Outlook for the car market in 2022

Better prospects

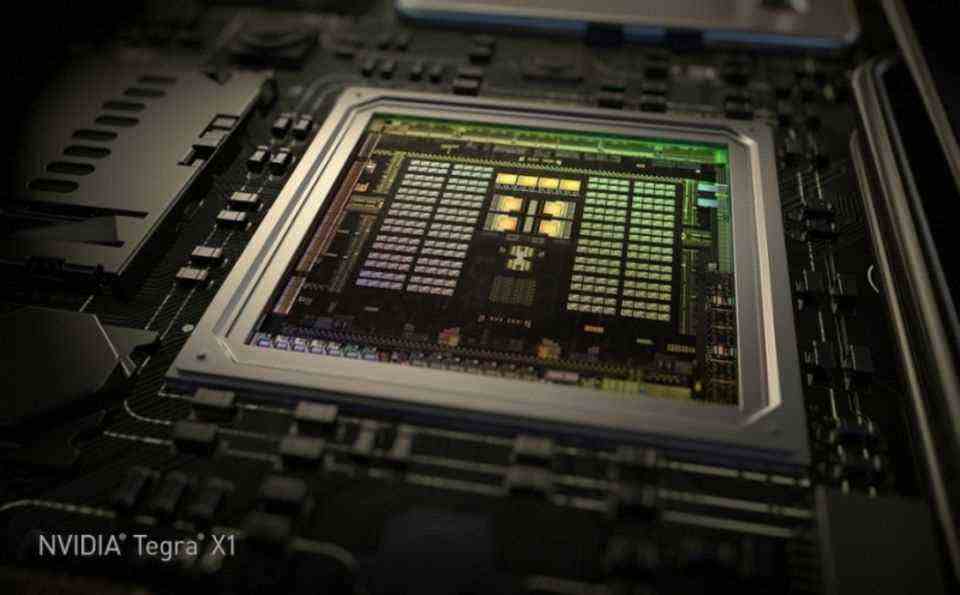

Nvidia Tegra X1 chip

© press-inform – the press office

The end of the 2021 automotive year was marked by the ongoing pandemic and an ever-spreading chip crisis. The prospects for 2022, on the other hand, are quite promising.

It’s not the case that the car industry is looking at 2021 with sad eyes – on the contrary, because the chip crisis caused the discount battles that had been going on for years to come to a complete standstill. However, it was primarily the car manufacturers who benefited from this and the supplier industry had to struggle. Almost all the vehicles that could also be produced were sold on the market at good prices. On the other hand, many new vehicles could not be delivered or the manufacturers had to contend with delivery times of well over a year. One reason why used car prices have risen by around 20 percent in recent months. An end to the trend does not seem to be in sight at first.

Nevertheless, the experts at Dataforce are looking forward to 2022 with optimism. According to their own analyzes there is an increase in vehicle production in the first half of the year and stronger growth in the second half of the year. This should lead to around 12.6 million new registrations across Europe in 2022. Compared to 2021, that would be an increase of at least 8.9 percent. The private market should therefore develop somewhat more strongly than new commercial registrations. Although the analysts at Dataforce are expecting more significant growth for company cars, car rental companies, manufacturers and retailers will still only be able to be supplied to a limited extent. “Even if the bottom has been passed, vehicle production will remain the bottleneck in 2022, demand is significantly greater than supply,” explains Benjamin Kibies – Senior Automotive Analyst at Dataforce, “therefore manufacturers will continue to focus on high-margin sales in 2022. Large customers such as car rental companies or the large fleet operators get fewer discounts and the self-registrations of manufacturers and dealers are further restricted.”

At the same time, it is assumed that electric vehicles will expand their market share in the coming year. According to Dataforce calculations, however, the pace of growth is expected to slow down, which should mean an increase in market share of a maximum of 3.5 percent for electric vehicles and plug-in hybrids. An improved supply situation for semiconductors would again allow manufacturers to produce more traditional petrol and diesel vehicles. As the share of electricity continues to rise, they also have less to worry about their CO2 targets. At the same time, however, it is likely to become more difficult to acquire additional customers. Especially in the high-yield premium segment, many buyers are already driving electrically.

In the case of small and compact cars, on the other hand, the surcharge for BEVs is still relatively high and the ranges are shorter; at the same time, some countries are reducing their subsidies for electricity. “In 2022, the new governing coalition in Germany will have to make important decisions on promoting e-mobility and expanding the charging infrastructure so that we can make progress with electrification,” says Katharina Wolff from Dataforce. “In sales to fleet customers, user choosers are becoming increasingly important This is an employee loyalty model that is being used more and more frequently by companies, whereby the company car driver can choose his vehicle himself and thus acts like a financially well-positioned private individual.”