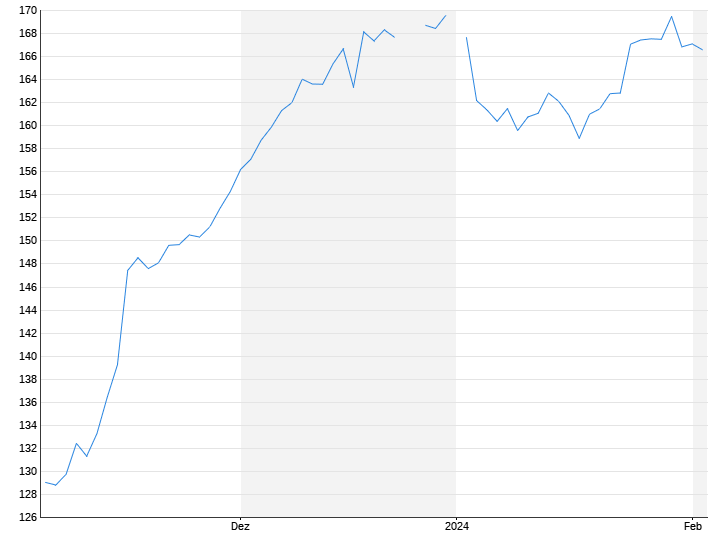

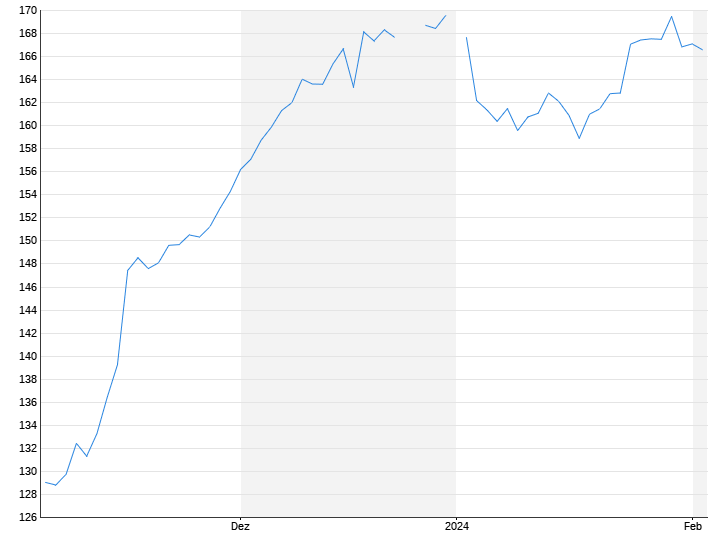

The stock market week that starts today brings numerous economic data and corporate balance sheets. According to the experts, it will only then become clear whether investors’ continued interest rate optimism and the recent record highs DAX and S&P 500 are justified.

According to Chairman Jerome Powell, investors abandoned hopes of an interest rate cut by the US Federal Reserve in March last week. Monetary policy easing will come, but a step down at the very next meeting is “unlikely,” Powell said on Wednesday. The monetary authorities needed more clarity about the development of inflation and the economy. On the futures markets, the probability of an interest rate cut in March is currently only estimated at 35 percent. Before the Fed meeting it was 65 percent. However, interest rate cuts at the next meetings are still considered a foregone conclusion. Economic data and corporate balance sheets, which were received positively, soon brightened the mood again after a short wave of sales. “In the end, both stocks and bonds went up and even gold said goodbye with a strong weekly gain,” said the Helaba experts. “So who’s wrong?”

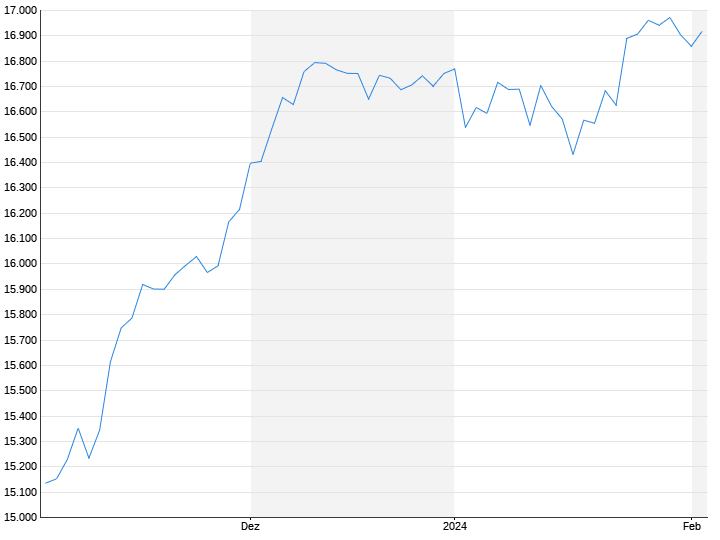

The DAX initially jumped to a new all-time high of 17,004.55 points on Friday following strong balance sheets from US tech giants Amazon and Meta. However, after the publication of the latest US labor market data in the afternoon, the gains were limited: it then exited trading with a premium of 0.4 percent and a level of 16,918 points.

When it comes to economic data, the German economy is in the spotlight. They open the week Foreign trade data for December. Investors then turn their attention to German industry with data on orders on Tuesday and production on Wednesday. Experts expect stagnation or a decline of 0.1 percent.

Meanwhile, the accounting season continues. Five DAX companies, among others, publish their financial reports. The chip manufacturer laid on Tuesday Infineon and the diagnostics company Qiagen their business figures. The results will be available in the middle of the week German stock exchange and the energy technology specialist Siemens Energy at. The conglomerate opens on Thursday Siemens his books. In the USA, McDonald’s, Eli Lilly, Ford, PayPal and PepsiCo, among others, present their figures.