Interest rates: RBA leaves on hold but here’s why it’s not all good news

The Reserve Bank has left interest rates on hold for a second straight month after inflation fell – hinting the worst could be over for Australian home borrowers.

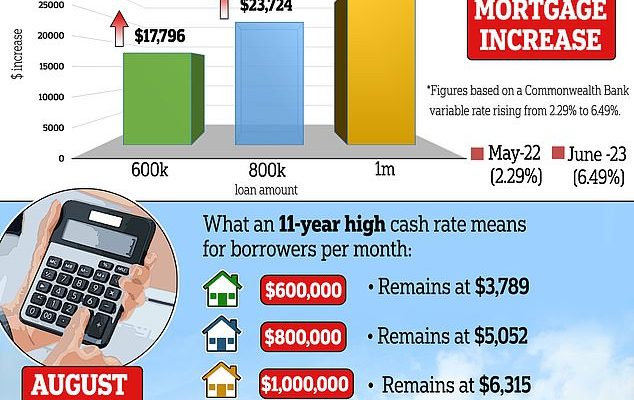

Outgoing Governor Philip Lowe’s second last board meeting opted to pause the cash rate at an 11-year high of 4.1 per cent, suggesting increases may be a thing of the past.

‘The higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so,’ he said.

‘In light of this and the uncertainty surrounding the economic outlook, the board again decided to hold interest rates steady this month.

‘This will provide further time to assess the impact of the increase in interest rates to date and the economic outlook.’

While this was the third pause in 2023 so far, rates have still climbed 12 times since May 2022, marking the most aggressive pace of monetary policy tightening since 1989.

The Reserve Bank has left interest rates on hold for a second straight month after inflation fell

Outgoing Governor Philip Lowe’s second last board meeting opted to pause the cash rate at an 11-year high of 4.1 per cent, suggesting increases may be a thing of the past (he is pictured in India last month)

A borrower with an average, $600,000 mortgage has seen their annual repayments surge by $17,796 in just 15 months.

But the rate rises appear to have reduced inflation, which fell to 6 per cent in June, down from 7 per cent in the March quarter and a 32-year high of 7.8 per cent at the end of 2022.

Three of Australia’s Big Four banks – Commonwealth, Westpac and NAB – had wrongly expected a rate rise on Tuesday but the futures market had regarded an increase as a 14 per cent chance.

Only ANZ had forecast a pause among the biggest banks.

Dr Lowe’s seven-year term ends on September 17 and his deputy and successor Michele Bullock could be spared having to increase the cash rate, with the big banks expecting cuts in 2024 as the economy slows.