The secret offshore wealth of more than 300 world leaders, politicians and billionaires has been exposed in one of the biggest ever leaks of financial data.

Dubbed the Pandora Papers, the documents show how 35 current and former world leaders – including associates of Vladimir Putin – used accounts in tax havens to accrue huge amounts of wealth and carry out transactions.

The files consist of 12 million documents from 14 financial services companies in countries including the British Virgin Islands, Panama, Belize, Cyprus, the United Arab Emirates, Singapore and Switzerland.

They were obtained by the International Consortium of Investigative Journalists (ICIJ) before being studied by more than 650 reporters from BBC Panorama, the Guardian and more than 100 other news outlets.

They reveal that former British prime minister Mr Blair and his wife Cherie saved some $434,000 (£321,000) in stamp duty when they bought an office in London by purchasing the offshore company that owned it.

Meanwhile Russian President Mr Putin was linked to secret assets in Monaco, while an offshore company owned by his alleged lover purchased a $4.1million apartment below the principality’s casino.

The luxury fourth-floor flat was purchased by Brockville Development Ltd, which was eventually traced back to Svetlana Krivonogikh, reported the Guardian.

The woman, who was 28 at the time, is said by Russian investigative outlet Proekt to be the mother of Putin’s child, after giving birth to Elizaveta, or Luiza, in March of the same year.

A luxury fourth-floor flat below Monaco’s casino was bought by Brockville Development Ltd, which was eventually traced back to Svetlana Krivonogikh (pictured), alleged to be a lover of Mr Putin and the mother of his child

The apartment bought by Ms Krivonogikh was in the exclusive Monte Carlo Star apartment complex (pictured)

Ms Krivonogikh is said by Russian investigative outlet Proekt to be the mother of Putin’s child, after giving birth to Elizaveta, or Luiza, in March 2003 (Pictured: Monte Carlo Star apartment complex)

Since becoming friends with Putin, the former cleaner seems to have amassed a luxury portfolio of assets, including a flat in a well-to-do area of St Petersburg, other properties in Moscow and a yacht, coming to a total of $100million – the Kremlin has refused to comment.

Meanwhile, the King of Jordan was able to secretly add £70million worth of property to his portfolios in the UK and US – mainly in Malibu, California and in London and Ascot, the papers showed.

While many of the transactions leaked in the papers – made by tens of thousands of different offshore firms -feature no legal wrongdoing, they expose how the UK Government has failed in its promise to bring in a register of offshore property owners.

There are concerns that some of the purchases could be the work of money laundering – while some of those named now face allegations of corruption and global tax avoidance.

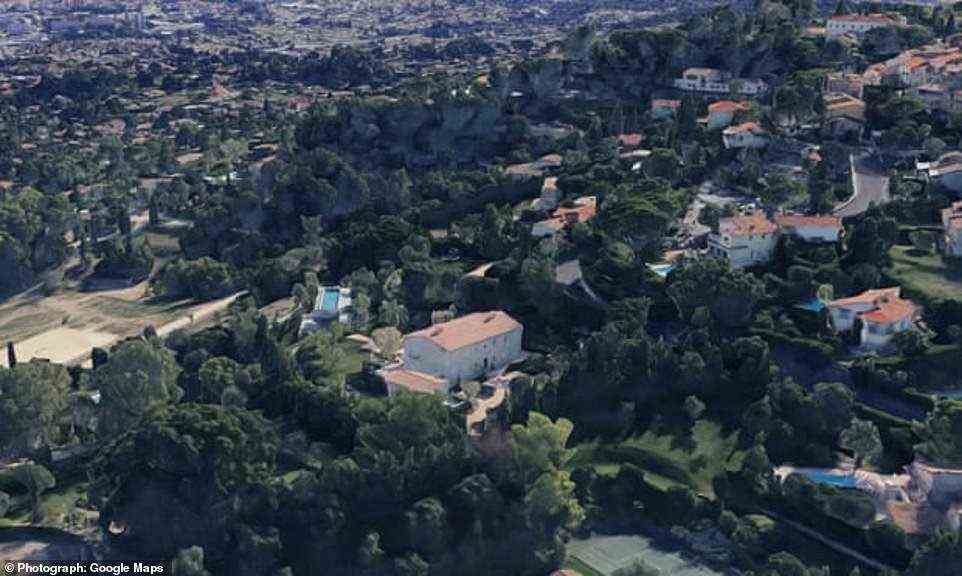

The release of the documents could not have come at a worse time for Czech Prime Minister Andrej Babis – who is facing an election later this week – as they show how he failed to declare an offshore investment company used to purchase two villas for $16.2million in the south of France.

The papers follow four other huge data leaks in the past seven years – including the FinCen Files, the Paradise Papers, Panama Papers and LuxLeaks.

They also show how some 95,000 offshore firms were legally set up to secretly by property in Britain.

Azerbaijani President Ilham Aliyev and his family and close associates snapped up more than $500million (£400million) worth of property in the UK, the papers revealed.

They also appeared to have made a tidy $41.9million (£31million) profit after selling a London property to the Queen’s Crown Estate, which is managed by the Treasury.

The group bought 17 properties, including an office block in London for $44.6million (£33million) for the president’s son Heydar Aliyev, aged 11.

The building, in the exclusive Borough of Mayfair, was bought by a front company owned by a family friend of President Ilham in 2009 before being transferred a month later to young Heydar.

According to the papers, a second nearby office block, also owned by the family, was sold to the Crown Estate for $89.3million (£66million) in 2018.

The Crown Estate is now reportedly looking into the purchase, but said it conducted the sale using all the checks required by the law at the time.

Speaking on the papers, Fergus Shiel, from the ICIJ, said: ‘There’s never been anything on this scale and it shows the reality of what offshore companies can offer to help people hide dodgy cash or avoid tax.’

He added: ‘They are using those offshore accounts, those offshore trusts, to buy hundreds of millions of dollars of property in other countries, and to enrich their own families, at the expense of their citizens.’

Duncan Hames, Director of Policy at Transparency International UK, added: ‘These revelations should act as a wake up call for the Government and regulators to deliver on much-needed and long-overdue measures to strengthen Britain’s defences against dirty money.

Azerbaijani President Ilham Aliyev and his family and close associates snapped up more than £400million worth of property in the UK using offshore accounts, the papers revealed.

Dubbed the Pandora Papers, the documents show how Tony (pictured) and Cherie Blair avoided paying stamp duty on their purchase of an office in London. The transaction was not illegal.

While the Blairs’ purchase of the London office (pictured) was not illegal, its revelation comes after the former Labour leader has been critical of tax loopholes, once saying that ‘the tax system is a haven of scams, perks, City deals and profits’

Czech Prime Minister Andrej Babis (pictured ) failed to declare an offshore investment company used to purchase two villas for £12million in the south of France

The chateau and neighbouring villa in Mougins, France, bought by Mr Babis using offshore companies, which he failed to declare, according to the Pandora Papers

‘These leaks show that there is one system for corrupt elites who can buy access to prime property and enjoy luxury lifestyles and another for honest hard-working people.

‘Once again Britain’s role as an enabler of global corruption and money laundering have been exposed with the same loopholes exploited to funnel suspect wealth into the country.

‘Not only does this damage the UK’s reputation as a country governed by the rule of law, but it enriches corrupt elites around the world at the expense of their populations. No one benefits from this system but them.

‘The UK must redouble its efforts in tackling illicit finance, bringing in long overdue transparency reforms to reveal who really owns property here as well as resourcing regulators and law enforcement to clamp down on rogue professionals and corrupt cash held in the UK.’

While the Blairs’ purchase of the London office was not illegal, its revelation comes after the former Labour leader has been critical of tax loopholes, once saying that ‘the tax system is a haven of scams, perks, City deals and profits’.

The property is now used by Mrs Blair’s legal consultancy firm Omnia Strategy and the Cherie Blair Foundation for Women.

Mrs Blair said the sellers had insisted they buy the house through the offshore company, reported the BBC, and that they would be liable to pay capital gains tax should they go on to sell it.

It was purchased from a family with political connections in Bahrain. Both sides maintain they did not initially know who was involved in the deal.

Russian President Vladimir Putin (pictured) was linked to secret assets in Monaco by the Pandora Papers

The papers show King of Jordan Abdullah Il bin Al-Hussein (pictured) bought 15 homes since coming to power in 1999, using offshore companies in the British Virgin Islands and other tax havens

Properties purchased by Mr Al-Hussein using offshore companies include three ocean-view homes in Malibu, California (pictured)

Elsewhere, lawyers for King of Jordan Abdullah II bin Al-Hussein said the leaked property purchases in the UK and US were bought with personal wealth, adding that using offshore companies to carry out such transactions was common practice for high profile individuals, citing privacy and security concerns.

The papers show Mr Al-Hussein bought 15 homes since coming to power in 1999, using offshore companies in the British Virgin Islands and other tax havens.

It comes as he has been accused of running an authoritarian regime, which has seen a rise in protests in recent years over tax hikes and austerity measures.

A string of other world leaders have also been named in the Pandora Papers leak – which owes its name to the fact that it will be ‘opening a box on a lot of things’, according to the ICIJ.

They include president of Kenya Uhuru Kenyatta and six of his family members, who were revealed to secretly own 11 offshore companies containing $30million worth of assets.

Meanwhile the prime minister of Pakistan Imran Khan’s cabinet ministers and their families were shown to own millions of dollars worth of offshore companies.

And the president of Ukraine Volodymyr Zelensky was shown to have moved his stake in a secret offshore company just before his victory in the 2019 election.

Who’s who in the Pandora Papers? All the wealthy and powerful figures identified in the biggest leak of offshore financial data ever

Vladimir Putin

The Russian President is not personally named in the leaked data but several of those closest to him are, including Svetlana Krivonogikh, a former cleaner from St. Petersburg who is thought to have given birth to Putin’s love-child – a daughter, Elizaveta – in 2003.

The papers reveal that Krivonogikh – who suddenly came into a vast fortune around the time of her daughter’s birth – is the owner of a $4million apartment at the Monte Carlo Star, located underneath Monte Carlo’s famed casino.

Krivonogikh owns the apartment through a chain of shell companies located in the British Virgin Islands and Panama, the documents have revealed.

Svetlana Krivonogikh is the owner of a Monte Carlo apartment purchased via a chain of sell companies in 2003 – the year she is thought to have given birth to Putin’s love child

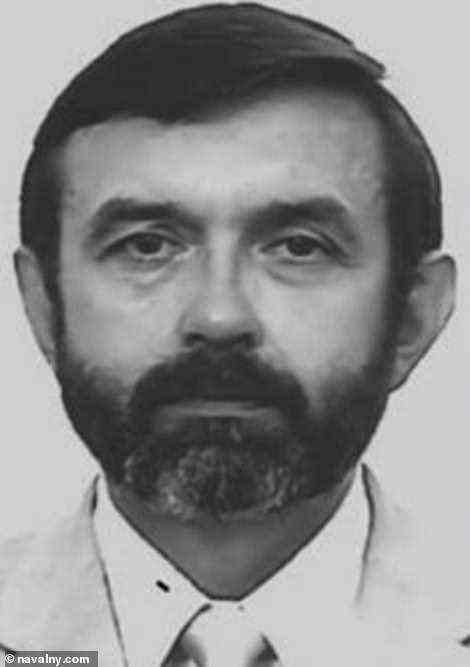

Gennady Timchenko (left) and Petr Kolbin (right) have both been accused of managing money on behalf of Putin, are also named in the papers and linked to Krivonogikh via a Monte Carlo accounting firm called Moores Rowland

The luxurious fourth-floor pad – which comes with two parking spaces, a storeroom, and the use of a pool in the Monte Carlo Star complex – was purchased for her in September 2003, shortly after Elizaveta’s birth.

It is just one piece in a portfolio of assets including exclusive properties in Russia, a yacht and shares in state-owned Russian firms that almost-overnight gave her a wealth that – thanks to the leaked documents – can now be estimated at $100million.

One of the companies through which Krivonogikh owns the apartment was created for her by a British-born accountant – Eamonn McGregor – who also has links to other super-wealthy Russians.

Gennady Timchenko – a bureaucrat-turned-oil trader worth an estimated $22billion – is also a client of McGregor via Monte Carlo-based accounting firm Moores Rowland.

McGregor has looked after Timchenko’s assets for two decades, the papers reveal, among them jets and a 130ft yacht called M/S Lena.

Timchenko has been closely linked with Putin, and in 2014 was sanctioned by the US as part of the ‘Russian leadership’s inner circle’ which alleged that money from Timchenko’s oil trading may have been funnelled to the Russian leader.

The oil firm that Timchenko runs and Putin have dismissed the claim as ‘ridiculous’.

Putin is not named personally in the papers, though several members of his ‘inner circle’ are

Also named in the papers is Petr Kolbin, a childhood friend of Putin whose family owned a house in the village of Imenitsy that Putin’s parents rented when he was growing up.

Kolbin initially worked as a butcher, but in 2001 – shortly after Putin became president – his fortunes suddenly changed. He went into business and prospered, largely thanks to deals with some of Russia’s biggest state-owned firms.

He, too, became a client of Moores Rowland and opened several overseas bank accounts that contained a fortune of $550million.

But it is not clear that he actually had access to that money. Alexei Navalny, via his deputy Leonid Volkov, has accused Kolbin – who died in 2018 – as being a proxy for the Russian President.

‘Putin is smart. You can’t expect to find an account in his name,’ Volkov previously said. ‘But if you see “Kolbin” you can be sure as hell this is Putin’s money.’

Claudia Schiffer, Shakira and cricketer Sachin Tendulkar are named in Pandora Papers leak revealing offshore fortunes

- Shakira accused of using offshore companies in British Virgin Islands to conceal assets

- Lawyers of Colombian star, 44, said she declared all of her offshore companies

- Representatives for Ms Schiffer, 51, said she correctly pays her taxes in the UK

- Mr Tendulkar’s lawyers said his investment is legitimate and has been declared

Claudia Schiffer and Shakira are among the famous faces linked to the unprecedented Pandora Papers leak – which has revealed how the super wealthy used offshore companies to accrue wealth and make transactions.

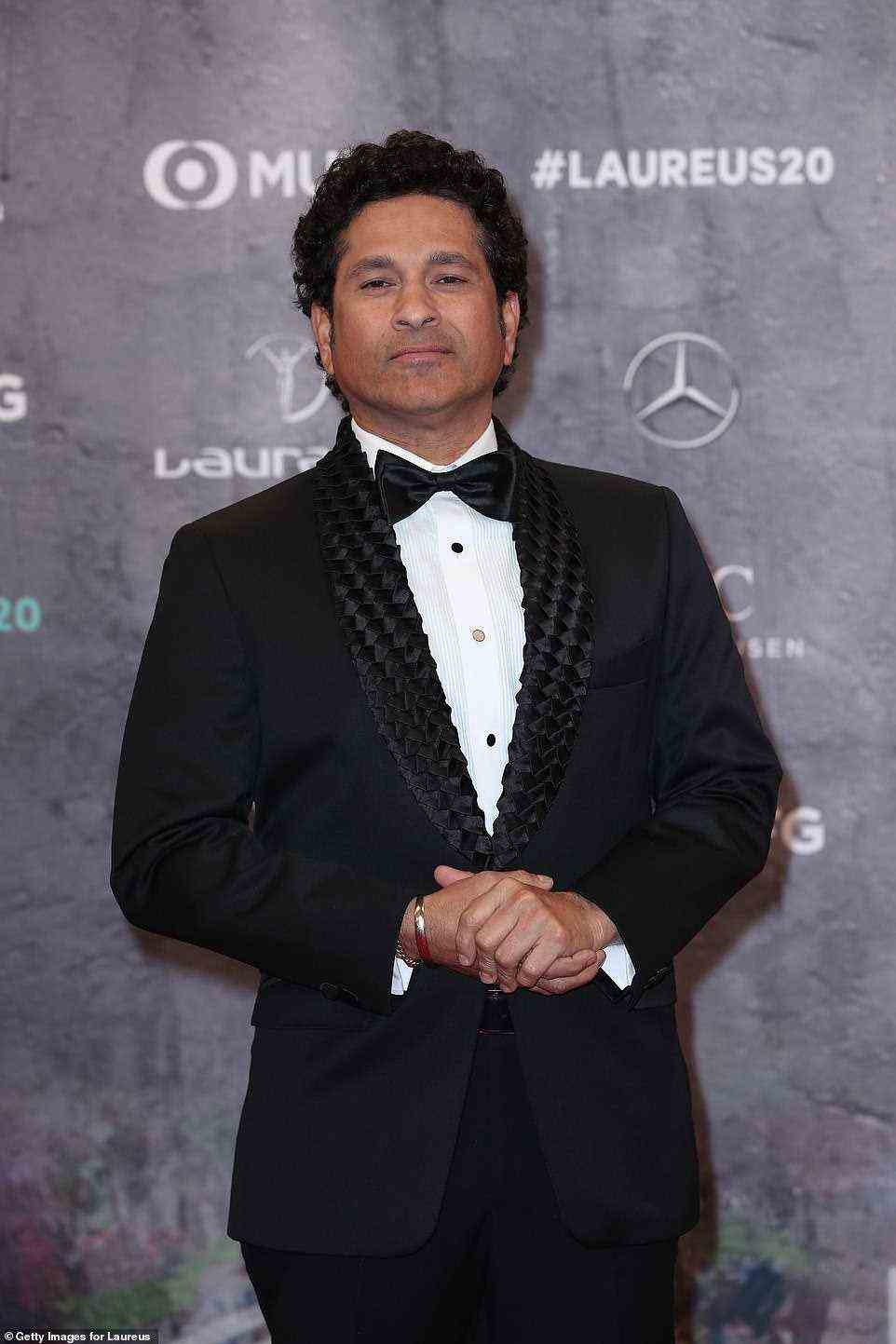

They are joined by Indian cricket legend Sachin Tendulkar – as well as associates of Vladimir Putin and 35 world leaders – after they were all found to have companies set up in tax havens.

The papers claim Colombian pop star Shakira set up offshore entities in the British Virgin Islands to conceal assets.

But lawyers of the 44-year-old said the singer declared the offshore companies, adding that they did not provide tax advantages.

It comes as the Hips Don’t Lie hitmaker is already in a legal wrangle with the Spanish Government, which has accused her of failing to pay taxes in Spain in the years 2012, 2013 and 2014.

In response to their client being named in the report, representatives of German supermodel Ms Schiffer, 51, said the mother-of-three correctly pays her taxes in the UK, where she lives.

Meanwhile Mr Tendulkar’s lawyers said his investment is legitimate and has been declared to tax authorities.

The cricket star is also reported to have dissolved an offshore company in the British Virgin Islands three months after the release of the Panama Papers in 2016.

The papers claim Colombian pop star Shakira (pictured) set up offshore entities in the British Virgin Islands to conceal assets

In response to their client being named in the report, representatives of German supermodel Claudia Schiffer (pictured), 51, said the mother-of-three correctly pays her taxes in the UK, where she lives

The Pandora Papers consist of 12 million documents from 14 financial services companies in countries including the British Virgin Islands, Panama, Belize, Cyprus, the United Arab Emirates, Singapore and Switzerland.

They were obtained by the International Consortium of Investigative Journalists (ICIJ) before being studied by more than 650 reporters from BBC Panorama, the Guardian and more than 100 other news outlets.

Italian mobster Raffaele Amato is also named in the leak, which shows how he used a shell company in the UK to buy land in Spain, where he fled to to set up his own crime gang.

Mr Amato, who has been tied to at least a dozen killings, is currently serving a 20-year prison sentence. His lawyers declined to comment.

While many of the transactions leaked in the papers – made by tens of thousands of different offshore firms – feature no legal wrongdoing, they expose how the UK Government has failed in its promise to bring in a register of offshore property owners.

There are concerns that some of the purchases could be the work of money laundering – while some of those named now face allegations of corruption and global tax avoidance.

The papers also exposed how current and former world leaders used offshore companies to carry out transactions.

They revealed that former British prime minister Mr Blair and his wife Cherie saved some $434,000 (£321,000) in stamp duty when they bought an office in London by purchasing the offshore company that owned it.

Sachin Tendulkar’s (pictured) lawyers said his investment is legitimate and has been declared to tax authorities

In a statement, a spokeswoman for the couple said they had bought the property in ‘a normal way through reputable agents’ and should not have been ‘dragged into a story about “hidden” secrets of prime ministers etc’.

The spokeswoman said: ‘The vendor was an offshore company. The Blairs had nothing whatsoever to do with the original company nor those behind it.

‘The vendor sold the company not the property – again a decision the Blairs had nothing to with.

‘Since the purchase was of a company no buyer would have had to pay UK stamp duty on that transaction.

‘However, because the Blairs then repatriated the company and brought it onshore, they are liable for capital gains and other taxes on the resale of the property which will significantly exceed any stamp duty.

‘For the record, the Blairs pay full tax on all their earnings. And have never used offshore schemes either to hide transactions or avoid tax.’

Meanwhile Russian President Mr Putin was linked to secret assets in Monaco, while an offshore company owned by his alleged lover purchased a $4.1million apartment below the principality’s casino.

The luxury fourth-floor flat was purchased by Brockville Development Ltd, which was eventually traced back to Svetlana Krivonogikh, reported the Guardian.

The woman, who was 28 at the time, is said by Russian investigative outlet Proekt to be the mother of Putin’s child, after giving birth to Elizaveta, or Luiza, in March of the same year.

The King of Jordan was able to secretly add £70million worth of property to his portfolios in the UK and US – mainly in Malibu, California and in London and Ascot, the papers showed, and Czech Prime Minister Andrej Babis – who is facing an election later this week – failed to declare an offshore investment company used to purchase two villas for $16.2million in the south of France.

The Pandora Papers probe is much larger than the landmark Panama Papers investigation, which rocked the world in 2016, spawning police raids and new laws in dozens of countries and the fall of prime ministers in Iceland and Pakistan, reported the ICIJ.

This time around, the papers also shine a light on the lawyers and middlemen who are at the heart of the offshore industry, with the owners of more than 29,000 companies revealed from more than 200 countries and territories – mostly from Russia, the UK, Argentina and China.