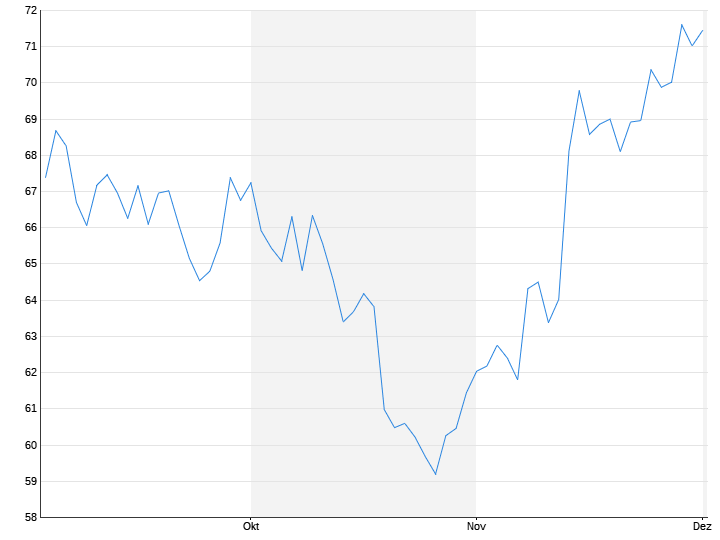

Strengthened by the brilliant price gains in November, the… DAX According to strategists, the much-hyped Christmas rally will begin in the new week. Cooling inflation data from the US and the euro zone fueled investors’ hopes that major central banks are now done raising interest rates and made stocks more attractive.

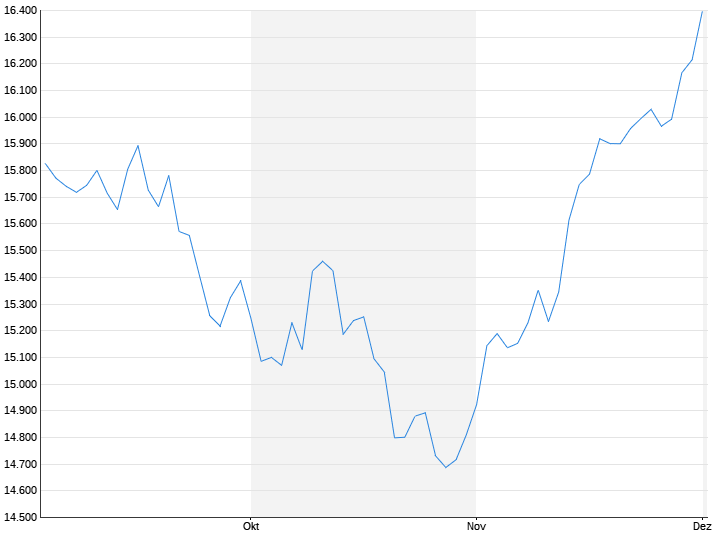

On a weekly basis, the DAX rose by almost 2.5 percent. On Friday alone it gained 1.1 percent and closed at 16,298 points. In November it closed with a gain of 9.5 percent. According to Helaba, this is the second highest November increase in the DAX history and is only exceeded by the “relief rally” in the pandemic year 2020, which was 15 percent at the time. Wall Street also made profits at the end of the week.

The DAX all-time high of 16,528.97 points is now increasingly within reach for the leading German index. “The brand is the DAX’s intended target for the last month of a very successful stock market year,” says Konstantin Oldenburger, analyst at broker CMC Markets. “Inflation is cooling down and investors remain optimistic about a change in monetary policy by central banks.” Even if the Fed fails to meet growing expectations of multiple interest rate cuts next year, the rally could continue “as long as the economy continues to grow and companies increase profits.”

It is currently firmly priced in on the stock markets that the Fed will leave interest rates unchanged in December. The labor market report for November on Friday could be one of the last indicators before the FOMC meeting that could persuade central bankers to raise interest rates again. “We assume that the labor market data in November will not suggest such a step and that the key interest rate corridor has reached its cyclical high of 5.25 to 5.50 percent,” says Helaba strategist Claudia Windt. Overall, the rate of cooling on the job market should be sufficient.

At the start of the week, however, the situation in German industry is initially in focus. The Federal Statistical Office lays down the Export figures for October. In September, exports fell surprisingly sharply – by 2.4 percent to 126.5 billion euros. The slow global economy is causing problems for many companies. And the sharp rise in interest rates in many currency areas is making financing for the purchase of goods from Germany significantly more expensive.

On the corporate side, the auto supplier wants to Continental offer an insight into its strategy at its Capital Markets Day. The focus is likely to be on the ailing automobile division, in which Continental recently announced that it would cut thousands of jobs. There is also speculation about possible sales of parts of the business. However, insiders dampened excessive expectations: a buyer for individual divisions was ultimately not in sight, it was recently said. You can find further weekly dates here.