The issue of inflation is having a negative impact on the markets

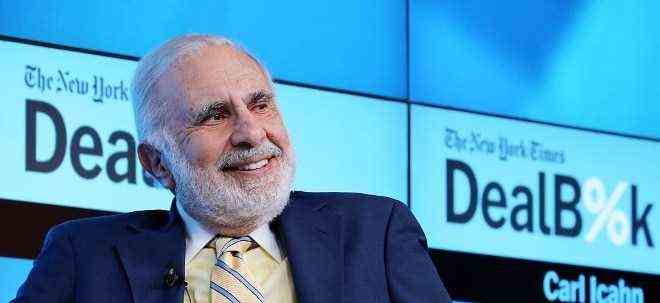

Carl Icahn warns of a crisis

Renewable energies are gaining in importance

The topic of inflation keeps investors in suspense

In the market, concerns about inflation are currently keeping investors on their toes. Particularly strong demand and problems in the supply chain, fueled by the pandemic, caused inflation in the US to climb to a new 30-year high in August. Economic aid from the central banks, which should serve to cope with the Corona crisis, also contributed to this. The core price index for personal consumption expenditure, which excludes food and energy costs, rose by 0.3 percent and was thus 3.6 percent higher than in the same period of the previous year. The index is considered the preferred measure of inflation by the US Federal Reserve. And even if the key figure does not include energy prices, price pressure has recently increased, especially in this sector. A development that is likely to manifest itself in high heating costs, especially with a view to the upcoming winter.

Carl Icahn predicts an approaching crisis

Investors are watching the price increase with concern. If Groinvestor and billionaire Carl Icahn have their way – and rightly so. In the “CNBC” program “Fast Money Halftime Report”, the stock market expert warned that the markets are currently heading straight for a crisis. “In the long term we will definitely hit the wall,” said Icahn in an interview with moderator Scott Wapner. “I really believe there will be a crisis, the way we do it, the way we print money, the way we go into inflation. If you look around, you see inflation everywhere and I don’t know how to deal with it should handle in the long run. ”

No specific period recognizable

Icahn did not name a specific period for the crash, but he firmly reckons that the markets will come under long-term pressure. “But if you ask me what will happen in the next year or in the next two or three years, I think it makes no sense to answer this question,” said the expert. Until then, the inflation cycle will repeat itself, Icahn told Wapner. “I honestly believe that the money works to a certain extent. They keep printing our money, the money goes out. I haven’t seen inflation until recently. If you see inflation now, then you have to worry . ”

Renewable energies on the advance

In response to Wapner’s comment that Icahn has numerous energy stocks in its portfolio such as Occidental Petroleum, Cheniere Energy, CVR Energy, Delek Group and SandRidge Energy, which can benefit from rising raw material prices, the market expert replies that the focus will be on sustainability in the future. “You can’t go on with the carbon you put out, and at the moment you already have too much carbon,” Icahn continues. “So you have to go for renewable fuels, and instead of going through some of the plans it is making, the government has to subsidize renewable fuels in one way or another.”

No investment in Bitcoin & Co.

Even if many market participants are of the opinion that crypto currencies such as Bitcoin, Ethereum and Co. represent suitable protection against inflation, Icahn has not yet positioned himself in this area. “We do a lot, a lot of research to find companies we could understand, and I can [Bitcoin] don’t understand “, the investor admits to Wapner. The same goes for his employees, whose lack of understanding of Bitcoin does not change their competence, as he emphasizes.” We will not invest in something that we do not understand. [] Obviously we’ve been busy with it a lot. But we are not invested there. ”

Finanzen.net editorial team

Image Sources: Heidi Gutman / CNBC / NBCU Photo Bank via Getty Images, Neilson Barnard / Getty Images for New York Times