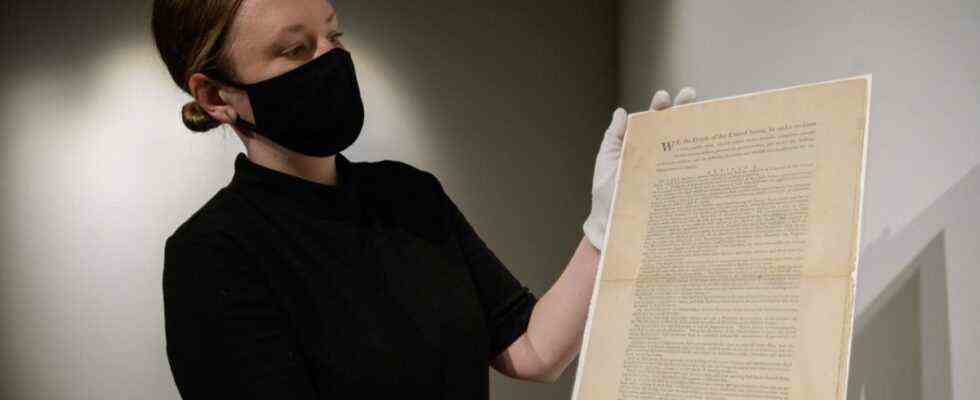

If you listen to fantasy stories, the audience’s sympathies usually go to the underdog. It was the same on the usual social media last week. A gang of upstarts wanted to buy a valuable print of the US constitution at auction house Sotheby’s. Over 17,000 people gave money for the campaign in the form of cryptocurrencies. In just four days, the equivalent of more than 40 million US dollars was raised in this way.

At first glance, it sounds like a high-stakes flash mob. But there is also no lack of ideology. “Decentralization and cryptocurrencies have created structures that allow people to rule themselves with an unprecedented level of autonomy and freedom,” said the group’s website with a large dose of solemnity. It is therefore only “fitting that we use this technology to honor and protect the greatest historical tool for human government: the US Constitution.” The not entirely unintentional side effect of the action: give the establishment something on the hat again. Unfortunately, they didn’t make it. They were outbid by a representative of the traditional economic order, a hedge fund billionaire.

Even more interesting than the action itself, however, is the way in which the bid came about. The would-be buyers have organized themselves in a so-called DAO. In the acronym-loving world of cryptocurrencies, the abbreviation stands for “decentralized autonomous organization”, and even if you barely look through the fast-moving scene, be assured that DAOs are currently the latest hype.

Just a chat room with a bank account?

Anyone who purchases a specially created cryptocurrency can participate in such a DAO. The income generated ends up in a joint fund and together it is decided what should be done with the accumulated money. The more tokens you hold, the more weight your own opinion has. In this respect, the DAO concept does not initially differ that much from a completely analog stock company. Unlike the societies of the past, however, a DAO does not have a single person or hierarchy who controls the organization. Neither the CEO nor the board of directors make decisions; instead, each member can make a suggestion for the actions or direction of the group. In addition, all rules and financial transactions are recorded in the blockchain. That makes DAOs at least theoretically transparent, unchangeable and incorruptible.

Ideally, these are global collectives from the Internet who share resources and work towards common goals. Some thought leaders believe that DAOs will be the best way people organize themselves in the future. Perhaps this form of digital self-management is also the logical consequence of an increasingly acute feeling of powerlessness that is rampant among people. A person with a bad tongue, on the other hand, once described DAOs as a chat room with a bank account. As is so often the case when you are out and about in the crypto world, the whole thing is somewhere in the gray area between performance art and serious business. Some want to buy historical documents – but in most cases today’s DAOs are about investing in crypto assets together in the hope of getting rich quick.

And the constitutional DAO? It can not be beaten – typically underdog – and declared failure to be a symbolic triumph. On Twitter and Discord, the spontaneously formed group of like-minded people is now wondering how to proceed. Some just want their deposit back. Others suggest buying the Declaration of Independence instead of the Constitution. Or an island on which you can then proclaim your own state.