On January 23, 2012, the Schlecker drugstore chain finally filed for bankruptcy after a steep downturn. 25,000 employees lost their jobs from one day to the next. How do those affected think today about the end of the drugstore empire?

40 percent market share, 6.55 billion euros in sales – until the early 2000s, Schlecker was one of the largest drugstore chains in all of Europe. In almost every municipality in Germany, the white shop lettering hung at least once on a blue background. What followed was a crash of unparalleled proportions.

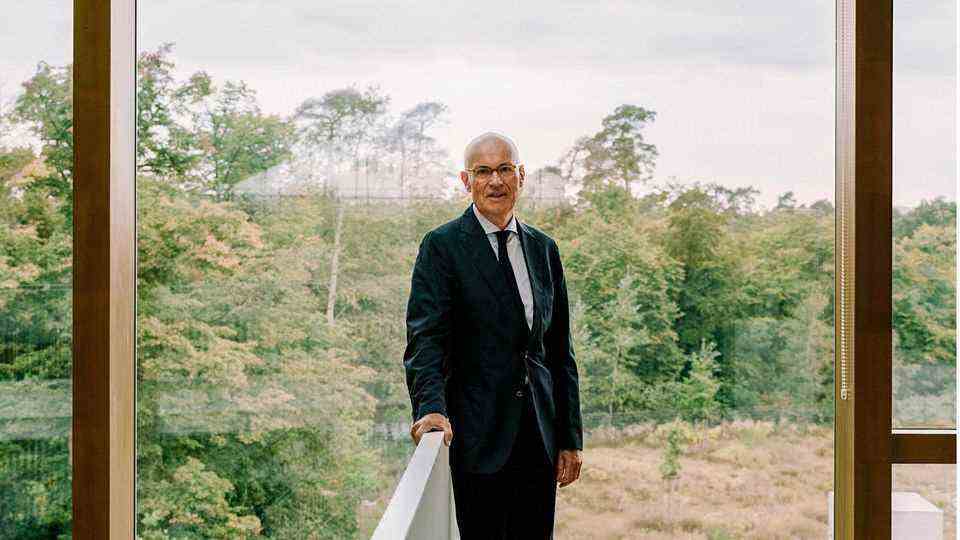

Ten years ago, on January 23, 2012, the empire of the drugstore king and self-made man Anton Schlecker finally had to file for bankruptcy. The drugstore group had announced the move three days earlier. Around 25,000 employees in Germany, mostly women, lost their jobs. “There has probably been hardly any comparable insolvency proceedings in Germany in terms of public and media interest,” says the office of insolvency administrator Arndt Geiwitz.

Bankruptcy was homemade

The decline of the Schlecker empire became apparent more than half a year before the bankruptcy. In June 2011, the company announced that it would close around 10 percent of its more than 8,000 branches in Germany. The reason is their insufficient profitability. The problems were homemade. According to the spokesman for the insolvency administrator, Schlecker tried to get even bigger with more and more shops, to achieve more shopping advantages in order to be able to achieve even lower prices. “However, customers stayed away because the shops were too small, too old and unattractive.” The conversion of what was once the largest drugstore chain in Europe could not be implemented quickly enough because there was a lack of money. “And then the house of cards built for expansion collapsed.”

Legendary are the words of Schlecker’s daughter Meike a few days after filing for bankruptcy at a press conference together with insolvency administrator Geiwitz. She is asked why the father did not support the company with money from his private assets. Meike Schlecker moved forward in her chair and replied: “I don’t think you understood that. There’s nothing left.” As a so-called sole proprietor, he was liable with everything he owned. Around 28,000 creditors have filed claims of just over 1.2 billion euros in the insolvency table.

Employees abandoned by politics

The Schlecker case also becomes a political issue. In March 2012, Geiwitz’s attempt to set up a transfer company for almost 10,000 employees who were about to be laid off failed. The then Federal Economics Minister Philipp Rösler (FDP) rejected a loan from the state bank KfW and referred to the responsibility of the federal states. The FDP economics ministers in Bavaria, Lower Saxony and Saxony prevent society from forming. And Rösler caused additional outrage because he had recommended that the women in the drugstore chain who were laid off should find a new job themselves and described this as “subsequent employment”.

Even ten years after the bankruptcy, Christel Hoffmann, the group’s former head of the works council, is still outraged. “Politicians had slammed the doors at Schlecker. The women employed there were not important to politicians,” says the 68-year-old. Looking back, Leni Breymaier, who is now a member of the SPD and then Verdi boss in Baden-Württemberg, believes that Schlecker simply had too bad an image. That is why there was no political involvement.

Schlecker children must be in custody

The former head of the works council worked for the drugstore company for almost 20 years. From Hoffmann’s point of view, the Schlecker family’s major shortcoming was that they were resistant to advice. When she was on the works council, she never saw Anton Schlecker, says Hoffmann. The master butcher, who opened his first drugstore after price maintenance for branded products was abolished in the 1970s, had to face a wider public during the trial before the Stuttgart Regional Court.

In 2017, Schlecker was sentenced to a two-year suspended sentence for willful bankruptcy. Knowing that bankruptcy was imminent, he had put money aside. He was spared prison. But not his children. Meike and Lars Schlecker had to go behind bars. They were sentenced to two years and seven months in prison each. In the past, the Schleckers had repaid over ten million euros to the insolvency administrator.

dm and Rossmann secure market shares

In retail, on the other hand, Schlecker’s market shares have long since been redistributed. “The bankruptcy of Schlecker first tore a huge hole. Above all, dm and Rossmann then fought massively for Schlecker customers and fought real price battles. That paid off for both of them: In the end they secured the largest piece of the cake “says retail expert Thomas Montiel-Castro of market research firm NielsenIQ.

“The top dog dm was then able to increase its market share from 28.5 percent to over 40 percent, Rossmann from 22.5 percent to 33.5 percent,” reports Mirko Warschun from the management consultancy Kearney. Other drugstore chains, on the other hand, benefited little. And even the major grocers largely got nothing when Schlecker’s market shares were redistributed. “They simply didn’t have enough space in their branches to offer a really competitive range of products in the drugstore segment, and in the eyes of many customers they may also lack competence in this area,” says the industry insider.

Is Schlecker really coming back?

Meanwhile, Austria-based businessman Patrick Landrock has announced that he wants to revive the Schlecker brand. So Schlecker should no longer become a pure drugstore, but also appear strongly with products of daily use such as food, office and business supplies as well as hardware store articles. Online sales should start in the first half of the year. The first branches are to follow, this year 50 sales outlets are planned. The start of online sales has already been financed.

Landrock claims to be the Schlecker brand owner. A spokesman for the insolvency administrator says that the rights to the brand could not be sold to a suitable bidder in the course of the insolvency proceedings. “Since the trademarks have not been used since 2012, the insolvency administration deleted them – according to a note from the German Trademark and Patent Office – or did not extend the registration.” The insolvency administrator once negotiated with Landrock: “There was no sale at the time.”