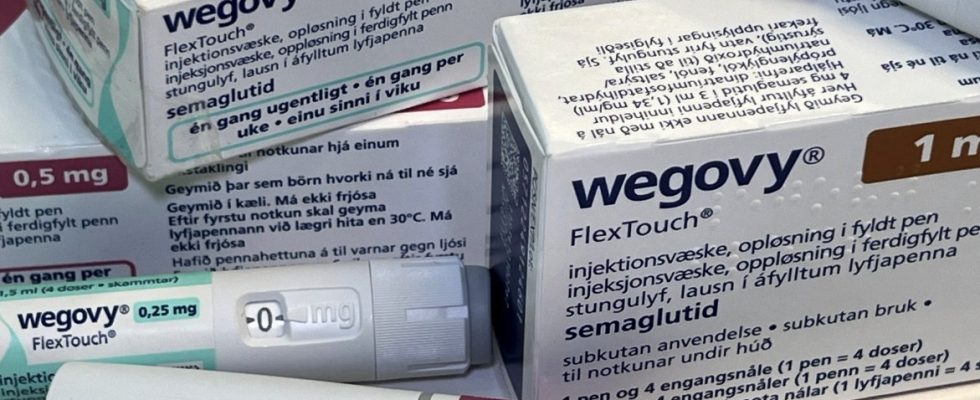

It’s a big deal. And it’s just the beginning. In the 2023 financial year, the Danish company Novo Nordisk generated sales of a good 31 billion crowns, the equivalent of around four billion euros, with its Wegovy weight loss injection. Within a year, sales increased fivefold. Ozempic, a treatment for type 2 diabetes with the same active ingredient, brought Novo Nordisk an additional almost 96 billion Danish kroner. The Danish company was also helped by a few celebrities such as Elon Musk and Kim Kardashian, who raved about the weight loss caused by the weight loss injection – without any diet or exercise.

Anyone who is as successful as Novo Nordisk has pursuers. The largest is the US company Eli Lilly with its Zepbound weight loss injection. There have been repeated bottlenecks at Wegovy in the past few months. Bottlenecks are nothing more than lost sales and ultimately lost profits. On Monday, Novo Nordisk’s parent company took a few important steps to secure production capacity and put its competitors at a distance again. Novo Holding wants to take over the US contract manufacturer Catalent for $11.5 billion. According to its own information, the company has more than 50 locations worldwide. After the transaction is completed, the holding company wants to sell three of them on to Novo Nordisk, of which the holding company is the largest shareholder. Catalent expects the transaction to be completed towards the end of 2024, subject to approval from the authorities.

The competition between Novo Nordisk and Lilly, writes the US news agency Bloomberg in a report, is becoming more intense. Lilly’s drug Zepbound hasn’t been approved for as long as Wegovy – and isn’t even on the market in Europe yet – but it has great potential. Zepbound could become the highest-selling drug in history, writes Bloomberg. In studies, the drug led to greater weight loss than anything Novo Nordisk has on the market. The shares of Catalent and Novo Nordisk reacted with premiums to the planned transaction. According to Bloomberg, Novo Nordisk is the most valuable listed company in Europe with more than $520 billion. The news agency puts Eli Lilly’s value at $600 billion.

According to the World Obesity Report 2023, 2.6 billion people worldwide suffered from overweight or obesity in 2020. According to the forecast, their number will rise to a good four billion by 2035. Even if it sounds cynical, the market is growing. The Association of Research-Based Pharmaceutical Companies (vfa) refers to the definition of the World Health Organization (WHO). According to this, adults suffer from obesity if they have a body mass index (BMI) of at least 30. The WHO considers a BMI of 25 to under 30 to be overweight, and a BMI of 18.5 to under 25 is considered normal weight. The BMI is calculated as body weight divided by the square of the body height. The economic costs are significant.

Zepbound has only been available on the US market for a few weeks. Analysts quoted by Bloomberg are already expecting sales of $2.4 billion this year. Lilly’s market value could therefore approach $700 billion. And according to Bloomberg, Lilly is already the world’s most valuable pharmaceutical company.