World trade

Magnesium deficiency – is the next crisis looming after the semiconductors?

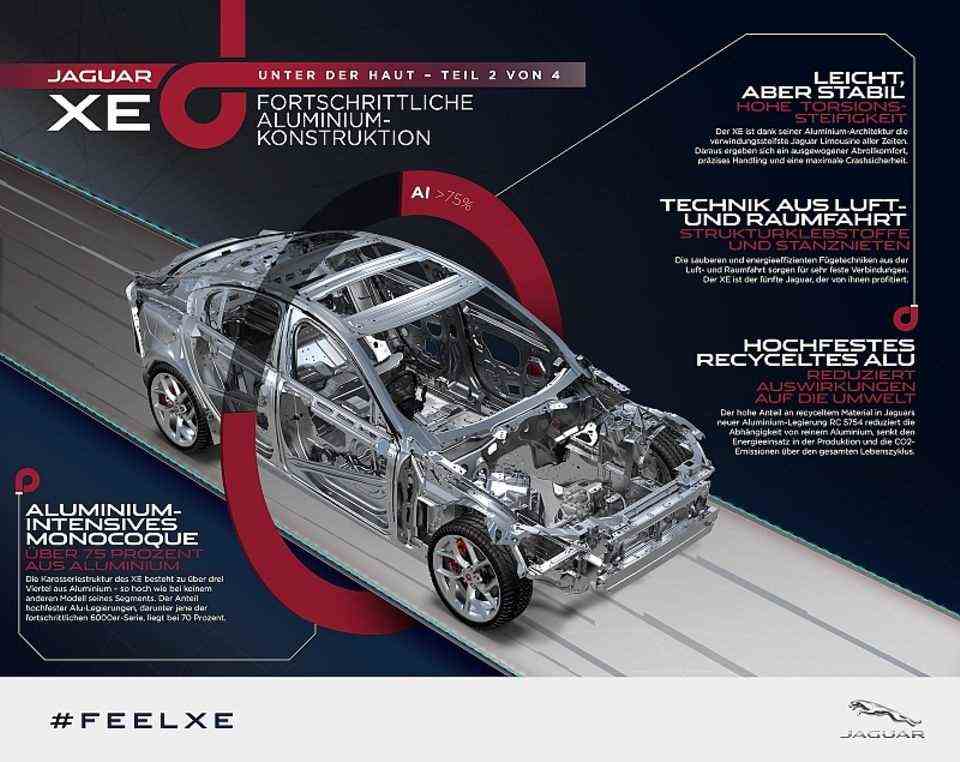

JLR aluminum

© press-inform – the press office

The semiconductor crisis still has a firm grip on the automotive industry and the ongoing corona pandemic with its forthcoming fourth wave does not mean that there will be a calm winter. But now that there is a lack of semiconductors, the next problem is looming: magnesium deficiency.

As the automotive sector struggles to maintain production in the face of semiconductor shortages, concerns about the stability of the supply of magnesium have increased. Magnesium is of central importance for the production of aluminum, which plays an essential role in automobile production. Most of the magnesium used to make auto parts comes from mainland China. The price of the raw material has tripled compared to pre-pandemic prices. No big surprise that magnesium was on the agenda of the most recent EU Council meeting, as it could have “far-reaching effects on the entire value chain in the European Union”. In the opinion of the IHS analysts, a noticeable deficiency in magnesium would have an unpredictable impact on the production of vehicles and components. Problem: with the increasing number of electrified vehicles, the demand for raw materials such as cobalt, nickel or aluminum is increasing. “In 2017, mankind consumed more than 100 billion tons of raw materials within a year for the first time – we must also counter this trend in the automotive industry,” says BMW CEO Oliver Zipse. and thus a strategic dimension, because the current development of raw material prices shows the effects that an industry that is dependent on limited resources must expect. “

Magnesium is considered to be the lightest of its kind among the materials commonly used for structural applications. It is about a third lighter than aluminum and has the most pleasant property of being easily combined with other elements. The applications of magnesium in automobile construction began like many lightweight materials in racing cars, where the material was already used for some components in the 1920s. Most of the material is extracted from natural minerals such as dolomite and magnesite, and the extraction is usually carried out by two processes, both of which require high energy consumption and cause high emissions: the pidgeon and the electrolysis process, one of which is from the mineral dolomite and the other comes from magnesium chloride. In the automotive industry, magnesium plays an important role primarily in aluminum alloys. These alloys have been recycled to a large extent in the automotive industry’s value chain for years. In the value chain of the automotive industry, a large part of the demand for wrought alloys is met by aluminum sheets, which are used in car body construction.

China domains manufacturing

The source of concern lies in mainland China, which accounted for 85 percent of global magnesium metal production last year 2020. There is especially the province of Shaanxi, to which with 0.61 million tons contributed 63.5 percent of the total production. In order to reduce the share of energy consumption in per capita GDP growth by two percent in the third quarter and by 3.2 percent in the whole of 2021, the city of Yulin in Shaanxi has established industrial plants, including magnesium plants, which are classified as emission-intensive plants, asked to either shut down completely or to only work at 50 percent of production capacity in the last two weeks of the third quarter. Most magnesium plants have resumed operations since the beginning of October, although they were originally asked to only operate at around 40 percent of their capacity by the end of this calendar year.

This has triggered fears of an impending material shortage, particularly in the automotive industry. “The fear that there will be a shortage of materials if this lasts for a few months is justified,” said John Mothersole, IHS Markit’s director of economics in the area of pricing and purchasing. However, there are signs that mandatory production cuts in China will be eased as production in Shaanxi Province has risen to around 70 percent of the first half-year level. Prices in mainland China and Europe have started to fall as a result, although they are still double or more than double what they were in June in both regions. After all: so far, no bottlenecks in aluminum have been reported.

Most of the factories in the Chinese province will operate at 40 percent production capacity by the end of the year. Beyond the next quarter of magnesium production, investments in energy capacity in Shaanxi Province, easing of energy cuts or changes in the prioritization of energy restrictions will determine the market direction for both magnesium availability and the cost base of production. While policy easing could alleviate the bottleneck in the supply chain for this material, the energy-intensive nature of magnesium production will not be affected in the medium to long term. In order to reduce energy consumption, extensive research and development work is required for every material production. Furthermore, there is no clear way to account for the fact that Shaanxi Province is responsible for producing more than half of the world’s magnesium supply.

Production cuts lead to material shortages

“In the worst-case scenario, extensive production cuts will inevitably lead to material shortages as capacity outside of Greater China will not be able to fill the gap in global supply,” says Michael Tao, Senior Research Analyst at IHS, “in this situation there could be a cascading effect on the aluminum sector even if aluminum prices seem stable so far. We have no confirmation that this is the case, nor that aluminum producers are concerned about the situation in magnesium. The next two months will be crucial to understand if this is going to be similar to what we saw with the semiconductor shortage, or if it is an overreaction in the metals market, in the meantime, keep an eye on the long-term supply risks be kept. “

A recent study by the US Department of Defense identified magnesium as one of the most important strategic minerals for the country. Such over-reliance on China may not bode well in the context of US economic decoupling or European policies of “strategic autonomy”. In this context, it would be wise for OEMs and suppliers to look for ways to reduce their reliance on magnesium-intensive alloys in the long term.