Five savings providers have announced they are upping easy-access deals following the Bank of England’s base rate hike.

Skipton Building Society and Nationwide Building Society are among those upping their variable rates in response to the Bank of England adding 0.25 percentage points on to base rate to take it to 5.25 per cent earlier today.

HSBC has boosted rates on its easy-access accounts, Isas and children’s accounts, while First Direct bank has also upped rates across its easy access accounts and Isa.

Digital challenger Chase, backed by JP Morgan, is another provider which has raised the rate on its easy-access account in response to the Bank of England’s base rate hike.

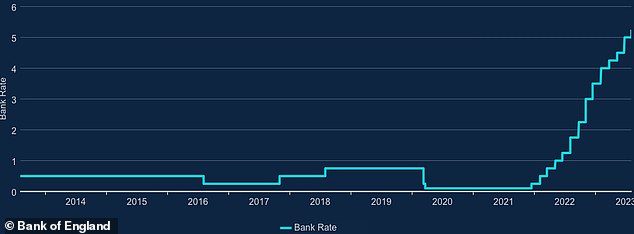

The Bank of England decided to hike the base rate to 5.25% earlier today

Deposits held with all three providers are protected by the Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person.

Skipton Building Society has announced it will automatically add 0.25 per cent to its variable rate savings accounts.

The average increase on Skiptons savings products will be 0.19 per cent across its on and off-sale range, with some accounts receiving the full 0.25 per cent.

> Check out the best easy-access rates savings accounts here

Its average variable rate will now be 3.66 per cent while its lowest variable rate will be 3.25 per cent.

All qualifying accounts will be updated automatically with the changes coming from 14 August.

Andrew Bottomley, of Skipton Building Society, said: ‘In the last 18 months, we’ve responded to the Bank of England’s base rate rises quickly and positively, increasing rates for our savers no fewer than 12 times. On this 14th occasion, we’re responding quickly and positively again.

‘Today, Skipton will be increasing rates on all of our variable rate savings accounts.

‘At a time when some savings providers have been under scrutiny for their variable savings rates, I’m really proud that we continue to pay an average savings rate well above the market average.’

Nationwide Building Society announced its Triple Access Online Saver will see an increase of 0.75 per cent to pay 4.25 per cent now.

Current account customers saving in its Flex Instant Saver 2 will see the rate increase by 0.25 per cent to 3.25 per cent.

From 1 September, existing customers saving in Nationwide Loyalty Saver, Loyalty Isa and Loyalty Single Access Isa accounts will see rates rise by 0.25 per cent to 3.75 per cent.

The rates on all of Nationwide’s instant access accounts will increase by 0.10 per to up to 2.35 per cent depending on the amount saved.

Tom Riley, director of retail products at Nationwide Building Society, said: ‘As a mutual, we are always keen to support savers and pay the best rates we can sustainably afford, which is why we are increasing rates on our most popular variable rate accounts. As a result of these changes, the vast majority of savers will see an increase in their rate.’

HSBC has upped rates on easy-access accounts by 0.25 per cent. Rates have been upped to 2.25 per cent on Premier Savings accounts and 2 per cent on the Flexible Saver.

The bank has added 0.25 per cent on its Online Bonus Saver rate when a withdrawal is made in a month, with a new rate of 2 per cent. This follows an increase in the higher paying tier of the account from a maximum of £10,000 to £50,000.

Its MySavings childrens’ account has been upped by 0.25 per cent for balances over £3,000, which now provides a return of 2.25 per cent. Balances under £3,000 have a rate of 5.00 per cent.

The rate increases are effective from 10 August.

First Direct bank is now offering customers a minimum of 2 per cent interest on easy-access balances, with this going up to 4 per cent on balances up to £50,000 on the FD Bonus Savings Account.

Customers can now also earn 2.85 per cent tax-free on their cash Isa balance.

The new rates will take effect from 10 August.

Going up: The Bank of England’s Monetary Policy Committee continues to try and get inflation down with interest rate rises

JP Morgan owned challenger Chase upped the rate on its saver account from 3.8 per cent to 4.1 per cent from 14 August. The new rate will automatically be passed onto all existing and new customers

Savers can deposit up to £500,000 with Chase, which comes with FSCS protection up to £85,000 per person.

Commenting on the bounce in rate rises from savings providers, Myron Jobson, senior personal finance analyst at Interactive Investor says: ‘There might be a bit more urgency among banks and building societies to pass on the base rate rise to their savings products this time around.

‘The Financial Conduct Authority has recently gained new powers to take robust actions against those offering unjustifiably low rates. The city watchdog has wasted no time in exercising its new powers, gained under the Consumer Duty, by setting out a 14-point plan to make sure that interest rate rises are passed on to savers appropriately.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.