The total crypto market capitalization returned to the $2 trillion level for the first time since April 2022 due to positive market sentiment. and continued inflows into Spot Bitcoin ETFs push up the price of BTC to be higher

The rise of Bitcoin makes it the world’s largest cryptocurrency. It hit a multi-year high of $57,513, while Ether was up 7% at $3,270 at the time of writing, with other leading altcoins also in the green.

This caused the global crypto market value to jump 7.7%, rising to a 22-month high of $2.14 trillion, according to data from CoinMarketCap.

And if you look deeper, the crypto market is now worth $33 billion more than Amazon and $42 billion more than Google’s parent company, Alphabet.

The crypto market has more than doubled in just a few months.

X account The Kobeissi Letter asks, “Are New All-Time Highs Ahead for Bitcoin?”

The Kobeissi Letter noted that The total crypto market cap “has more than doubled from the recent low” of $978 billion on September 11, 2023.

Popular analyst Voice of Crypto also posted an image showing that the move above $2 trillion in total market capitalization is “extraordinary.”

Positive market sentiment supports crypto prices

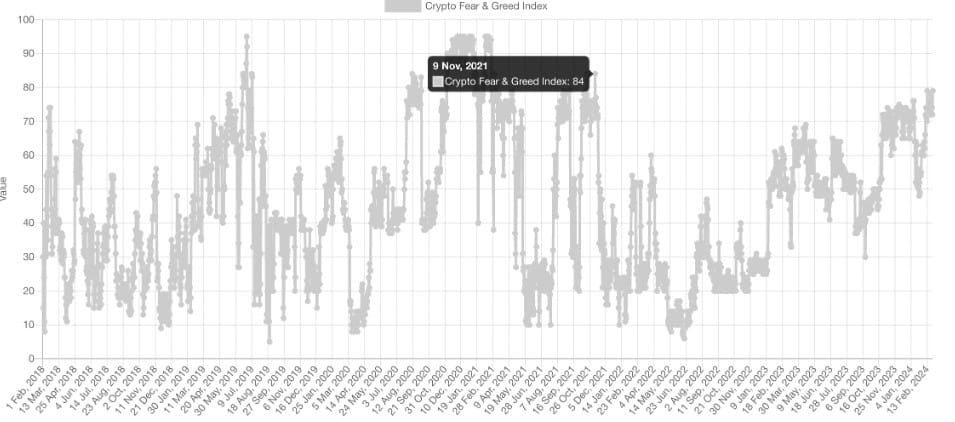

The rising market is showing confidence as the Fear & Greed Index is showing an “extreme greed” level of 79 on February 27, according to data from Alternative.

The Fear & Greed Index was in the “extreme greed” zone in November 2021 when the price of the cryptocurrency hit an all-time high of $69,000. However, Alternative warns that “when investors become too greedy, That means the market is time to correct.”

Driven by Flows into Crypto Products

The recovery in the crypto market was driven by strong demand from the Spot Bitcoin ETF, with outflows from the Grayscale Bitcoin Trust (GBTC) reaching a record low of $22 million.

Information from Farside Investors shows that GBTC outflows slowing asThird day in a rowon February 26, with a net outflow of $44.2 million, which was further halved on February 26.

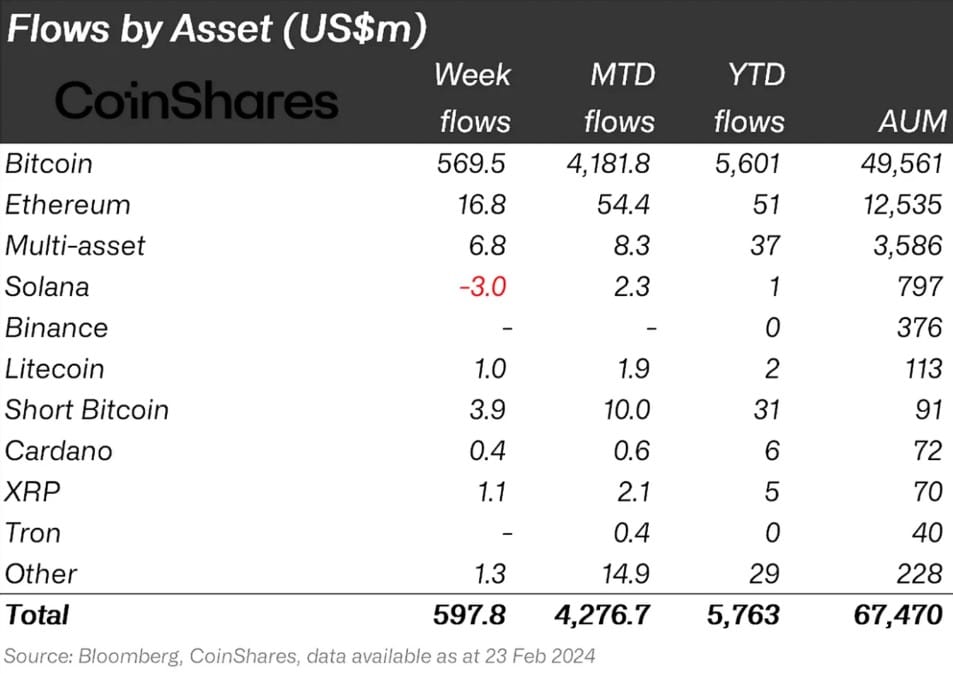

According to CoinShares, BTC investment products accounted for 99% of all crypto fund inflows last week, with Bitcoin funds inflowing $569.5 million, bringing global assets under management to 67.5 billion. Millions of dollars

Additionally, Bitcoin ETFs have continued to see inflows totaling $5.5 billion since their market debut on January 11, according to data from Yahoo Finance, making the crypto product overall net worth $5.8 billion since trading began. According to CoinShares data

refer : cointelegraph.com

picture dailyhodl.com