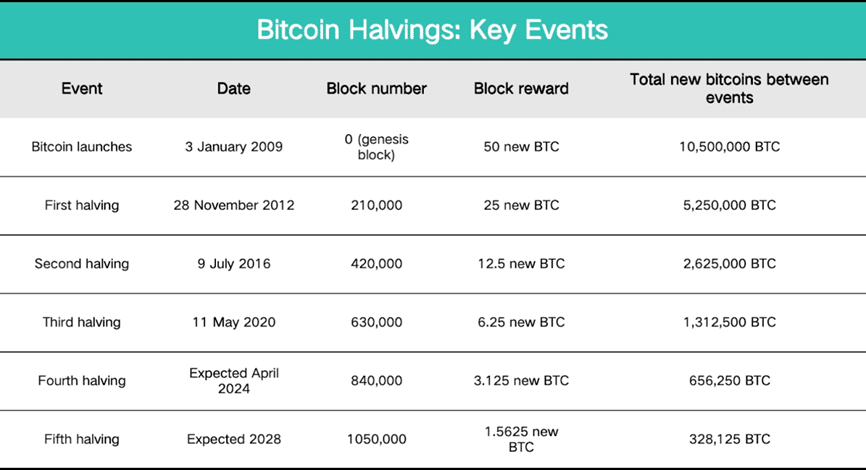

2024 is considered to be the year of Bitcoin, with the approval of Bitcoin ETFs and the upcoming Bitcoin Halving once again becoming the focus. As we all know, Bitcoin Halving is a key mechanism designed in the protocol to control the supply of new Bitcoin that will enter circulation. This year’s Bitcoin Halving is expected to occur in April 2024 when the number of blocks reaches 840,000. The block reward will be reduced from 6.25 BTC to 3.125 BTC.

What happens after the Halving?

We can estimate annual inflation after the Bitcoin halving. From the current single block reward of 6.25 BTC, daily production will be approximately 900 blocks, resulting in annual production of 900 * 365, according to official data from CoinEx Explorer. As of January 30, the total Bitcoin circulation is 19,613,577.

Therefore, the current annual inflation rate is 900 * 365 / 19,613,577 = 1.67%.

The projected annual inflation rate after the halving is 450 * 365 / 19,613,577 = 0.83%, which means that Bitcoin’s annual inflation rate will drop from the estimated 1.67% to 0.83%, falling below 1%. for the first time

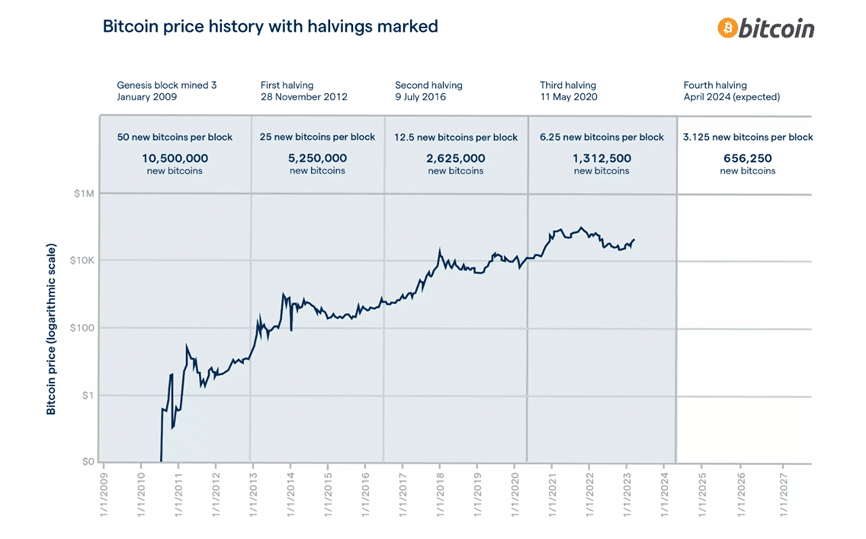

In the past, halving reduced the reward for mining new blocks. This has led to a reduction in the rate of new Bitcoin issuance. This reduced supply growth will be accompanied by a significant appreciation of the Bitcoin price.

Additionally, a reduction in issuance is predictable. along with the expected increase in demand. This results in tighter Bitcoin supply. As a result, there may not be enough Bitcoin available for purchase. Incentivize the price to increase to encourage long-term holders to sell. Relevant data shows that the Bitcoin price has increased to different levels after each halving event, although not necessarily immediately.

What effects will halving have?

While the halving may increase the price of Bitcoin, it is likely to have the biggest impact on miners. This is because this will directly affect their earnings. After the halving, there are four main factors that affect a miner’s earnings:

Reduced prizesd

That Bitcoin halving This directly results in the mining reward being halved. This means that miners receive half of their Bitcoin when they mine a new block. With reduced mining rewards Miners will need to pay close attention to Bitcoin price fluctuations to better assess mining earnings.

Bitcoin price fluctuations

The fluctuations in Bitcoin’s market price also have a significant impact on mining revenue. If the price of Bitcoin increases after the halving, miners may experience higher values both before and after the halving.

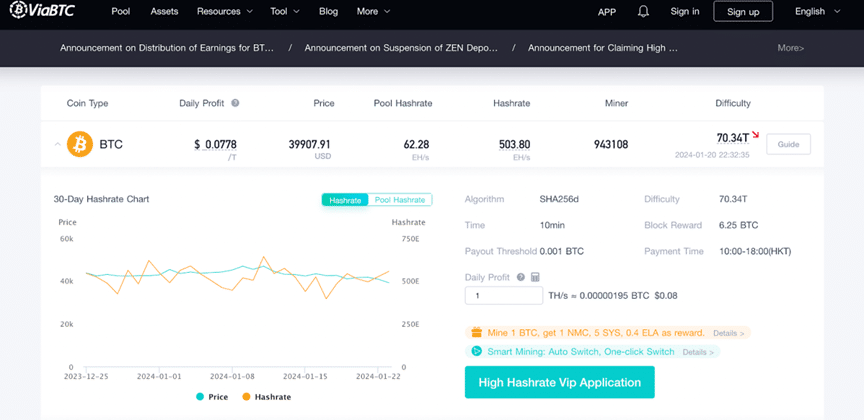

Difficulty in mining

The Bitcoin network adjusts mining difficulty based on changes in the number of global miners and processing power. To be sure, the average block production time is around 10 minutes. According to statistics from ViaBTC, as of January 30, Bitcoin mining difficulty was 70.34T after this year’s halving, due to the profitability of Mining decreased Some miners may abandon mining, which will result in a decrease in mining difficulty. However, mining is a dynamic equilibrium process. And if the difficulty of mining decreases Income will naturally increase. This leads to the entry of new miners and increased difficulty. thus reaching a new equilibrium point.

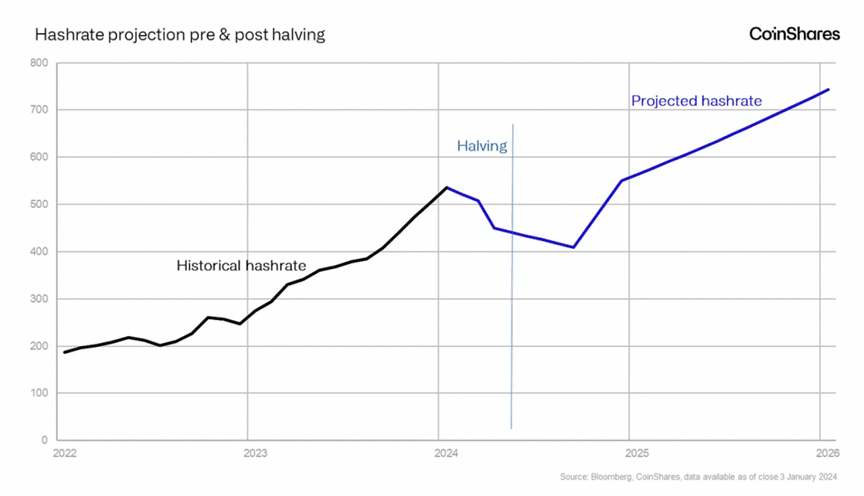

Hash rate decreased

According to CoinShares, since the first Bitcoin halving in 2012, as well as halvings in 2016 and 2020, the mining hash rate has generally decreased by approximately 9% relative to the trend line after each halving event. This descent usually lasts about six months.

However, the impact of the halving on miners is not all negative. But it can also be a “less is more” process, so let’s examine general bitcoin price trends during past halvings.

• November 28, 2012 (First Halving): The first Bitcoin Halving occurred three years after the creation of the Genesis block. Bitcoin prices did not experience a significant increase immediately before and after the Halving, but in the months after. Halving the price of Bitcoin increased significantly.

• July 9, 2016 (2nd Halving): After the second Bitcoin Halving, the Bitcoin price fluctuated before and after the halving, but in the year after the halving, the Bitcoin price began to increase significantly. and reached a new high.

• May 11, 2020 (3rd Halving): After the third Bitcoin Halving, mining rewards decreased by 50%, with block rewards decreasing from 12.5 BTC to 6.25 BTC. Tight supply creates a bullish outlook for the asset. And the price of the token increased from 6,877.62 USD. One month before the Halving (April 11, 2020), it was $8,821. During the Halving event

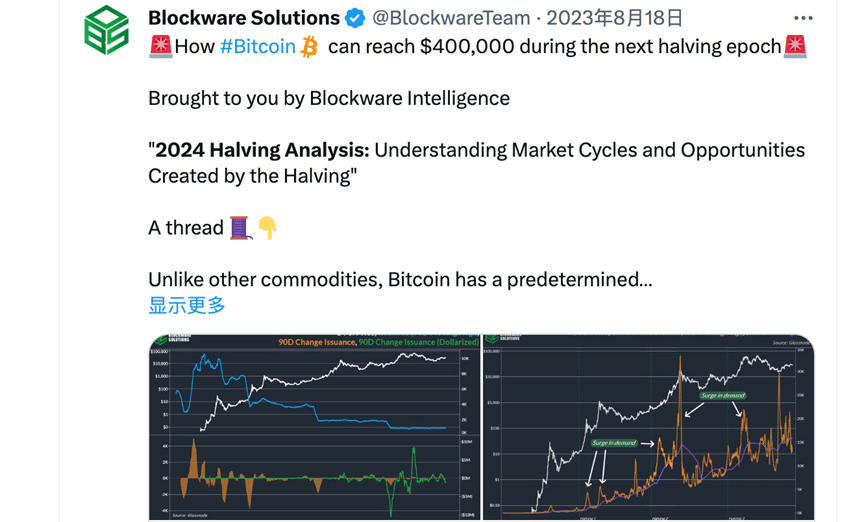

This year, analysts from Blockware Solutions said that the 2024 halving could push the price of Bitcoin as high as $400,000.

In general, the impact of Bitcoin Halving on a miner’s income is a complex combination of factors involved in the halving of the reward. Market price fluctuations and the difficulty of mining and halving

That means Miners face increasing challenges and pressure. Miners need to find more efficient mining equipment and lower mining costs to maintain profitability and survive in an increasingly competitive market.

at the same time This may accelerate the reshaping of the mining industry. This has made competition more intense and concentrated in the industry, which the upcoming Bitcoin Halving brings with it challenges and pressure. The same is true of survival problems for miners.

How do miners view the halving?

How can miners overcome this difficulty and survive? What is their perspective on halving strategies? In order to explore this issue further. The author interviewed several miners.

Miners who are positive about Bitcoin’s halving say that revenue is the main concern for the mining community. They emphasize that as long as their income is continuously higher than their electricity bill, Will continue to dig. Regardless of income fluctuations resulting from halving.

For miners, the two main factors that affect their income are the cryptocurrency price and the hash rate, since the cost of electricity is fixed. Cryptocurrency prices and hash rates therefore directly affect the final income that will be earned.

Meanwhile, some miners said that based on the current price of Bitcoin (as of January 30, 2024, the price of Bitcoin is $43,412.45, according to CoinEx market data), many machines may be forced to shut down after the halving, they said. that these machines can only be restarted when prices reach a certain level

Another miner suggested that if the Bitcoin price trend after the halving is not optimistic, Miners can choose to upgrade their machine models or relocate their mining operations to control costs and maintain the same income as much as possible. Miners in countries with high electricity costs have started upgrading their machines since six months ago. Meanwhile, some are considering moving to regions with lower electricity costs, such as South America and the Middle East. The Middle East is a region favored by many miners. Because it has an energy system that is ideal for Bitcoin mining.

The hot and dry climate in the Middle East causes large fluctuations in energy demand. This results in a surplus of energy during a period of reduced demand for local electricity. Miners can use this excess power to stabilize the Grid and increase their income.

But there are still some miners with no long-term plans choosing to temporarily shut down operations. To wait for market fluctuations and price changes before making relevant plans. They said that as the price of cryptocurrency increases, the price of machines tends to increase.

On the other hand, selling machines when cryptocurrency prices are high or buying machines when prices are low can help them find a balance in their income. Additionally, some miners say they engage in arbitrage. Dollar-cost averaging as a bear market approaches a bull market This is because future mining income is difficult to predict. But holding cryptocurrencies will provide visible returns.

Certainly for the mining community. Plans after halving vary from person to person. Most miners plan in detail based on their own breakeven time frame. While evaluating mining difficulty in preparation for the next phase of Bitcoin’s future halving, some miners have adopted the idea. “Mine when possible. Give up when you don’t get it.

It acknowledges the unpredictable nature of the cryptocurrency industry. where market changes always exceed plans However, most miners tend to make long-term plans ahead of the halving, even if the final plans may deviate from the market.