This reduces the supply and increases the price. “We expect that the price cap will not lower prices for European consumers, but rather increase them.”

The exchange operator ICE is a US company based in Atlanta, Georgia. ICE founder Jeff Sprecher brought commodity futures transactions in the energy sector, which around 20 years ago were still handled physically and practically with a handshake on the trading floor, onto the Internet. After acquiring the International Petroleum Exchange of London, ICE expanded its operations in Europe.

The relocation of trading activities depending on the local legal framework is not entirely unusual for exchange operators. For example, ICE had withdrawn trading in CO₂ certificates from London due to Brexit and settled it in Amsterdam.

After the deliberations of the European heads of state and government on Thursday, Chancellor Olaf Scholz (SPD) had expressed the expectation that the use of the planned price cap would never really be necessary. It will be “so high that I hope it never becomes relevant”.

Gas tankers could avoid Europe

Like the federal government, the Netherlands, which is heavily dependent on gas, fear that liquid gas tankers will no longer head for Europe if the price cap here is set too low. The concern is that the LNG tankers will set course for China again in the future if the economy there picks up again after the end of the corona lockdown.

It is unclear how low the gas cap can be set without endangering Europe’s gas supply. During the negotiations, it was suggested that the price cap should take effect as soon as gas for delivery in the following month trades at more than 275 euros per megawatt hour for ten consecutive days.

Such a level was dismissed as a joke by critics, as it would still be 12 times the pre-crisis level. Most recently, a level between 180 and 220 euros was considered likely. Some countries, whose security of supply is less based on gas, had already demanded maximum prices of well under 100 euros per megawatt hour.

But the risk that the gas supply in Europe will collapse as a result is high. A memo from the stock exchange operator ICE to the EU Commission states that, according to their analyses, traders are allowed to stop their offers at an average of 56 euros below the maximum permitted price due to the high fluctuation margins.

Even a high gas price cap of 275 euros could therefore often be triggered – and gas suppliers from Europe driven out. “Europe’s gas market is at risk of a collapse in supply and demand if the proposed cap on TTF prices is approved,” the company warns in the memo: This increases the risk to security of supply and the likelihood of higher energy costs for European consumers.

The Leipzig-based energy exchange European Energy Exchange (EEX) shares the criticism of the ICE colleagues: “We see the introduction of the gas price cap as a dangerous intervention in the functionality of the market,” said a spokeswoman in Leipzig when asked by WELT: “The restriction From our point of view, free pricing does not lead to falling prices.” The introduction of a cap is more likely to result in “a shift to over-the-counter trading, which has a negative impact on transparency, creates uncertainty in the market and jeopardizes security of supply”.

“Everything on shares” is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast at Spotify, Apple Podcasts, Amazon Music and deezer. Or directly by RSS feed.