Locked value (TVL) in a decentralized finance (defi) protocol has lost 17.77 percent over the past 30 days, down from $221.67 billion to $182.27 billion today. Locked inclusions (TVL) in a variety of defi protocols have lost significant value over the past seven days.

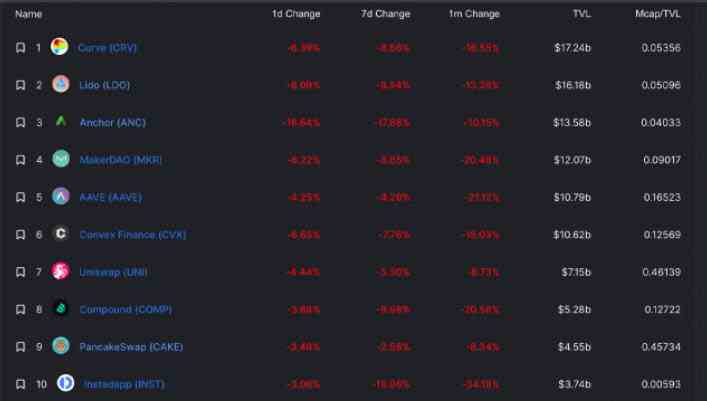

The decentralized finance (defi) protocol has lost a lot of value over the past month, a 17.77% drop since April 8, 2022. The largest defi protocol in terms of TVL size, Curve Finance, lost 16.55% last month. already

The Lido pontocall also lost 13.28% of its TVL in 30 days, Anchor’s TVL was down 10.15%, Makerdao’s was down 20.48% and Aave’s TVL was down 21.12% in the past month.

Two protocols with a huge increase in TVL in 30 days are version 3 of Aave (v3) and Tron’s Sunswap protocol.

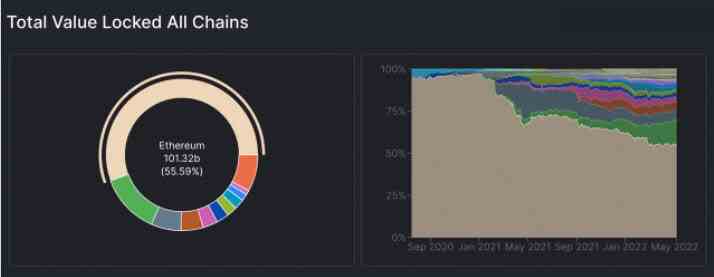

Ethereum continues to dominate defi TVL at 55.59% as $101.32 billion of TVL’s $182.27 billion is on the ETH chain, while Terra is second in terms of defi TVL with $23.44 billion, representing 12.86%. And finally, Binance Smart Chain (BSC) is the third largest blockchain in defi, accounting for 6.37% of the total, valued at about $11.6 billion today.

The current top three cross-chain TVLs are Polygon, Avalanche, and Arbitrum, respectively, with the top three crypto assets leveraging cross-chain bridges today: USDC, wrapped ethereum (WETH), and tether (. USDT), while the entire crypto economy has lost 5.1% in value over the past 24 hours to $1.65 trillion.

The post Total TVL on DeFi has dropped 17% in the last 30 days appeared first on Bitcoin Addict.