podcast

stocks for life

How investors should deal with strong price fluctuations in their heads

Don’t let the daily price fluctuations drive you crazy

© insta_photos / Getty Images

It’s not a time for the faint-hearted on the stock markets, volatility remains high. As an investor, you have to be even more clear about your strategy – and detach yourself from the prices in your head.

The first week of May was such a week. On one of the days there was a small rally: Many indices shot up, participants talked about euphoria and relief, the S&P 500 alone rose by three percent on May 4th. Only to fall again by 3.5 percent the next day. Two days later: another 3.2 percent down. The Dow Jones and the Nasdaq experienced similar swings. Prices have tended to fall on the stock exchanges for weeks – it is the mixture of fear of war, commodity and energy crisis, tense supply chains, high inflation and the interest rate turnaround by the Fed. Sometimes good labor market data trigger a small price firework, sometimes they fizzle out.

“Some days you have the feeling that just one wrong comma from the American Federal Reserve will lead to a price slide,” says stock investor Christian Röhl in the podcast “Shares for Life”, which he runs together with Capital editor-in-chief Horst von Buttlar. The concentration of crises has shaped the mood since the beginning of the year – on the one hand the corona pandemic, which is still not over, which is leading to drastic lockdowns, especially in China. Added to this is the war in Ukraine, which has triggered an energy price shock in Europe and fueled inflation. The IMF speaks of a “crisis on top of a crisis”.

investors would have to deal with the great uncertainty even more purposefully – and free yourself from the daily fluctuations. “You have to be careful not to let the media superimposition of crises drive you crazy,” says Röhl. “Then you’re paralyzed and just say: I don’t want to do anything anymore. And that’s a mistake.” As an investor, you have to position yourself broadly and understand the scenarios facing the economy even better – and adapt to them. “There’s no point in leaving everything in the call money account or shooting everything in Bitcoin or hoarding gold,” said Röhl.

Get off course in your head

A challenge for many investors is that the “reward system” for the brain is currently changing. For several years, prices have tended to rise despite the fluctuations, leading to the certainty that you are doing everything right with your portfolio. This time is over for now, apart from short-term speculation or day trading. Those who want to participate in the growth of companies in the long term will therefore experience secure dividends rather than the course successes as a “reward”. In other words, you have to mentally detach yourself from the course a little.

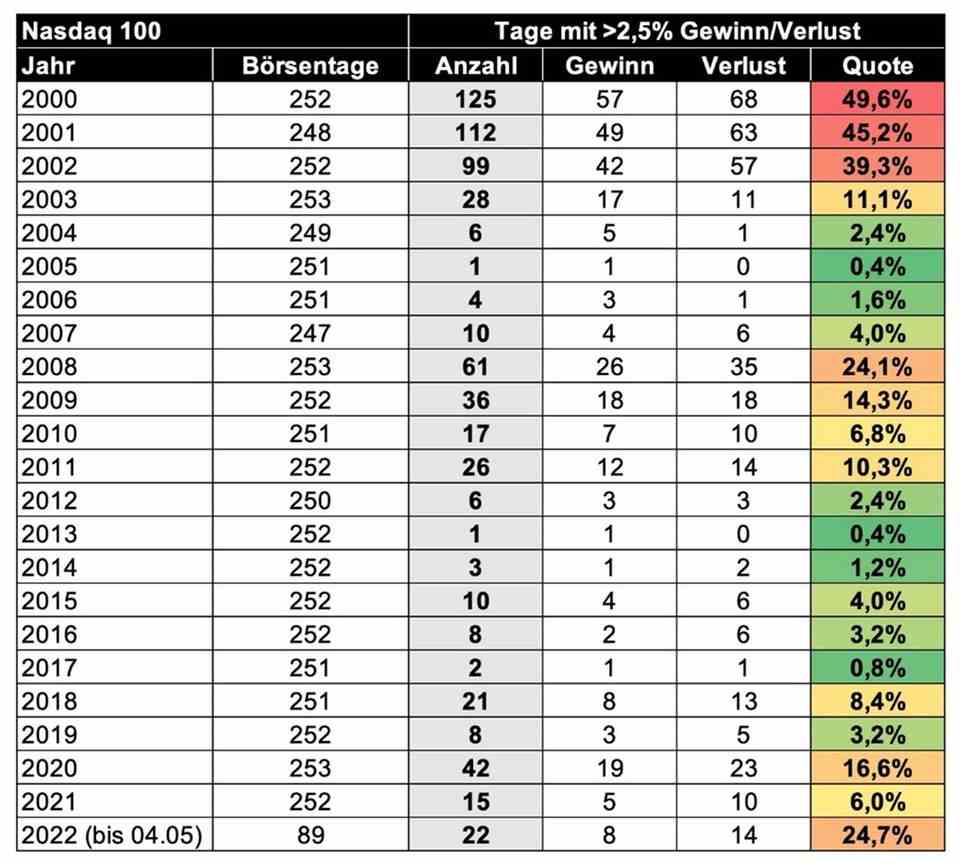

The great uncertainty becomes visible in the daily fluctuations. In the Nasdaq 100, for example, we have experienced fluctuations of more than 2.5 percent compared to the previous day on 21 of the 87 trading days this year (see chart). “It’s a clear symptom of stress,” said Röhl. By the way: Both the 25 best (+6.6 percent to +18.8 percent) and the 25 worst days of this millennium (-6.5 percent to -12.2 percent) come from the crisis years 2000-02, 2008- 09 and 2020. “The rate of stress days is reminiscent of this time,” says Röhl.

It is therefore a fundamental question that investors have to ask themselves: Do I want to participate in short-term price increases (“multiple expansion”) – or do I want to have a long-term stake in companies? “With the latter, you have to think more like a real estate investor,” says Röhl. Real economic factors are important – and the dividend.

Hear in the new episode of “Aktien fürs Leben”:

- New E-Commerce Data: Is Zalando Stock Still Attractive?

- Why Deutsche Post is a good investment as a “share for life”.

- The future of car sharing: A brief look at the Sixt share