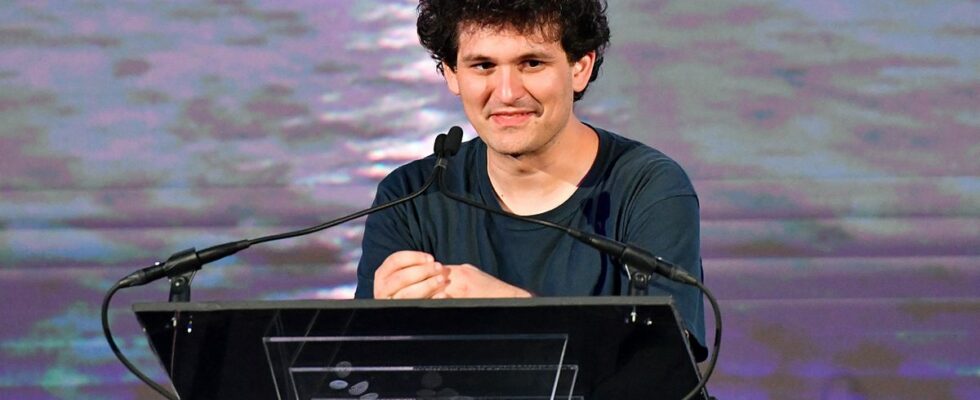

It is an earthquake with endless aftershocks. The fall of crypto empire FTX, which went bankrupt last Friday after running out of cash, raises fears of a long-lasting nuclear winter for a sector already reeling from the Luna/Terra summer crash. At the heart of this scandal compared to the bankruptcy of Enron and Lehman Brothers, a man: Sam Bankman-Fried. Suspected of having used the funds of his clients to cover the losses of his trading company Alameda Research, the 30-year-old, who in one week saw his fortune melt from 16 billion dollars to almost 0, is the target of judicial investigations in the United States and the Bahamas.

People under the spell

Son of two law professors from Stanford University, Sam Bankman-Fried (“SBF”) started out on Wall Street after passing through the prestigious MIT in Boston. In 2017, he founded the trading firm Alameda Research. He earns nearly 20 million dollars in a few weeks by buying bitcoins in the United States which he resells at a higher price in Japan.

Bankman-Fried launched FTX in 2019 in California and then moved to Hong Kong, where regulations are more flexible. The ascent is meteoric. In three years, FTX, which moved to the Bahamas for tax reasons, became the 2nd largest crypto exchange market in the world behind the Chinese Binance. Everyone wants their share, including celebrities. Tom Brady and Gisele Bündchen, but also Steph Curry, become brand ambassadors and take a stake in the capital. The Miami Heat basketball hall becomes the FTX Arena, with rights bought out for $130 million. Larry David plays the skeptics in a commercial broadcast during the Super Bowl. Bill Clinton and Tony Blair participate in a crypto conference in the Bahamas. Sam Bankman-Fried, who runs his empire with a dozen roommates who all live together in a heavenly residence, is the king of the world.

An “altruistic” white knight

While the decentralized and deregulated Far West of cryptocurrencies most often attracts right-wing libertarians, Bankman-Fried clashes. The nerd dressed in a t-shirt is a leftist vegetarian who advocates “effective altruism”. He becomes the second largest donor to the Democratic Party in the 2021-2022 election behind George Soros, with nearly $40 million given to progressive candidates.

When the crypto sector experienced severe turbulence last summer, SBF turned into a white knight. In particular, it flies to the aid of creditors Voyager Digital and BlockFi. The young entrepreneur claims to have “a few billion” at his disposal to help stabilize a struggling industry.

The fall

In reality, it was FTX that needed help. On November 2, the specialized site Coindesk, which obtained an accounting balance sheet from Alameda Research, revealed the incestuous links between the two entities. The trading company is run by Caroline Ellison, who is believed to be an ex-girlfriend of Sam Bankman-Fried. And more than half of Alameda Research’s assets are actually tokens of the cryptocurrency issued by FTX, dubbed FTT. A particularly worrying lack of diversity given the hyper-volatility of the sector.

The chain reaction is brutal. Changpeng Zhao, the billionaire boss of the Chinese exchange Binance, announced on November 6 that he will liquidate more than $500 million in FTT he holds. The price of FTT collapses by 80% in three days. FTX customers panicked and withdrew nearly $6 billion from the exchange, similar to a “bank run”. Binance announces that it will buy FTX then gives up after conducting an audit.

According to New York Times, FTX reportedly loaned up to $10 billion to Alameda Research, which was reportedly unable to repay. The crypto exchange files for bankruptcy protection on November 11. Sam Bankman-Fried is replaced as CEO by John Ray, a lawyer who had overseen Enron’s bankruptcy. The fallen boss, he apologized on Twitter for having “screwed up”. An understatement.