If you are having trouble deciding between choosing Solana or Ethereum for your Mint Non-Fungible Token (NFT), in this article we will explore the strengths, capabilities, weaknesses, and overall differences of both blockchains. two So you can make better decisions and fit your goals in the NFT market.

Ethereum: Ecosystem, Marketplace, and Security

Without a doubt, Ethereum is the largest ecosystem in the DeFi (decentralized finance) sector with thousands of projects built on it. So it’s no surprise that most NFTs choose to work there. because it is an ERC-721 token.

Approximately 95% of the entire NFT ecosystem is based on Ethereum, so it is no coincidence that when investors are looking for the NFT market, their first choice is OpenSea, Rarible, Nifty Gateway, and others.

When it comes to “size”, Ethereum is the leader, with a much larger pool of buyers and sellers – in other words, trading volume. So if you mint an NFT on an Ethereum-based market like OpenSea, you might be accepted. more And people will be happy to buy or bid on your NFTs. On the other hand, everyone knows that there are still so many NFTs that no one wants to buy or bid.

Ethereum’s features make it one of the leading ecosystems to start DeFi projects. Its data architecture and security elements are the reasons why so many developers choose to build on this blockchain.

However, when network activity increases exponentially, (Which is a common occurrence) the network will experience a critical transaction backlog. This has caused transaction fees to skyrocket. This may affect the user to mint NFT.

This has prompted NFT creators and collectors to search for alternative blockchains that support increased workloads. including the ability to scale and lower GAS fees, one option that has become a very serious competitor is Solana — A highly efficient blockchain that leverages the mechanism. cryptographic different to adjust the network size

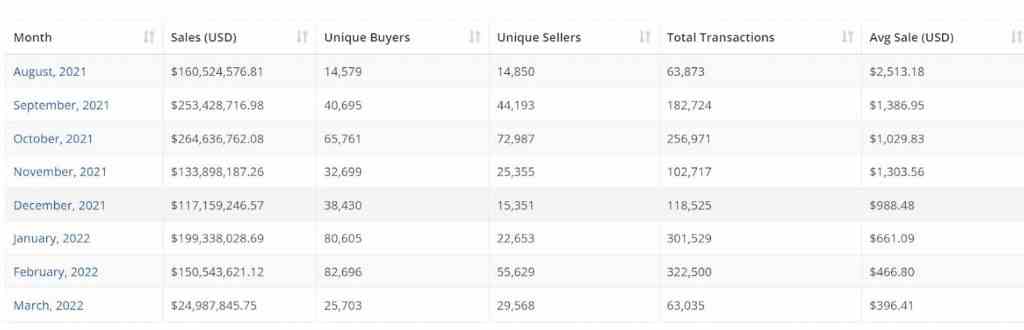

Although paying higher GAS fees can sometimes be a bad experience. But the good thing is that more money flows into Ethereum, whichinformationAs CryptoSlam shows, Ethereum has seen massive sales volumes of over $1.8 billion in the last 30 days, compared to $120 million from Solana.

Based on current data from CryptoSlam, we can see that some of the most popular NFT collections on the market are on the Ethereum blockchain, including CryptoPunks, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and other

Solana: Workloads, Low Fees, Growing Ecosystem

Solana is a high-performance blockchain that uses a consensus mechanism known as Proof-of-History. It leverages a set of protocols to process high throughput transactions—over 60,000 transactions per second (TPS).

In Solana, transaction costs are usually less than a dollar. And many NFT projects and collectors are moving to Solana to benefit from scalability and low transaction fees. They have more freedom to create projects without technical limitations. Which is why Solana has become a hub for common NFTs.

Creating NFTs with Solana based markets such as Solsea is cheap, fast and easy to make amazing profits when entering the secondary market.

Even though Solana’s ecosystem isn’t as big as Ethereum, that doesn’t mean it won’t grow. Indeed, Solana’s user base has grown rapidly since the beginning of 2022, and even JP Morgan analysts claim it can overtake Ethereum in the long run.

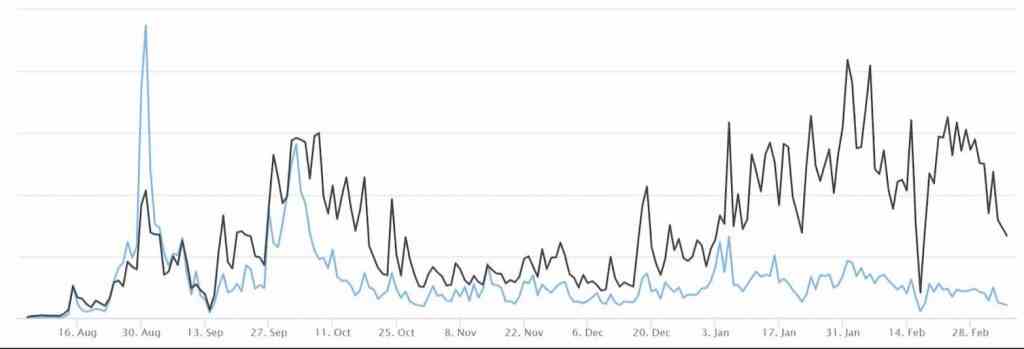

The Solana NFT market has gained a lot of momentum throughout Q1 of 2022, according to CryptoSlam, by the end of January. The sales volume in the ecosystem has surpassed $1 billion.

One of Solana’s most popular blockchain collections is Degenerate Ape Academy, a collection of 10,000 unique NFT monkeys.

Growing ecosystems are often great opportunities for beginners. However, one of their problems is that the risks are often higher. Since the beginning of 2022, the Solana network has experienced a series of outages, causing users to liquidate as they were unable to top up their collateral during network outages.

Another concern that developers have been addressing recently is the increase in rugpulls issues in Solana, which is a common problem with emerging technologies. This is because scammers will try to find weaknesses and take advantage of the weaknesses they find. However, rugpulls and scams can happen to any network. So we need to do some good research before investing in any NFT or DeFi project.

Each blockchain has its own advantages and disadvantages. So it depends on what you want to do with. If you are looking for a high throughput blockchain. With scalability and low fees, Solana might be a better fit for you.

Solana

Highlights:

- Higher throughput and scalability

- growing ecosystem

- Low gas cost and environmentally friendly

- Mint NFT is cheap and fairly straightforward.

Weaknesses :

- A less secure network

- Lower adoption with a smaller market

- There is a chance of frequent downtime

Ethereum

Highlights:

- Access to a bigger market

- high network security

- NFT sells at a much higher price on average.

Cons:

- Network congestion can delay transactions.

- Lower throughput and scalability

- Very expensive transaction fees for users who want Mint NFT.