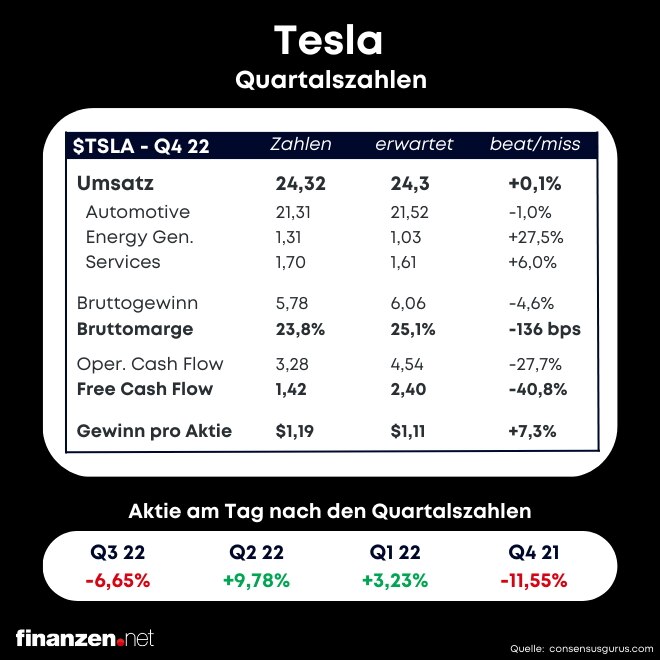

In the fourth quarter of 2022, Tesla posted earnings per share of $1.19. This is a significant increase compared to the same period last year, when the group was around Elon Musk reported $0.847 in earnings per share. Analysts had expected earnings to rise to $1.13 per share.

The electric-car maker’s quarterly revenue came in at $24.32 billion, up from the $24.16 billion that analysts had forecast. Tesla had sales of $17.72 billion in the fourth quarter of last year.

For the full year 2022, Tesla posted earnings per share of $4.07. Analysts had expected $3.98 per share here – after $2.26 per share in the previous fiscal year. In terms of sales, the e-car pioneer has 81.46 billion US dollars in its books for the year as a whole. Analysts had predicted a strong increase in sales for the Musk group from US$ 53.82 billion in the previous year to US$ 82.14 billion.

Click here for the Instagram profile of finanzen.net

Despite high inflation, economic concerns and supply chain problems, Tesla earned more in 2022 than ever before in a fiscal year. The electric car group from star entrepreneur Elon Musk increased its profit by 128 percent compared to the previous year to 12.6 billion dollars (11.5 billion euros), as Tesla announced. Revenue grew 51 percent to $81.5 billion. “It’s been a fantastic year, our best so far,” Musk said when presenting the numbers.

But what about 2023? “We’re probably going to have a very difficult recession,” Musk warned. Should this happen, however, Tesla’s material costs should also drop significantly. Either way, the outlook is not rosy – without a stronger economic downturn, the major central banks could continue to raise key interest rates, making financing car purchases even more difficult. Management knows there are questions about the “uncertain economic environment,” Tesla said in its letter to shareholders. Nevertheless, the market leader in the e-car segment has set ambitious goals for the current year.

Tesla wants to increase production “as soon as possible” in 2023 and sees itself on track to deliver around 1.8 million cars for the full year. He sees the actual potential at two million, Musk said. But certain external factors cannot influence Tesla. The group confirmed that it would continue to aim for annual growth of 50 percent in the longer term. But Tesla missed this goal as early as 2022 – deliveries increased by 40 percent to 1.3 million electric cars. In the three months to the end of December, they only grew by 31 percent compared to the previous year.

Recently, the company’s price cuts had raised further concerns among investors about a possible dwindling demand and shrinking profit margins. Some owners of older Teslas were also upset because of the falling residual values of their cars. However, Musk defended the reduction in a web conference with analysts and investors – it had always been Tesla’s goal to make electric cars affordable for the general public. He also resolutely countered concerns about demand – orders are currently rising significantly faster than Tesla’s production.

The group continues to gear up for rapid growth – production capacity was roughly doubled in 2022. Musk is planning more models, with the long-awaited Cybertruck finally set to go into production this year and Tesla opening up the lucrative US pickup truck market. The company mainly blamed the situation in China for the production and delivery problems last year, where Covid lockdowns put a heavy strain on the large plant in Shanghai.

In the fourth quarter, Tesla increased net income 59 percent year over year to $3.7 billion. Revenue increased 37 percent to $24.3 billion. The company thus achieved new records at the end of the year. The figures exceeded analysts’ expectations – significantly in terms of net income and slightly in terms of revenues. Investors initially reacted cautiously, but Musk’s statements during the conference call ultimately lifted the share significantly into the plus after the trading day.

Tesla had a difficult time on the financial market last year. The share price collapsed by around 65 percent in 2022, but recently it has been up a bit again. Elon Musk’s escapades surrounding the controversial takeover of the online platform Twitter and his Tesla share sales to finance the approximately $44 billion deal were badly received by investors. There have already been complaints from influential major shareholders that the tech multi-billionaire – who also runs space and rocket company SpaceX – is neglecting Tesla too much.

Record earnings and outlook fuel Tesla recovery

Strong business numbers and what some saw as confident guidance gave Tesla shares a strong boost on Thursday. In US trading on the NASDAQ, they rose at times by 8.19 percent to $156.26, continuing the recovery initiated at the start of the year. The papers of the electric car manufacturer also climbed above the 50-day line for the first time since September. The increase in the still young year is now around 30 percent. From September to the low at the beginning of the year, however, the course had previously tripled.

Analyst Ryan Brinkman of the US bank JPMorgan described the delivery target as a disappointment, especially given the recent discounts on Tesla cars, which should only really make an impact in the current quarter. As a result, margin expectations on the market are likely to decline, according to Brinkman. The price cuts had also raised concerns among investors about a possible dwindling demand.

In an analyst conference, however, Tesla referred to the strongest demand since the beginning of the year in the company’s history, wrote analyst Mark Delaney from the US investment bank Goldman Sachs. The number of orders is currently twice the production figures, the electric car manufacturer announced. Even if this level of demand is not likely to be maintained, according to Delaney, Tesla is still on course for its delivery forecast, which he, like Tesla, estimates at 1.8 million cars.

The US group confirmed that it would continue to aim for annual growth of 50 percent in the longer term. But Tesla missed this goal as early as 2022 – deliveries increased by only 40 percent. Analyst Philippe Houchois from the US bank Jefferies therefore drew a cautious first conclusion: “The consensus estimates should continue to decline in the coming weeks”. Free cash was about half below market expectation, weighed down by higher inventories.

Tesla had a difficult time on the financial market in 2022. The share price collapsed by around 65 percent last year and fell to its lowest level since August 2020 at the end of the year his Tesla stock sales to fund the roughly $44 billion deal with investors. There have already been complaints from influential major shareholders that the tech multi-billionaire – who also runs space and rocket company SpaceX – is neglecting Tesla too much.

Editorial office finanzen.net / dpa-AFX

Leverage must be between 2 and 20

No data

More news about Tesla

Image sources: Andrei Tudoran / Shutterstock.com, Zhang Peng/LightRocket via Getty Images, finanzen.net, finanzen.net