Savers and investors face another tax raid this year, making it even more important that they make the most of their Isa allowance.

Frozen thresholds mean more savers are being dragged into paying tax on interest. Meanwhile, investors face capital gains and dividend allowances being slashed.

An Isa offers a way to keep more of your hard-earned returns and that’s never been more essential. In this special guide, we reveal why you need a cash Isa, how to choose the best other Isa options for you, and how to save tax-free for children.

Grow your wealth: The tax-free benefits of Isa saving and investing are an essential tool

Why cash Isas are a must-have again – and the tricks to find the best

By Sylvia Morris, Money Mail and This is Money’s savings expert

Cash Isas have always been a valuable tool for savvy savers. Unlike with other savings accounts, no matter how much money you have in an Isa, you will never have to pay tax on your interest, protecting every last penny from the taxman.

This year, Isas are showing their worth more than ever.

Until recently, they played second fiddle to ordinary savings accounts because they simply did not offer as good rates.

Two years ago, there was a 0.6 percentage point gap between the best ordinary fixed-rate savings account and an equivalent Isa.

By last year, the gap had shrunk, but ordinary accounts were still 0.28 percentage points ahead of Isas.

Today, there is but a whisker between them — as little as 0.05 percentage points. In fact, the gap is now so small that there is little reason not to opt for the tax-free Isa.

> Check the best cash Isa rates in our savings tables

Beware savings tax outside of an Isa

That is not the only reason why Isas are more valuable than in previous years. At times such as these, when interest rates are generous — frequently breaching 5 per cent — the tax shelter that Isas offer really comes into its own.

Opt for an ordinary savings account and you could land yourself a tax bill if you have more than £20,000 in a top easy access savings account paying 5 per cent.

Basic rate taxpayers have a personal savings allowance of £1,000; that means they can earn this amount in interest tax-free. After that, they pay tax on their interest at their income tax rate of 20 per cent.

Higher rate taxpayers would only need £10,000 in an account paying 5 per cent before being hit with a tax bill.

If you pay tax at the additional 45 per cent rate, you get no allowance at all and so are charged on every pound of interest you earn.

But not so with Isas. If you want to make sure you don’t pay tax on your savings, I would recommend putting one on the top of your to-do list.

The end of the tax year is looming on April 5, so act now to take advantage of this year’s Isa allowance.

You can save up to £20,000 in an Isa each tax year, but you cannot carry over your allowance — if you don’t use it, you lose it.

Get a cash Isas, says Sylvia Morris, Money Mail and This is Money’s savings expert

Watch out for sneaky cash Isa catches

Providers jostle with one another to catch your eye by offering competitive interest rates so that their Isa appears in the best-buy tables.

But sometimes, behind that top headline rate, there lurks some restrictive terms and conditions. For example, some limit the number of times you can take money out each year. That may not be a problem, but if you do need unlimited withdrawals, make sure you have it.

Look for a flexible Isa

Most easy-access Isas allow you to take money out, but not put it back in without it counting towards your annual allowance again.

That means, for example, if you had £20,000 in your account and withdrew £1,000, then replaced the sum within the same tax year, you would exceed your allowance.

However, some Isas are flexible, which means you can take money out and put it back in again without it counting towards your current year’s allowance.

It basically transforms your Isa from something you try to avoid taking cash out of — for fear of losing the valuable tax-free protection — to a savings pot that you can dip into when needed.

Flexible Isas are few and far between among the top- paying accounts.

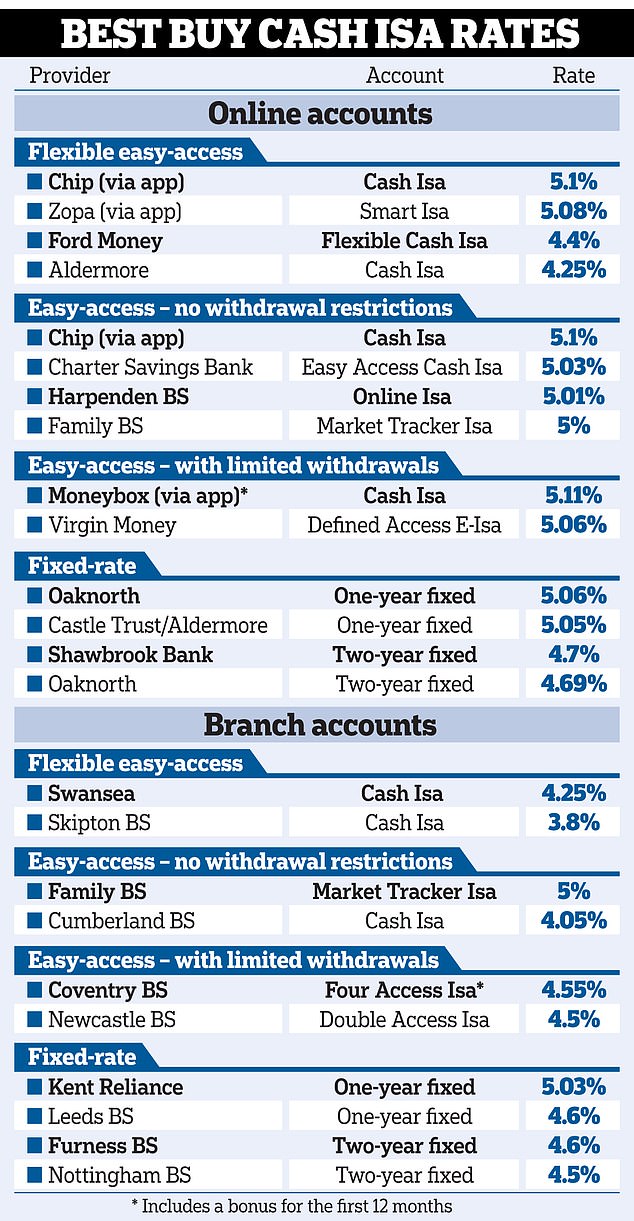

If you are happy to open an account on your phone through an app, then Zopa and Chip are the flexible ones to go for. Chip pays 5.1 per cent and Zopa 5.08 per cent.

Online rates are lower with Ford Money at 4.4 per cent while, on the High Street, Swansea BS offers 4.25 per cent.

How to choose between fixed OR easy-access Isas

Fixed-rate Isas, where you tie your money up for a certain term — usually anything between one and five years — are ideal if you have money that you do not want to touch for some time.

Look at what your current providers have to offer as they often give slightly better deals. For example, Virgin Money pays a top 5.25 per cent rate which is fixed for a year and available only to its current account holders.

The best rates are a tad over 5 per cent for one year. But if interest rates fall, as generally predicted, would you be better off going for a two-year fixed at 4.7 per cent?

You might get a lower rate now, but you could end up with more interest over the two years.

Basically, you are betting that one-year rates will be at least 4.4 per cent in a year’s time giving you an average of 4.7 per cent over the two years.

If you have already opened an Isa this tax year and have not paid in the full £20,000, you can top up your easy-access account. Don’t worry too much about the rate right now, as you can transfer it to a better one once the money is in the account.

If you have a fixed-rate Isa, it’s probably too late to top it up. That means you have lost the rest of your cash Isa allowance.

But there is a twist here; you can use the rest of your allowance if your fixed-rate Isa is with a handful of providers such as Charter Savings Bank, Kent Reliance, Aldermore, Paragon or Newcastle or Nationwide building societies. They organise their Isas so that you can split your money between easy-access and fixed-rate Isas and it still counts as just one cash Isa.

> Five of the best cash Isas: We pick the top deals you should consider

Which other type of Isa is right for you?

By Ruth Jackson-Kirby

All Isas share the same tax-free advantages. Whether you’re earning interest, dividends or capital gains, you don’t pay tax.

You can pay into one of each type that you are eligible for in any tax year, so long as you don’t exceed your £20,000 allowance.

From April 6, you can pay into more than one of the same type. So, if you are saving towards more than one goal, you may find you would benefit from more than one type of Isa.

Here are some tips to help you decide which is right for you.

Are you saving long or short-term?

If you are likely to need your money within the next five years, a cash Isa could be for you. You can opt for an easy-access account, which allows you to make withdrawals, or a fixed rate cash Isa, which locks your money away for a set period of time.

The balance of your cash Isa will never fall unless you make withdrawals, unlike a stocks and shares Isa, which can experience volatility as markets rise and fall.

The value of a cash Isa could still be eroded over time by inflation if the rate of interest you get does not match or exceed inflation.

If you don’t need access to your savings for at least five to ten years, a stocks and shares Isa could be a better option.

These allow you to invest your money in assets such as company shares or bonds. Long-term, they tend to produce a better return. But they are subject to volatility, which is why a longer time frame is important, so you can ride out some of the rises and falls.

‘Investing is ideal for anyone looking to grow their long-term savings if they’re prepared to keep their money invested for five years or more to give it the best chance,’ says Derence Lee, chief finance officer at Shepherds Friendly.

‘However, it’s important to remember with investing that your capital is at risk. and returns aren’t guaranteed.’

Are you saving for your first home?

The Lifetime Isa is designed for those saving for their first home. The money in these accounts can be used only to buy a first property or for retirement. Every time you make a deposit, the Government will add 25 per cent. You can deposit up to £4,000 a year, so you could get an extra £1,000 a year towards your first property.

Lisas have strict criteria. You must be aged between 18 and 39 to open an account but, once you have one, you can continue saving into it until you are 50.

To use the money to buy a property, your account must be open for 12 months before you buy; it must be the first property you’ve owned anywhere; you have to be planning to live in it; and it can’t be worth more than £450,000.

> How a Lifetime Isa and its 25% bonus can help you buy a home

Are you saving for your children’s future?

If you want to set aside money for a child, a Junior Isa (Jisa) is a great option. These work like standard Isas in that the money can grow tax-free.

Jisas cannot be accessed until the child turns 18, at which point they will have control of it.

Only parents can open a Junior Isa but anyone can make deposits into it, and there is an annual deposit limit of £9,000.

‘There are both cash and stocks and shares Jisas available, with many parents opting for the cash option,’ says Laith Khalaf, at investment platform AJ Bell. ‘Given the long-term investment horizon most children would have, it makes sense for parents to consider stocks and shares.’

Jisas’ tax-free status means parents won’t risk being taxed on the interest. If you pay into a standard savings account in your child’s name and they earn more than £100 in interest, the interest will be treated as if it belongs to the parent and taxed accordingly.

> Check the best cash Junior Isa rates

Do you want to save for retirement and a home?

If you want to use an Isa to save for retirement and a first home at the same time, then a Lifetime Isa can give your mission a boost, too.

As well as being able to grow tax-free, you’ll get a 25 per cent government bonus on anything you pay in, up to a limit of £1,000 a year.

You can’t access the money in your Lisa until you turn 60, unless you use it to buy your first home. Withdraw it and you’ll face a harsh penalty.

If you opened an account aged 18 and paid in the maximum amount until you are 50, you would pocket £32,000 from the Government on top of growth.

However, if you have access to a workplace pension, you may want to prioritise saving into this above a Lisa, as they also benefit from employer contributions.

> How to make the most of your work pension

I plan to build my grandson a £50,000 pot for his 18th birthday – but I will only pay £18,000 in

By Adele Cooke

Rather than gifting a cheque every birthday, Anthony Weale has found a better way to build a nest egg for his grandson, Benedict.

With help from other family members, who are also contributing, Anthony, from Cambridge, will hand over tens of thousands of pounds in savings to Benedict when he turns 18, while avoiding inheritance tax at the same time.

Aged five, Benedict already has £5,000 stashed in a Junior Isa (Jisa) with investment platform Hargreaves Lansdown, which Anthony hopes will have grown to £50,000 in 13 years’ time.

The retired university administrator, 78, began paying into the account three years ago, and contributes £1,000-a-year as a lump sum, which is invested on Benedict’s behalf by his mother, Gillian. To spread the risk, the money is split between funds, to try to minimise any losses.

Only a parent or guardian can open a Jisa for a child under 16, but, once open, anyone can pay into it (stock image)

Anthony hopes his grandson will be able to use the cash to pay for education or a house deposit. It could also reduce the inheritance tax payable on his own estate. Any gifts are free from the tax, so long as the giver survives for seven years after making them.

You can give up to £3,000 each year to one individual or split it between several people without risking an inheritance tax bill.

You can also make regular gifts to loved ones from surplus income, such as your pension, as long as you can show these payments were made regularly and have not impacted your standard of living.

More than £1.5 billion was paid into Jisas in the 2021/22 tax year, according to HM Revenue and Customs. Launched in 2011, it has the same tax-free benefits as an adult Isa and allows families to pay in up to £9,000 every year.

There are two types of Jisas: cash or stocks and shares accounts. Children can have both and split their allowance. Interest earned on savings or any increase in the value of investments is tax-free.

Only a parent or guardian can open a Jisa for a child under 16 but, once open, anyone can pay into it. The money is locked away until the child is 18, apart from in exceptional circumstances.

When choosing whether to open a cash or stocks and shares Jisa, Laura Suter of AJ Bell says: ‘If you’re starting to save from birth you can take more risk. If your grandchild is a bit older it may be better to stick to cash.’

The best-paying Jisa is from Beverley Building Society at 5.5 pc, but it can be opened only in person. Coventry Building Society offers 4.95 pc, and it can be opened by post, in branch or by telephone.

If you invested the full £9,000 allowance into a Jisa every year from your grandchild’s birth, by 18 it would be worth £266,000, assuming it grew by 5 pc a year.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.