So far, expectations have been steadily increasing that the ECB will cut interest rates in June or possibly earlier. Some members of the central bank’s council wanted to make the first interest rate cut last week. Today, two major banks are scaling back their expectations. Both Deutsche Bank and Morgan Stanley have cut their ECB interest rate forecasts and only expect three cuts this year.

“We are updating our ECB baseline to a more gradual – and uncertain – easing cycle,” Deutsche Bank economists led by Mark Wall said in a note. They had previously assumed five reductions of a quarter point each in 2024. “We are sticking with the same base ending rate, although three quarters later than our previous estimate.”

Morgan Stanley economists changed their forecast to reflect their US colleagues’ predictions of fewer interest rate hikes by the US Federal Reserve. They had previously assumed four interest rate cuts in the euro zone this year. “While some degree of decoupling between the Fed and the ECB (on interest rates) may occur, we believe it will be limited,” wrote chief European economist Jens Eisenschmidt and his colleagues. “We think we will see a relatively similar profile between the Fed and the ECB, particularly during the first part of their respective rate cutting cycles.”

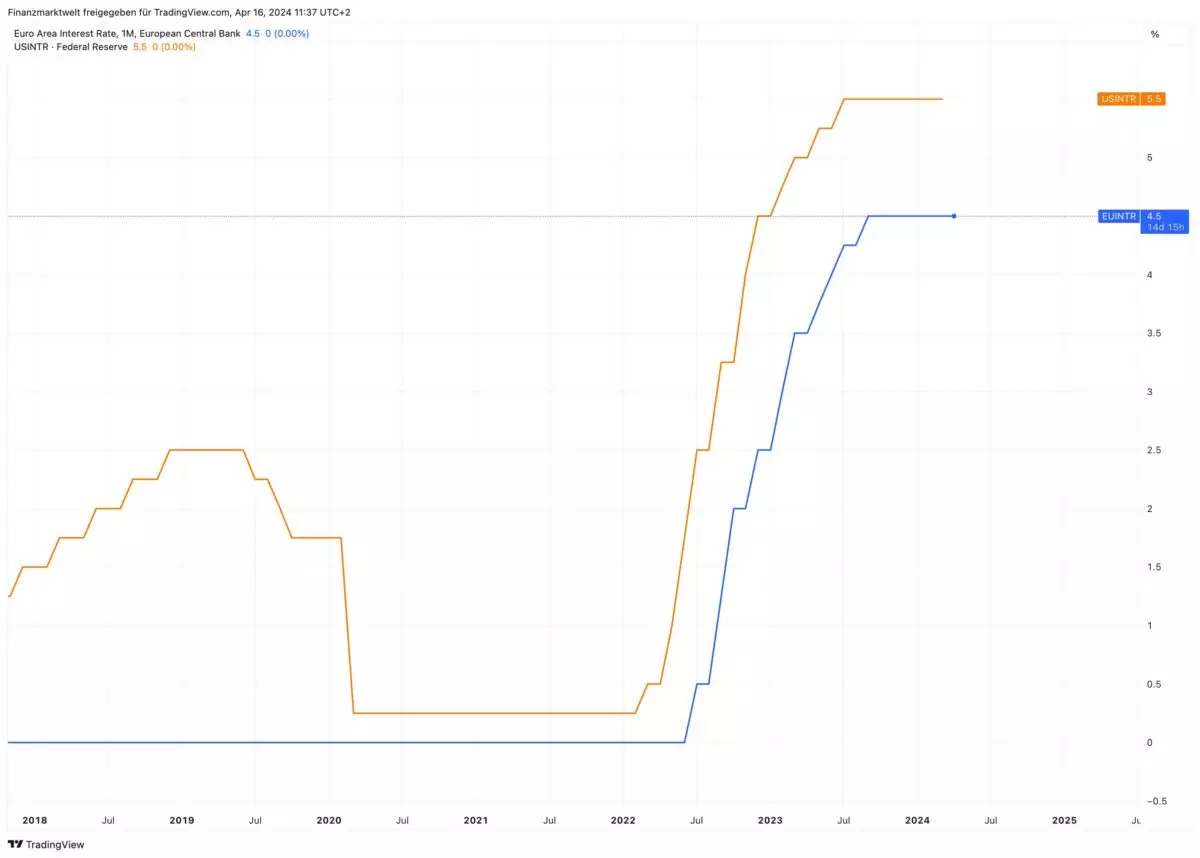

FMW: In the following chart we can see how interest rates at the ECB (blue) and Federal Reserve (orange) have developed since 2018. The Key interest rate The ECB is currently at 4.5% and the deposit rate is 4.0%.

FMW/Bloomberg