Democrats’ tax plans

US Billionaire Tax: What Jeff Bezos and Elon Musk should pay in the future

Gigantic fortunes, largely untaxed: Tesla boss Elon Musk and Amazon founder Jeff Bezos

© BRENDAN SMIALOWSKI / AFP

In the US, the super-rich pay very little in taxes. Some Democrats want to change that: A new billionaires tax should wash hundreds of billions of dollars into the state coffers. It would break a taboo.

One of the peculiarities of the American system is that the super-rich sometimes pay significantly less taxes than a middle-class worker. The fortunes of an Elon Musk or a Jeff Bezos are rising in ever more dizzying spheres, but the multi-billionaires regularly count themselves poorly in front of the tax authorities.

Data from the US tax authority, the IRS, published by the investigative portal Propublica a few months ago, showed that Tesla boss Elon Musk got away with a measly tax rate of 3.27 percent between 2014 and 2018. Bezos even paid 0.98 percent in the same period. Previously, the Amazon founder had not paid a single cent for years and also received child benefit because his expenses exceeded income according to the tax return. By comparison, the average American household pays 14 percent federal income tax.

700 Americans are said to pay billions

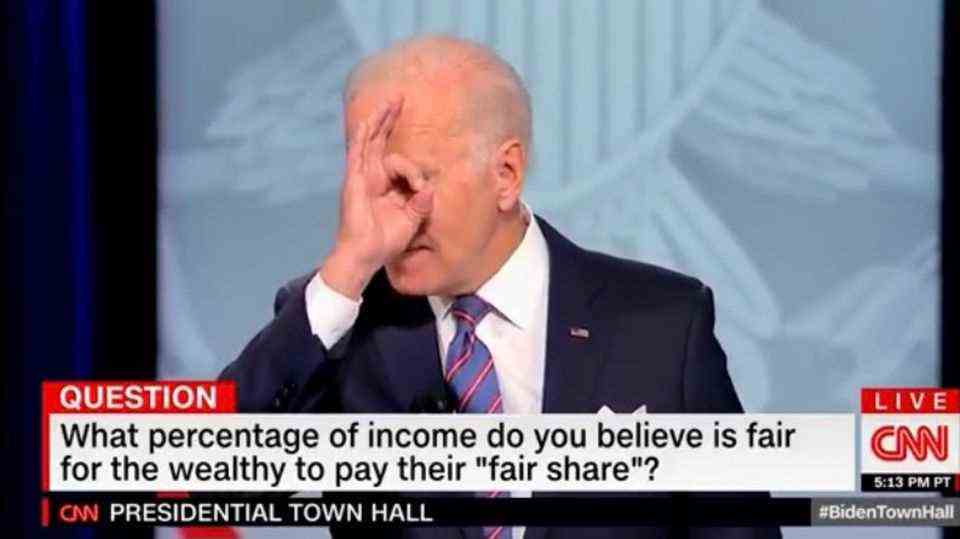

To tackle this injustice, US President Joe Biden’s Democratic Party unveiled plans for a new super-rich tax on Wednesday. This should flush “hundreds of billions of dollars” into the state treasury and only affect the richest of the rich, as Senator Ron Wyden, chairman of the finance committee, said. Only those who earn more than 100 million dollars for three years in a row or who have owned more than one billion dollars during this period should only pay. Affected would be the richest 700 US citizens.

It is still unclear whether the plan will get enough political support, but the idea alone is causing a sensation. House spokeswoman Nancy Pelosi said the tax could bring in $ 200 billion to $ 250 billion in ten years.

This is not a classic wealth tax that taxes all assets, but a tax on capital gains. According to the plan, the billionaires will pay an annual capital gains tax of 23.8 percent on the appreciation of their stocks and other securities. If there is a loss in one year, this can be offset. In addition, gains in value from real estate and similar property should also be taxed, but only when they are sold.

Can you tax unrealized profits?

That Bezos and Co. have to pay taxes on their capital market gains sounds obvious at first, after all, their gigantic asset growth is based primarily on this. In fact, the plan is breaking a taboo: So far, only actual profits are taxed, but the new tax is aimed at unrealized profits, since the shares are not sold at all, but have only risen in price.

But is it okay to tax a profit that has not yet been made? Proponents of the tax argue that you simply can no longer afford to wait for the super-rich to sell their stocks at some point (aside from the fact that stock profits are taxed less than income). “Working Americans like nurses and firefighters pay taxes on every paycheck, while billionaires postpone paying taxes for decades or even indefinitely,” said Senator Wyden.

Because some people have just become so rich that they don’t even have to realize their paper profits and can still do what they want. A Jeff Bezos can get practically unlimited cheap loans, he can fly into space and live in luxury without having to sell his Amazon shares. “If Jeff Bezos’ blocks of shares increase in value by $ 10 billion and he gets a salary of $ 80,000, he should be taxed like a person with an income of $ 10 billion, not a middle-class breadwinner,” wrote the center’s tax expert Chuck Marr on Budget and Policy Priorities on Twitter.

Joe Biden is already a fan

Critics, on the other hand, consider the billionaire tax on unrealized profits to be unfair, difficult to implement or expect unpleasant side effects. For example, Washington Post columnist David von Drehle fears that companies like Tesla will no longer be able to look to the stock market where every small investor can participate, but rather get their money directly from major investors. Elon Musk himself has also made it clear in a tweet that he does not believe in the tax idea. CNN writer Edward McCaffery, on the other hand, believes the plan is an “excellent first step towards getting the richest Americans to pay after a century of nothing”.

US President Joe Biden supports the billionaire tax, as his spokeswoman Jen Psaki said. Biden urgently needs to raise money to finance his billion dollar infrastructure, climate protection and social programs, which is currently being fiercely politically contested. With his plans for higher corporate taxes – actually a central election promise – Biden has so far failed because of resistance from his own party. The billionaire tax would be just right for him. Whether he can get his own ranks behind the idea in this case still seems highly questionable. The first important democrats have already expressed themselves cautiously or skeptically.

Sources: Reuters / CNN / CBS / Washington Post