While the price of Bitcoin has been recovering since its March lows. It rose near $28,900 amid the US banking crisis.

However, the closure of Silvergate’s SEN and Signature’s Signet network in early March left the crypto market with low liquidity risk.

Poor liquidity of assets May lead to market inefficiency Traders may lose money due to events such as small order books, slippage and wider spreads. It can also cause extreme volatility and deter skilled investors from trading.

Clara Medalie, head of research at Kaiko, said the current situation “Pretty dangerous” and may show significant price fluctuations in both directions.

“When buying pressure decreases Anything can happen with the price.”

The liquidity crunch first came with a $200 million drop in market depth of 1% after Silvergate’s SEN network was shut down. asspecified inKaiko’s latest research note

The market depth for Bitcoin and Ethereum continues to decline by 16.12% and 17.64% respectively from their monthly open levels, with Kaiko analyst Conor Ryder writing, “We are currently at the lowest liquidity level in the BTC market in 10 months. which is lower than the effect of FTX.”

The most liquid trading pair in the crypto market, the BTC-USDT pair on Binance, was also affected. After ending the zero-free program, these conditions prevented market makers and day traders from trading due to additional costs incurred due to market inefficiency. which worsens the illiquid environment.

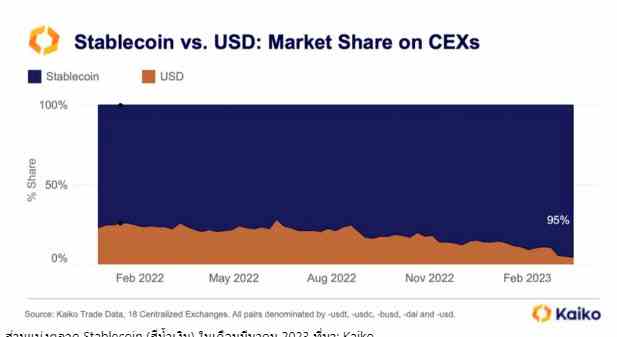

The market share of fiat dollars and stablecoins has also changed dramatically, with the volume of stablecoins on centralized exchanges increasing from 77% of the volume to 95% in just one year.

Although switching to stablecoin trading pairs will not cause problems for small to medium-sized investors. But it can become a problem for professional traders.

“Stablecoins are not ideal in terms of risk management. This is especially true at the end of the day or week if banks are closed and not processing transactions, so stablecoins are the next best alternative.”