The G20 agreement sparked a concert of enthusiastic reactions, from US Treasury Secretary Janet Yellen who called on the world “to act quickly to finalize” the reform, to European Commissioner for the Economy Paolo Gentiloni who spoke of a ” victory for tax fairness ”.

The finance ministers approved a reform considered “revolutionary” in the taxation of multinationals, already approved by 132 countries and which promises to permanently shake up international taxation. They called on recalcitrant countries to join the deal, a call that was heard by Saint Vincent and the Grenadines, a small Caribbean country, which just signed the declaration.

A worldwide corporate tax of “at least 15%”

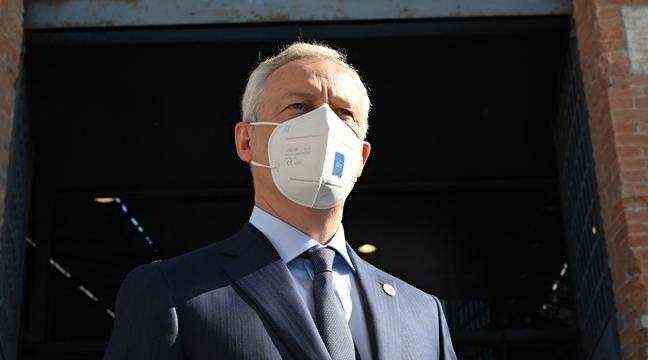

There is “no turning back possible”, welcomed the French Minister of the Economy Bruno Le Maire, calling now to “effectively implement the reform of international taxation by 2023”. Introduce a global corporate tax of “at least 15%” to sound the death knell for tax havens and tax companies where they earn their revenues: this agreement, the rules of which should be fine-tuned by October, must be implemented from 2023.

“Today we are operating a tax revolution. We are turning our backs on decades of tax-lowering which has shown it to be totally ineffective, ”he added. Several G20 members, including France, the United States and Germany, are campaigning for a rate above 15%, but it should not budge until the next meeting of the 19 richest countries in the world and the European Union in October.

But several members of the working group of the Organization for Development and Economic Cooperation (OECD) who reached an agreement in principle on July 1 are still missing, such as Ireland and Hungary. Ireland has been practicing a rate of 12.5% since 2003, which is very low compared to other European countries, which has enabled it to host the European headquarters of several technology giants such as Apple and Google.

Distribute taxes

The pillar number 1 of the reform aims to distribute equitably between countries the rights to tax the profits of multinationals. For example, a company like the oil giant BP is present in 85 countries. In their sights, the “100 most profitable companies in the world, which alone make half of the world’s profit”, including the Gafa (Google, Amazon, Facebook, Apple), explained Pascal Saint-Amans, director of the Center. OECD Tax Policy and Administration.

As for the global minimum tax, pillar 2, less than 10,000 large companies would be affected, those whose annual turnover exceeds 750 million euros. A minimum effective rate of 15% would generate additional revenue of 150 billion dollars per year, according to the OECD. Under the Italian presidency, the major funders of the G20 met for the first time, “face to face”, since their meeting in February 2020 in Riyadh, at the very beginning of the coronavirus pandemic.

Aid to vulnerable countries

While the Arsenal district where the meeting takes place was cordoned off, with police filter barriers, several hundred anti-G20 demonstrators gathered on Saturday afternoon in the center of Venice, causing some clashes with the police.

The G20 also supported the IMF’s initiative to increase aid to the most vulnerable countries, in the form of a new issue of Special Drawing Rights (SDRs) amounting to $ 650 billion, and called for “Its rapid implementation by the end of August”.

UN Secretary General Antonio Guterres on Friday urged members of the G20 to be “in solidarity” with developing countries. “Solidarity demands that rich countries direct their unused portion of these funds to developing countries,” he noted.