1) What is Futures Trading?

Future or Thai language is called A “future contract” is one of the financial instruments in which we can buy/sell an underlying asset at a specified contract price in the future. The main purpose of Future is to reduce our risk. If the price of that asset has a price that fluctuates in the future And it prevents us from buying or selling that asset at the price we expect.

And another advantage of futures trading is that we can find profitable opportunities on the asset both up and down. Because the global risk asset market Whether it’s stocks or crypto There is normal speculation from traders all over the world, and not every trader has the same view on the price of a given asset, so we can use futures to reduce our portfolio risk. And increase the opportunity to make a profit for our investment portfolio as well.

Since the future is both a hedging tool. and speculation tools This allows us to use leverage or borrow money to invest to increase our rate of return while we use the future. Therefore, using the future there is a risk that our assets will be seized. (Liquidation) while investing.

2) What does Future’s product consist of?

How to make profit with Future consists of 2 types: Long and Short. By long means that we predict that the underlying asset will have a higher price in the future. Opening a long position means that we Borrowing money (Leverage) from other people to buy assets. And sell in the future and gradually bring this money back.

Short means that we predict. That the underlying asset will have a lower price in the future. Opening a short position means that we borrow the underlying asset from the market to sell it now. And will buy back to the market in the future when the price of the asset is lower.

for example If we are an employee of a company whose salary is paid in Bitcoin and we are about to receive salary in the next 1 week. If we predict that in the next 1 week, when the salary period will be released, Bitcoin will fall in price. Of course, we can’t get salary in advance and sell it today to prevent Bitcoin price falling in the future. can But what we can do is “short Bitcoin” if the Bitcoin price really falls on payday. At least we can profit from our short position and we can sell our Bitcoin at the right price range.

Conversely, if we are the owner of an export business Have an appointment with customers that will sell big lots within the next 3 months. But it turned out that the customer needed the product within the day and we had the item ready to ship. But we predict that the price of the product in the next 3 months will be higher than the current price. In the end, nothing can be done, so it is necessary to sell products within today. Therefore, business owners should “Long this product” in order not to be an opportunity cost if the product price increases in the future.

3) Type of Future

Futures contracts are divided into two types: “with expiration date” and futures contracts ”No Expiration” by Future with Expiration Date It is a futures contract that has a contract term that we will have to close within what month or year. Also known as Perpetual Future, it is a futures contract where we can hold the contract until we close it. And there is no need to deliver the underlying assets to each other.

As perpetual futures do not require the delivery of the underlying asset like an expiry future. As a result, there is no price control at the closing date of the contract. Therefore, the price of the underlying asset within the Spot Market and Future Market is subject to discrepancy. and to reduce this discrepancy Therefore, what is known as the “Funding Rate” has been designed.

Funding Rate is the fee that futures contract openrs must pay each other in order to control the price of the underlying asset in the spot market and the futures market as much as possible. If the Funding Rate is positive, that is, the price of the underlying asset. In the futures market is more valuable than spot market or someone longs more than short, so the long one pays the funding fee to the short one, and if the Funding Rate is negative, that is, the price of the underlying asset in the future market has value. less than the spot market, or shorter than long, so the shorter pays the Funding Fee to the long.

4) What is FTX?

FTX is a cryptocurrency trading platform that offers a wide range of services including Spot Trading, Future Trading, Tokenized Stock Trading, Leverage Token and many more. Which is why today we are talking about the exchange of FTX is because FTX has an interesting vision. “Trading platform created by traders. for real traders” due to Mr. Sam Bankman-Fried The owner of the FTX exchange is an Arbitrage Trader who has been trading cryptocurrencies for a long time. Thus, he truly understands the needs of trading clients that one forex website should have features that can accommodate both novice and professional traders.

With FTX’s ease of use and features that have attracted traders from all over the world to use it, FTX has long been one of the Centralized Exchanges with long-standing Top 10 Trading Volumn globally, with Derivatives Trading in early 2022. It is second only to Binance, and in 2021, FTX saw a 2,400% Trading Volumn growth.

5) How to Trade Futures on FTX

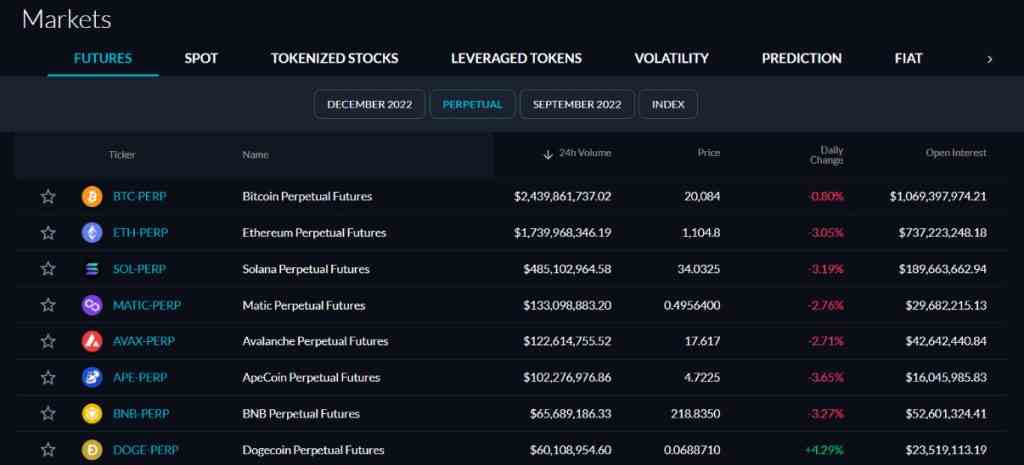

Future contracts on FTX are available in a wide variety of coins, including BTC, ETH, SOL, AVAX, MATIC, APE, BNB and many others. (e.g. BTC-1230, ETH-1230) is a future contract expiring on December 30, 2022, September 2022 (e.g. BTC-0930, ETH-0930) is a future contract expiring on March 30, 2022 and There are also trading indexes of each sector, such as ALT-PREP (Altcoin Index), DEFI-PREP (DeFi Index) and EXCH-PREP (Exchange Token Index), etc.

The process of trading Futures on FTX can be said that it is not as difficult as you think. Today I will teach you step-by-step in an easy-to-understand manner.

5.1) Access the website https://ftx.com/markets Then click on the “Future” section, you will see the different types of futures and coins that can be traded Futures, where we will see the information of each future contract, whether it is 24h Volumn or last 24h trading volume, coin price. In the futures market, coin price change and Open Interest is the volume of open long and short positions in the coin.

Today we are going to teach you how to trade perpetual futures or contracts that never expire. which the coins that will be demonstrated in the teaching method Then choose BTC-PREP because most of the coins in the market have correlation according to Bitcoin. If Bitcoin coin price goes any direction, various altcoins will move according to Bitcoin price.

5.2) Press enter and you will see a face like this It will divide the picture into three parts: left, middle, right. The left side is the BTC/USD price chart of FTX in the Derivatives Market, so the price is not the same as the Spot Market BTC/USD. The middle image is the Order Book item. People offer to buy and sell positions.

And the right side will be our future playing tool.

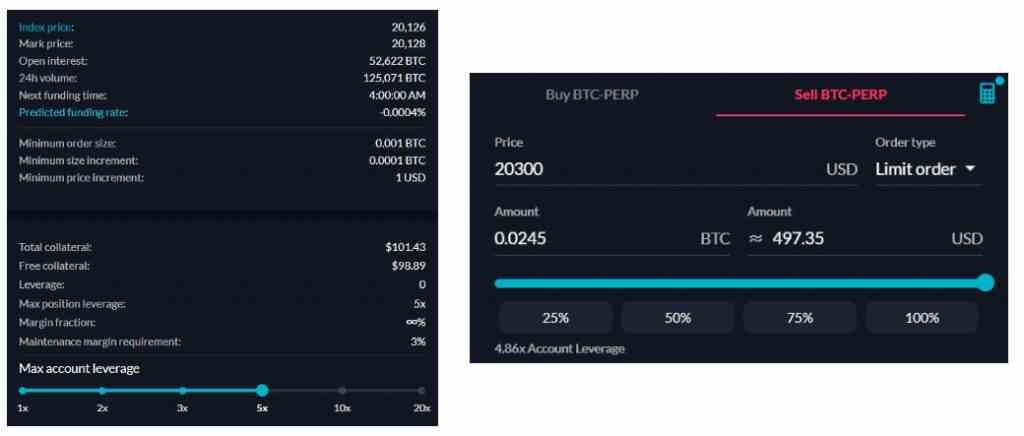

5.3) The above two images are zoomed in on the picture in section 5.2) out, consisting of

- Index Price : The price of BTC that we set a position to buy or sell.

- Mark Price : The current BTC price of the Derivatives market.

- Next Funding Time : The time when Funding Fee will be paid.

- Predicted Funding Rate : If negative, it means that there are people who are shorter than long and people who open short positions will have to pay Funding Fee to people who open long positions.

- Total Collateral : All our funds/collateral

- Free Collateral : Collateral available after deducting platform fees.

- Max Position Leverage : Use a leverage of 5 times the capital. And the amount of leverage within the FTX can be used from 1x 2x 3x 5x 10x and up to 20x. As shown in the picture if we have a margin of $100 and use a leverage of 5x, we will get the most profit from opening a position of $500 (right picture. that shows the figure $497.35 as it is all possible profit after fees)

- Buy BTC-PREP : Open Long Position

- Sell BTC-PREP : Open a short position

In this step we have to choose the Collateral to place, take into account the Position Size and calculate the leverage in every trade. If you are a beginner it is recommended not to use a lot of leverage because there is a risk of losing all the principal. In addition, we should have Stop Loss/Cut Loss points, as well as clearly calculating Risk/Rewards before every open position.

And after choosing whether to open a long or short position, set a Limited Order price in order to wait for the Bitcoin coin position to be opened at that price, as well as choose a leverage according to the acceptable risk, then press Buy or Sell. to open a position

5.4) In this demo we will try to open a short position of BTC after our position is paired with another order book in the market. We can see the results of our positions, whether

- Side : Long or Short Position

- Position Size : The total amount of Postions opened in this coin (Unit: BTC)

- Notional Size : The total amount of Postions opened in this coin (Unit: USD)

- Est. Liquidation Price : The price of BTC hits $21,639 without adding margin to increase margin. Our collateral assets will be confiscated.

- Mark Price : The current BTC price of the Derivatives market.

- PnL : Total Non-Monetary Profit/Loss

- Avg Open Price : Average price when we open a position.

- Break-even Price : Average price of BTC, if it goes down to $20,178, we will payback our position (because part of the money is deducted from trading fees).

Therefore, since it is a perpetual future, we can keep our positions open until we are satisfied. However, be aware of the Funding Rate and the opportunity cost of capital and profit in this respect.

6) Summary of Future usage on FTX

All in all, the features on FTX are very accessible to all investors due to their easy-to-use UX/UI. There is a wide range of services to try out, a wide range of futures pairs, a wide range of expiry and non-expiring futures. It is for these reasons that the FTX platform has been in the hearts of traders for a long time.

but in the end Using futures contracts, its main purpose is to hedge against various risks that could damage the company in the future. So if anyone uses the Future for speculation You should study the potential risks, manage your own investments well and don’t use too much leverage.

Reference from : https://help.ftx.com/hc/en-us/articles/360024780791-What-Are-Futures-