Interview: Berylls analyst Steffen Stumpp on the recycling of e-trucks

Recycling is not a sure-fire success

Electric trucks Berylls Steffen Stumpp

© press-inform – the press office

With the electric trucks, a paradigm shift is also taking place in the transport industry. Where diesel trucks used to be simply sold on after 20 years of service, batteries now have to be replaced or recycled. Berylls analyst Steffen Stumpp sees truck OEMs in particular facing major challenges.

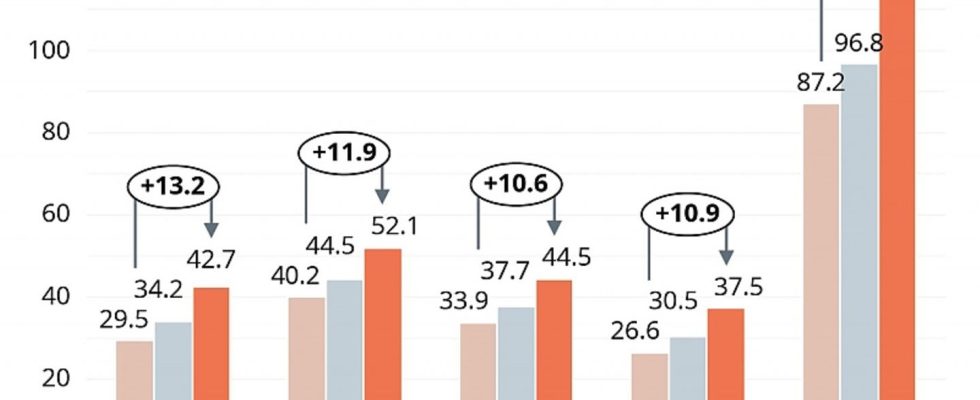

Trucks will also be electric in the future. What impact does this have on the logistics industry? Steffen Stumpp: Today’s trucks, which are powered by diesel engines, are very durable products and so is the drive train, which accounts for the greatest value of the vehicle. Such a diesel truck is in operation for around 20 to 25 years. With battery electric trucks, the most valuable component is not the motor but the battery, which has a much shorter lifespan than the vehicle. This is a completely new challenge for which the industry has not yet found a solution. What does that mean specifically? Stumpp: We assume that a truck battery has a service life of eight to ten years. Our analysis of used vehicle prices has shown that a truck is still worth between 25 and 50 percent of the new price at this point. Due to their mileage, articulated lorries are at the lower end of the scale, while concrete mixers, for example, reach the 50 percent mentioned, depending on their condition. This means that these vehicles need a new battery after eight years. How does the approach of the logistics industry need to change? Stumpp: The logistics industry will not have to change and does not want to. This is a problem that the providers of the vehicles have to solve. One possibility would be for the manufacturer to offer the truck as a leasing vehicle, in which case the customer has absolutely nothing to do with the residual value and the service life of the battery. And the manufacturer would then have the opportunity to equip the vehicle with a new or reconditioned battery after eight years. Does this business model pay off for the manufacturers at all? Stumpp: I think it’s best to market not just the battery, but the entire vehicle on a monthly basis in a business model like Truck-as-a-Service. It is important that the lessor uses remote diagnostics to monitor how the condition of the battery is developing and thus determine the ideal time for replacement. This can be the case after six years or only after twelve years. Is the swap that easy to do? Stumpp: Simple would be an exaggeration, but it is much less complicated than in a car, where the batteries are integrated into the floor structure of the vehicle, while in trucks the battery packs are attached to the longitudinal frame members, under or behind the driver’s cab. I assume that such a battery replacement is possible in two to three days. The question is which battery to use. Whether so-called “remanufactured batteries”, i.e. used batteries that are specially prepared for this purpose, or new ones. This is also a question of cost, because rechargeable batteries are expensive. Nobody has answered this question yet. So you advocate replacing the batteries? Stump: Right. We don’t even know today what batteries will be on the market in eight to ten years. The battery that the truck gets after its first life will no longer have much in common with the batteries that were originally installed, since battery technology is evolving. How will business models change? Stumpp: The sales models are becoming more innovative. Truck-as-a-Service is an offer that comes with a usage-based monthly fee. This can go so far that the traction energy, i.e. the electricity, is included in the monthly rate. Ultimately, there will be modular offers where customers only pay for what they actually use. I assume that leasing will increase in the future as logistics companies are very risk-averse. If the risks are passed on to the manufacturers, will they play along? Stumpp: The manufacturers will have to play along and adapt to the rules of the market. After all, they want to continue making money and not lose contact with customers. There are now intermediaries who buy large numbers of electric trucks from OEMs and lease them to logistics companies. The pressure on the manufacturers is great. How will electrification affect truck operations? Stumpp: Every company has to think about an optimal loading and deployment strategy. It is important whether the battery charge is sufficient for a day or whether you have to recharge in between. For vehicles that are under construction or in distribution transport, charging in the depot with lower power is sufficient, which is always preferable to fast charging. Since charging in your own depot is not only cheaper but also easier on the battery, all logistics companies will try to fill the batteries there as often as possible. What are the consequences for energy suppliers? Stumpp: Intelligent charging is becoming increasingly important. When the trucks return to the depot in the late afternoon, charging must be controlled in such a way that the peak load in the evening hours is not increased. Ultimately, variable electricity tariffs or financial incentives are needed for truck users to charge their trucks when the grid is able to deliver energy. In view of the imminent scarcity of raw materials, battery recycling is an important factor for batteries… Stumpp: The manufacturers will have a great interest in getting the vehicles back at the end of their life, since a battery contains valuable raw materials. Depending on how raw material prices develop, “urban mining”, i.e. the return of batteries to the cycle, can be an important source of raw material supply. Does this also end the export of discarded trucks to regions such as Africa or India? Stump: Yes. It will still be a few years before battery-electric trucks can be used in such countries, since the necessary charging structure will then be in place. However, this also means that the export of used trucks is likely to drop significantly once the fleet has been largely converted to electric drive. So recycling will become another business area? Stump: Definitely. However, commodity prices are very volatile. There is a good chance that raw material prices are so low that recycling becomes a premium business. It must be said very clearly that the effort to remove and recycle the battery is not worth it at any price. Especially since only lithium is a really valuable material for the LFP batteries, which are mainly used in the trucks, as they are free of cobalt and manganese. Recycling is not a sure-fire success. Are there alternatives? Stumpp: This is achieved by continuing to use the battery as stationary storage. For example as a buffer storage at a truck charging station. In this way, even with low raw material prices, you can maximize the value of the battery by connecting this second-life application to the truck cycle. This is quite possible with a battery state of health of between 60 and 80 percent. There will be a market for that too. What do you recommend? Stumpp: If you own a used truck, you have to see at the end of the life cycle where you can get the most money for the vehicle and the battery. This can also be resale. Since the truck market is very cyclical, it may even be worth storing the batteries and then recycling them when commodity prices pick up again. Ultimately, this is a commodity futures transaction.

Recycling is not a sure-fire success