Bitcoin traded at $68,319, down 4.5% over the past 24 hours. This is because the crypto market is “overheated,” according to a report by online analytics firm IntoTheBlock.

Information from TradingView It shows that BTC’s price fell from the most recent all-time high of $73,835 on March 14, dropping 9% to a new weekly low of $65,565 on March 15.

The drop in Bitcoin prices also sparked a market-wide sell-off. The global crypto market lost 4.1% on the day to $2.59 trillion, according to CoinMarketCap.

Ether also dropped 5% in the past 24 hours to $3,708, with Cardano’s BNB, XRP, ADA, and Dogecoin losing 2.3%, 7.3%, 5.8%, and 8% of their value, respectively. during the same time

Solana’s SOL (SOL) segment was the only token among the top 10 cryptocurrencies to gain, rising 8% over the past 24 hours.

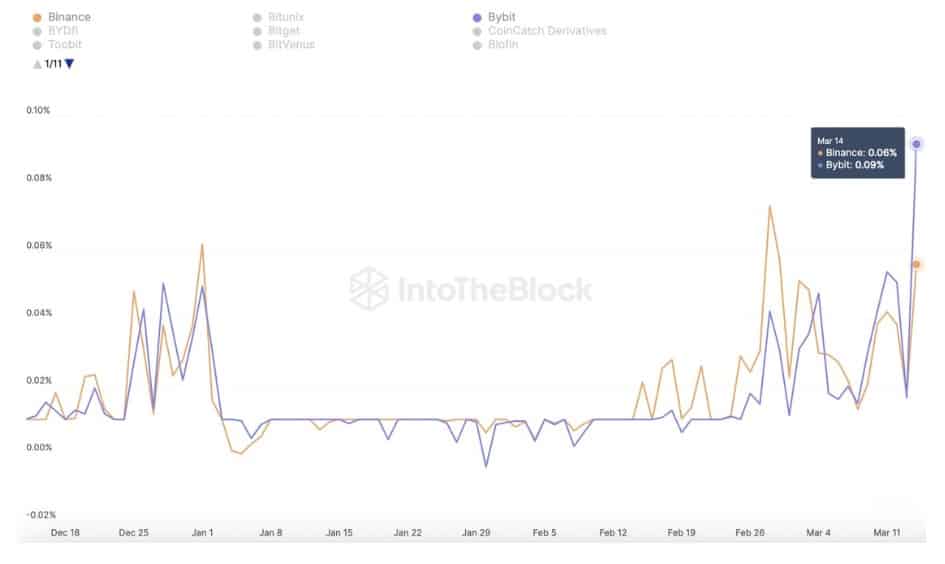

IntoTheBlock revealed that “the amount paid by buyers of Bitcoin perpetual swaps to short positions is the highest since October 2021.”

IntoTheBlock analysts noted that “BTC funding rates on Binance and Bybit reached levels of 0.06% and 0.09% yesterday, with payouts every 8 hours.”

“These fees translate to an annual cost of 93% and 168% in order to purchase Bitcoin,” the report adds.

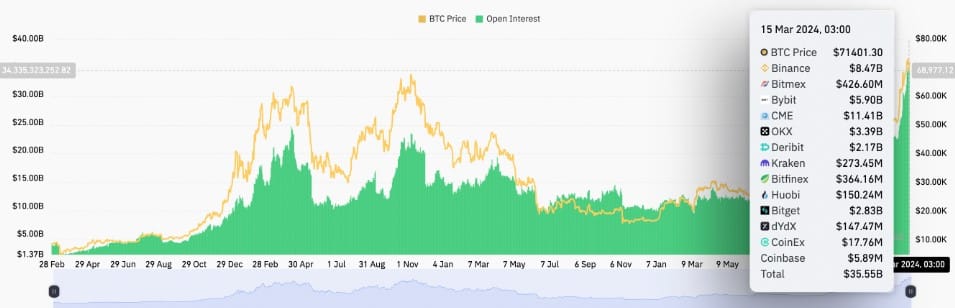

Additional data from Coinglass reveals that Bitcoin Futures Open Interest (OI) across all exchanges hit an all-time high of $35.55 billion on March 15.

Bitcoin holders are making profits

IntoTheBlock’s report points to the “overheated” condition, noting that “90-day average returns for top 20 crypto assets (excluding stablecoins) […] It’s at 103%.”

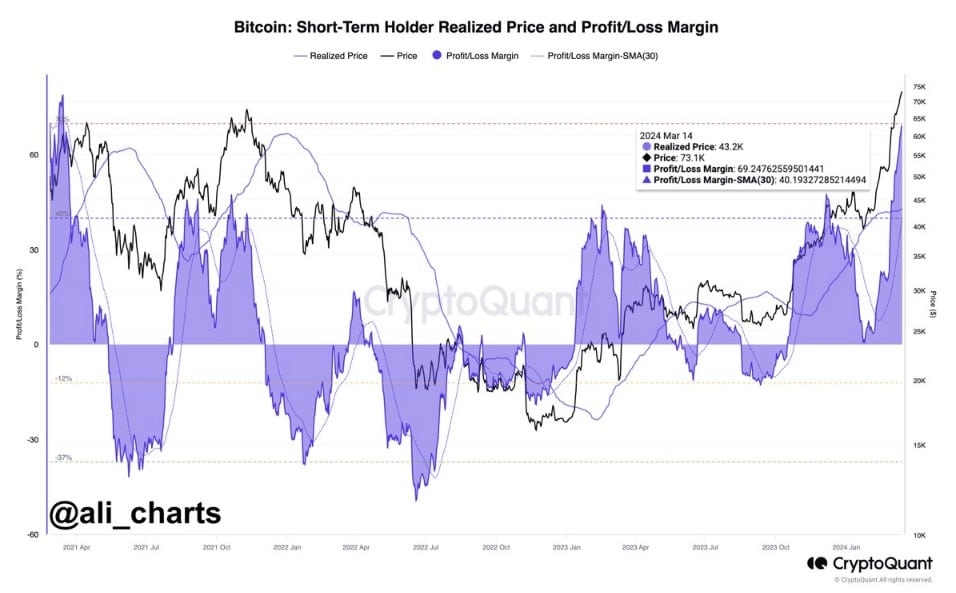

This means that most traders earn profits from their cryptocurrency investments. According to independent analysts and X Ali users, investors “They are currently making 70% profits on their holdings.”

In a March 14 post on A correction will occur as traders start to take profits.

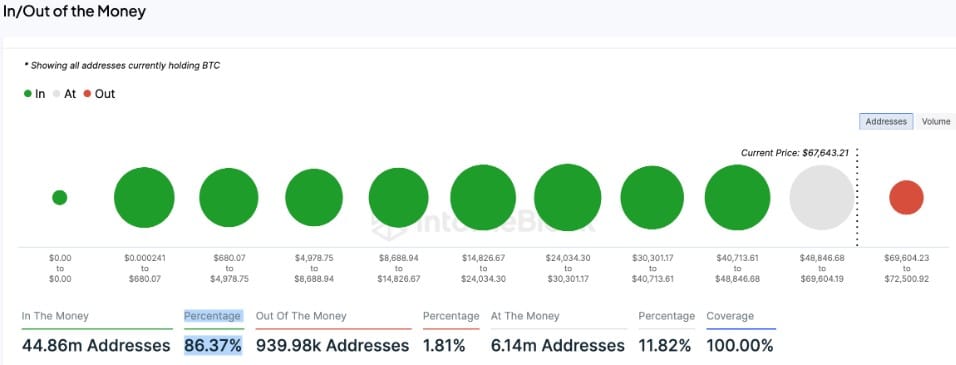

Additional data from IntoTheBlock shows that 86% of all Bitcoin holders are in profits at the current price, increasing the chances of a continued sell-off in the short term. When the profit capture continues

refer : cointelegraph.com

picture cryptoslate.com