The Fed building in Washington, May 4, 2022 (AFP/Jim WATSON)

Faced with prices that continue to climb in the United States, the American Central Bank should strike hard on Wednesday to try to curb inflation, while taking care to protect the economy from the recession that awaits.

The monetary committee of the powerful Federal Reserve (Fed) should indeed announce a new sharp increase in key rates.

The meeting of the monetary policy committee (FOMC), which began on Tuesday, resumed Wednesday “at 09:00 (13:00 GMT) as planned,” a spokesman for the Federal Reserve told AFP.

The decision will be announced at 2:00 p.m. (6:00 p.m. GMT) in a statement, which will be followed by a press conference by Fed Chairman Jerome Powell at 2:30 p.m.

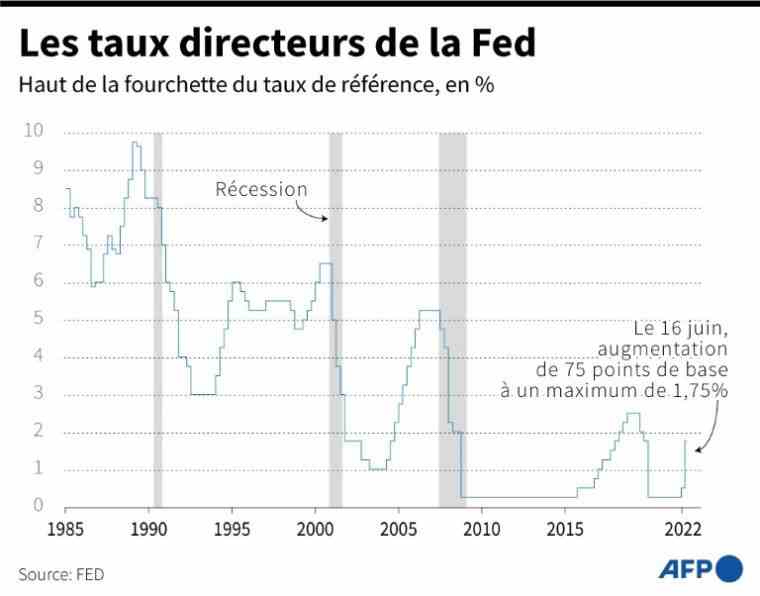

“We expect the Fed to raise (rates) by 75 basis points, (…) carrying out the most aggressive tightening cycle since the 1980s,” said Gregory Daco, chief economist at EY-Parthenon.

This is what it had already done at its previous meeting in mid-June, bringing rates within a range of 1.50 to 1.75%.

It was then the largest increase since 1994. This time, an even bigger increase, of one point, could even be on the table.

The objective: to make credit more expensive to slow down consumption and, ultimately, to ease the pressure on prices. Inflation indeed again reached a new record in June, at 9.1% over one year, unheard of for more than 40 years in the world’s largest economy.

Consumption is the engine of the American economy, accounting for almost 3/4 of the GDP.

– “Chance” –

The comments that Jerome Powell will be able to make on the rate of increases envisaged by the institution for the coming months will also be scrutinized and dissected by observers.

“Mr. Powell will repeat that the Fed sees inflation as a scourge, especially for low-income households, and that policymakers are determined to bring it down,” said economist Ian Shepherdson of Pantheon Macroeconomics.

Evolution of the main FED key rate since 1985 (AFP / )

The Fed has indicated that it would take a drop in inflation for it to consider stopping raising rates, or at least slowing the pace of hikes. “We expect this condition to be met by the time of the September meeting,” adds Ian Shepherdson.

But the long-awaited economic slowdown to bring prices down could prove too strong, and plunge the world’s largest economy into recession.

The European Central Bank (ECB) has also started to tighten its monetary policy, following many financial authorities. And the International Monetary Fund (IMF) said on Tuesday that it was essential that these institutions continue to fight against inflation.

This will of course not be without difficulty and “tighter monetary policy will inevitably have economic costs, but any delay will only exacerbate them”, according to the IMF.

The Fed hopes to achieve a “soft landing”.

– Recession? –

The good health of the American economy should allow it to escape a recession, according to Joe Biden’s Minister of Economy and Finance, Janet Yellen.

Fed Chairman Jerome Powell in Washington on June 15, 2022 (AFP / Olivier DOULIERY)

The IMF is less optimistic. “The current environment suggests that the possibility of the United States escaping recession is slim,” warned its chief economist, Pierre-Olivier Gourinchas, on Tuesday.

The international institution now expects only 2.3% growth in the United States for this year, ie 1.4 points less than in its latest forecasts, published in April.

Second-quarter gross domestic product (GDP) growth will be released on Thursday. It should have been very slightly positive, after a negative first quarter (-1.6%), thus saving the American economy from recession for this time.

In the event that it were negative again, the world’s largest economy would then enter a technical recession, with two negative quarters in a row.

The very definition of recession, however, is debated in the country as this publication approaches: is it two consecutive quarters of negative growth? Or a broader deterioration in economic indicators, which is not currently the case?