Avalanche’s network and decentralized application locked deposits are reflecting worse conditions. And this puts the protocol at a disadvantage compared to competitors.

Avalanche’s core DApp usage metrics began to show weakness in late July, after TVL dropped below 110 million AVAX and in two months to 85.4 million, a 40% drop and signaling investors were withdrawing their coins from the app. network apps

The image above also shows that Avalanche’s TVL value peaked at 175 million AVAX on June 13, followed by a steady decline. In dollar terms, the current $2.2 billion TVL is the lowest figure since September 2021, and this figure represents 8.2% of all TVLs (excluding Ethereum). followData from DefiLlama

DApp implementation underperforms competitors

To confirm if the drop in TVL in Avalanche is causing problems? We should analyze a few DApp usage metrics.

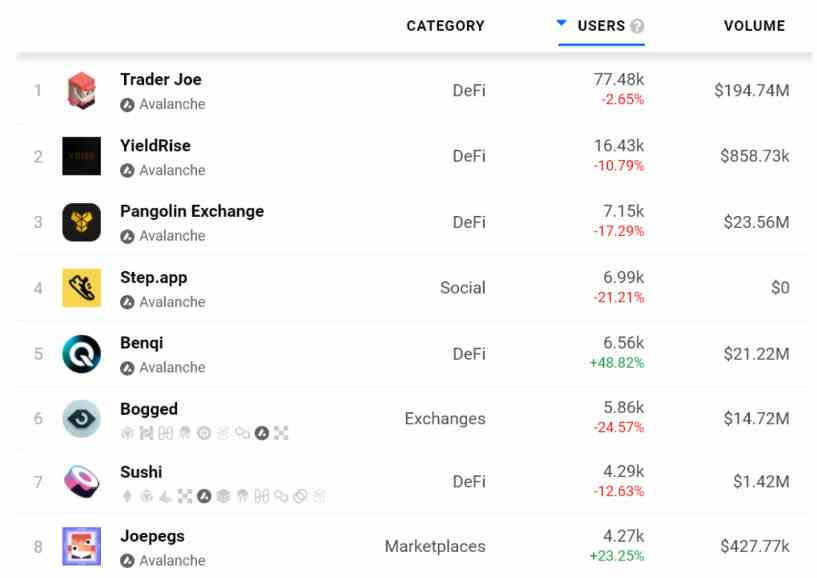

As shown by DappRadar, as of Aug. 18, the number of wallets in the Avalanche network that interacted with DApps decreased by 5% compared to the previous month. In comparison, Ethereum rose 4% and Polygon users increased 10%.

Avalanche’s TVL has been the most affected compared to other similar smart contract platforms, and this information could be a warning signal for investors betting on Avalanche.

The post Avalanche’s TVL is down 40% in two months, along with a sharp drop in DApp usage appeared first on Bitcoin Addict.