Bitcoin experienced a 12.5% price drop from March 14 to March 17, falling to $64,545, leading to significant buying activity around the $65,000 level, with excessive leverage currently being used in Bitcoin Futures. It has been fixed. But investors are still wondering if BTC can break past its all-time high of $73,755.

All eyes are on the Federal Reserve’s monetary policy meeting.

Many believe investors are waiting for the Federal Reserve’s monetary policy meeting on March 20 before deciding to invest more in cryptocurrencies. This is despite widespread expectations that interest rates will remain unchanged. This decision is more than just a short-term consideration. It focuses on the Fed’s confidence in the continued strength of the economy.

Another important uncertainty for investors. Bitcoin That is, when the Fed will stop reducing its balance sheet at 7.5 trillion dollars. which generally More expansionary Fed monetary policy indicates more money in circulation. which is beneficial to risky assets

The US monetary base represents the currency and reserves within the banking system. Higher interest rates generally aim to maintain stability. This contractionary economic strategy often helps control inflation by reducing the attractiveness for businesses to borrow and grow.

Some analysts speculate that whether Bitcoin’s potential surge in 2024 depends on the Fed shifting from contractionary to expansionary monetary policy. This change could come from inflation falling below 3% or signs of a slowdown in the economy. Therefore, if interest rates remain elevated for a long period of time, the chances of Bitcoin skyrocketing will decrease.

Bitcoin Futures and Stablecoin Demand in Asia Point to a Good Rebound

Excessive leverage has also caused uneasiness among Bitcoin investors, especially as open interest in BTC futures hit record highs in March. This increased from $22.2 billion on February 25 to $35.5 billion on March 14. In addition, the imbalance in demand for leverage has led to distortions that are less sustainable.

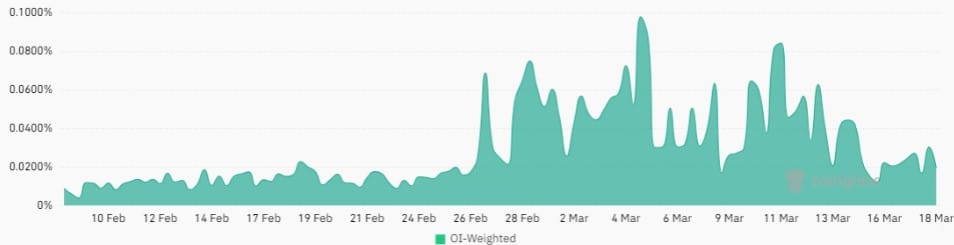

Perpetual contracts, also known as Inverse Swaps, include a rate that is recalculated every eight hours. A positive funding rate signals increased demand for leverage among long positions.

The unusually high funding rate of 0.09% on March 11 was 1.7% on a weekly basis. This indicator fell as bulls faced $370 million in liquidations from March 13 to March 15, although these figures This may seem significant, but consider that Bitcoin’s open interest is $34.8 billion. It means that about 1% of the position was forced to close.

Interestingly, Bitcoin’s funding rate dropped to 0.25% weekly on March 15, which is considered neutral in a typically bullish market. This indicates that there is no demand for short positions, which suggests that bears are reluctant to bet on Bitcoin falling below $65,000.

USDC premium has been above 3% in the past week. This indicates that the stablecoin is trading at a higher value than its pegged rate. Most notably, it has not fallen below fair value, despite the most recent correction to $64,545 on March 17.

refer : cointelegraph.com

picture decrypt.co